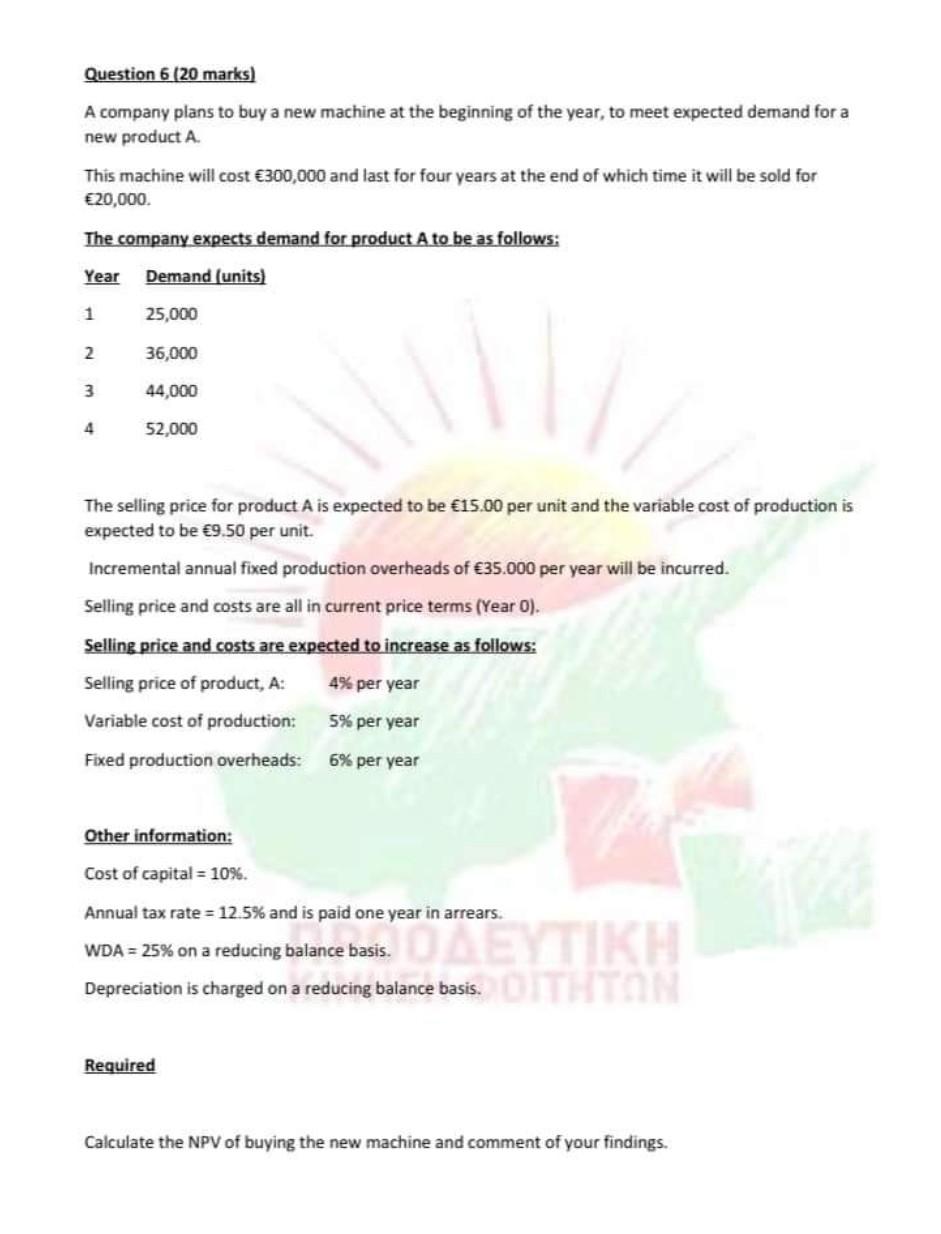

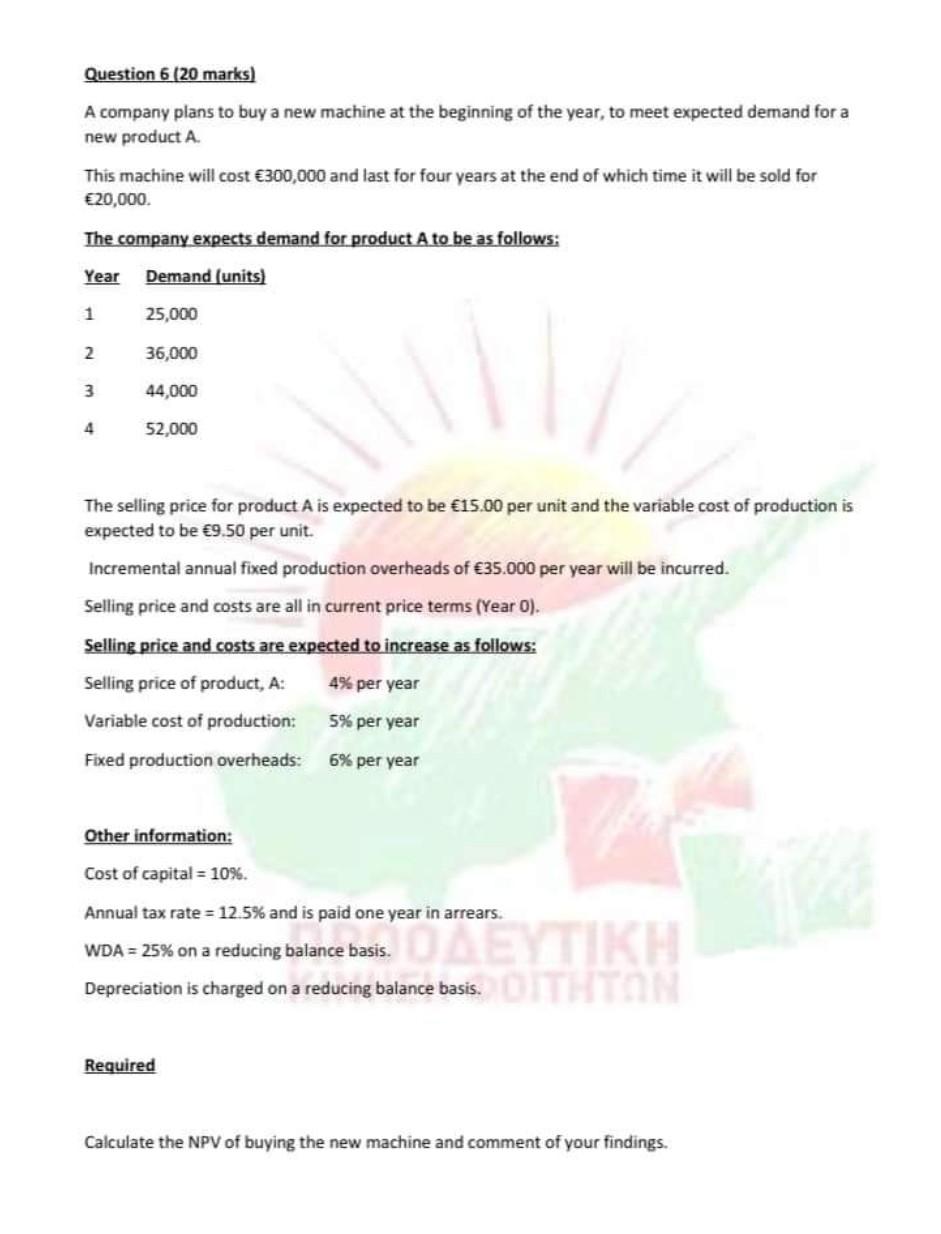

Question 6 (20 marks) A company plans to buy a new machine at the beginning of the year, to meet expected demand for a new product A. This machine will cost 300,000 and last for four years at the end of which time it will be sold for 20,000. The company expects demand for product A to be as follows: Year Demand (units) 1 25,000 2 36,000 3 44,000 4 52,000 The selling price for product A is expected to be 15.00 per unit and the variable cost of production is expected to be 9.50 per unit. Incremental annual fixed production overheads of 35.000 per year will be incurred. Selling price and costs are all in current price terms (Year 0). Selling price and costs are expected to increase as follows: Selling price of product, A: 4% per year Variable cost of production: 5% per year Fixed production overheads: 6% per year Other information: Cost of capital = 10%. Annual tax rate = 12.5% and is paid one year in arrears. DAEYTIKH WDA = 25% on a reducing balance basis. Depreciation is charged on a reducing balance basis. ITHTON Required Calculate the NPV of buying the new machine and comment of your findings. Question 6 (20 marks) A company plans to buy a new machine at the beginning of the year, to meet expected demand for a new product A. This machine will cost 300,000 and last for four years at the end of which time it will be sold for 20,000. The company expects demand for product A to be as follows: Year Demand (units) 1 25,000 2 36,000 3 44,000 4 52,000 The selling price for product A is expected to be 15.00 per unit and the variable cost of production is expected to be 9.50 per unit. Incremental annual fixed production overheads of 35.000 per year will be incurred. Selling price and costs are all in current price terms (Year 0). Selling price and costs are expected to increase as follows: Selling price of product, A: 4% per year Variable cost of production: 5% per year Fixed production overheads: 6% per year Other information: Cost of capital = 10%. Annual tax rate = 12.5% and is paid one year in arrears. DAEYTIKH WDA = 25% on a reducing balance basis. Depreciation is charged on a reducing balance basis. ITHTON Required Calculate the NPV of buying the new machine and comment of your findings