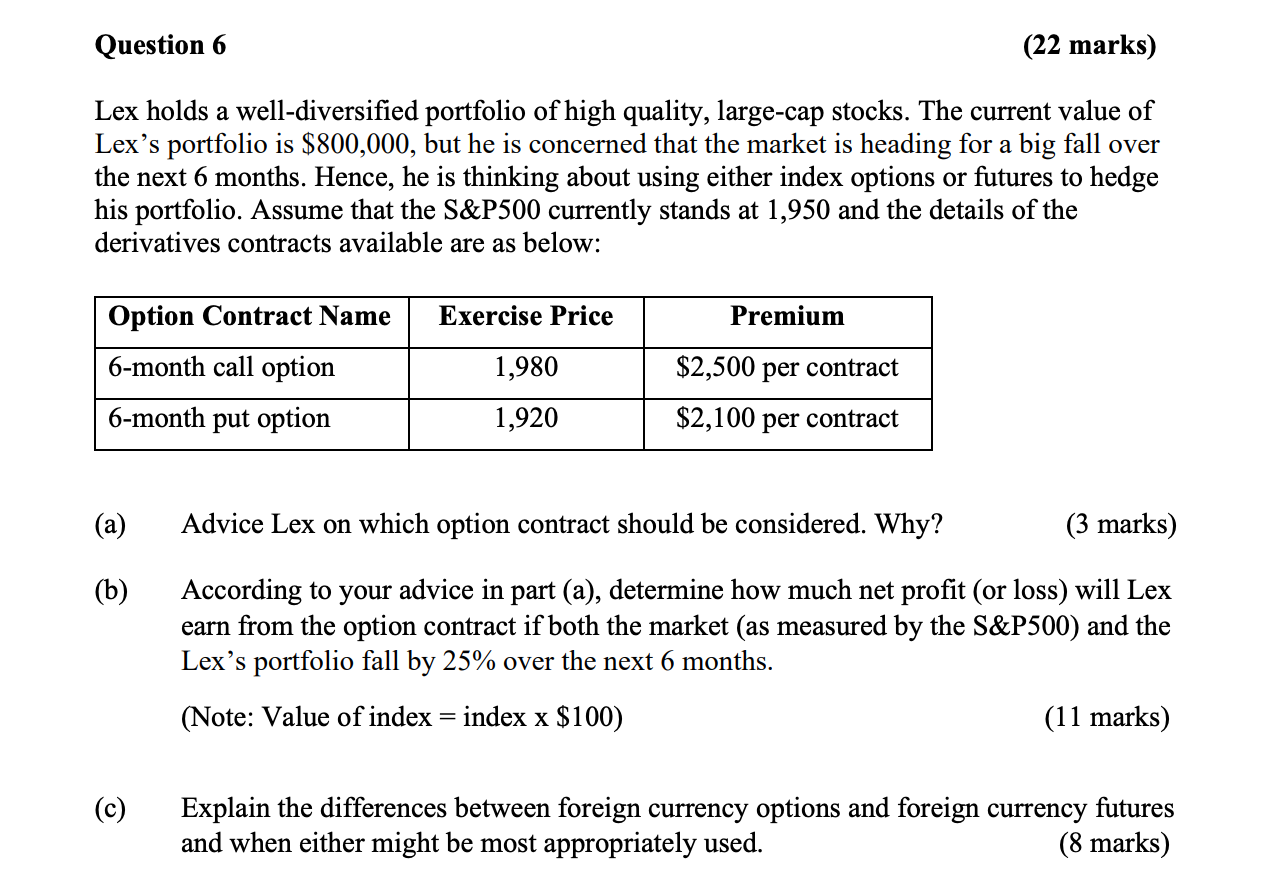

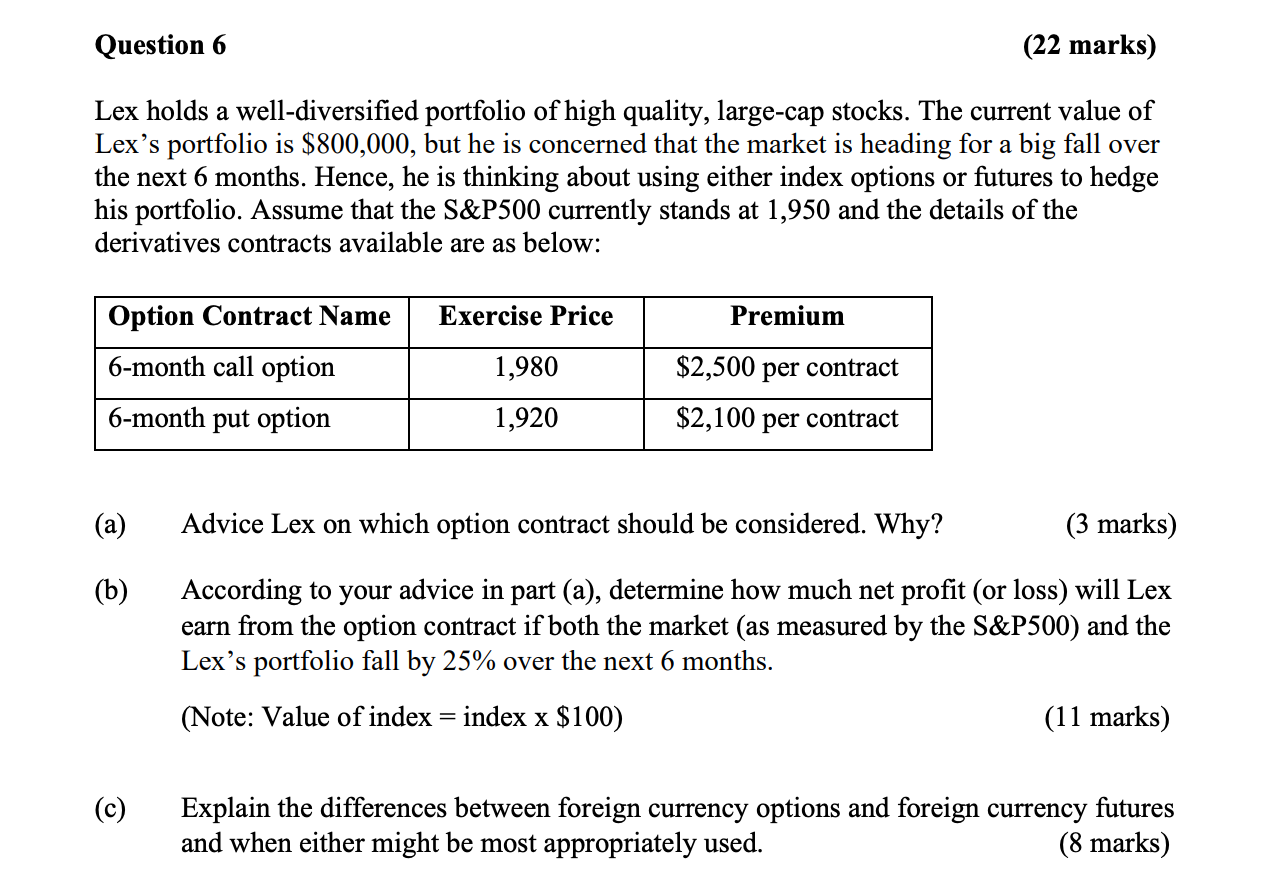

Question 6 (22 marks) Lex holds a well-diversified portfolio of high quality, large-cap stocks. The current value of Lex's portfolio is $800,000, but he is concerned that the market is heading for a big fall over the next 6 months. Hence, he is thinking about using either index options or futures to hedge his portfolio. Assume that the S&P500 currently stands at 1,950 and the details of the derivatives contracts available are as below: Option Contract Name Exercise Price Premium 1,980 6-month call option 6-month put option $2,500 per contract $2,100 per contract 1,920 (a) Advice Lex on which option contract should be considered. Why? (3 marks) (b) According to your advice in part (a), determine how much net profit (or loss) will Lex earn from the option contract if both the market (as measured by the S&P500) and the Lex's portfolio fall by 25% over the next 6 months. (Note: Value of index = index x $100) (11 marks) (c) Explain the differences between foreign currency options and foreign currency futures and when either might be most appropriately used. (8 marks) Question 6 (22 marks) Lex holds a well-diversified portfolio of high quality, large-cap stocks. The current value of Lex's portfolio is $800,000, but he is concerned that the market is heading for a big fall over the next 6 months. Hence, he is thinking about using either index options or futures to hedge his portfolio. Assume that the S&P500 currently stands at 1,950 and the details of the derivatives contracts available are as below: Option Contract Name Exercise Price Premium 1,980 6-month call option 6-month put option $2,500 per contract $2,100 per contract 1,920 (a) Advice Lex on which option contract should be considered. Why? (3 marks) (b) According to your advice in part (a), determine how much net profit (or loss) will Lex earn from the option contract if both the market (as measured by the S&P500) and the Lex's portfolio fall by 25% over the next 6 months. (Note: Value of index = index x $100) (11 marks) (c) Explain the differences between foreign currency options and foreign currency futures and when either might be most appropriately used. (8 marks)