Answered step by step

Verified Expert Solution

Question

1 Approved Answer

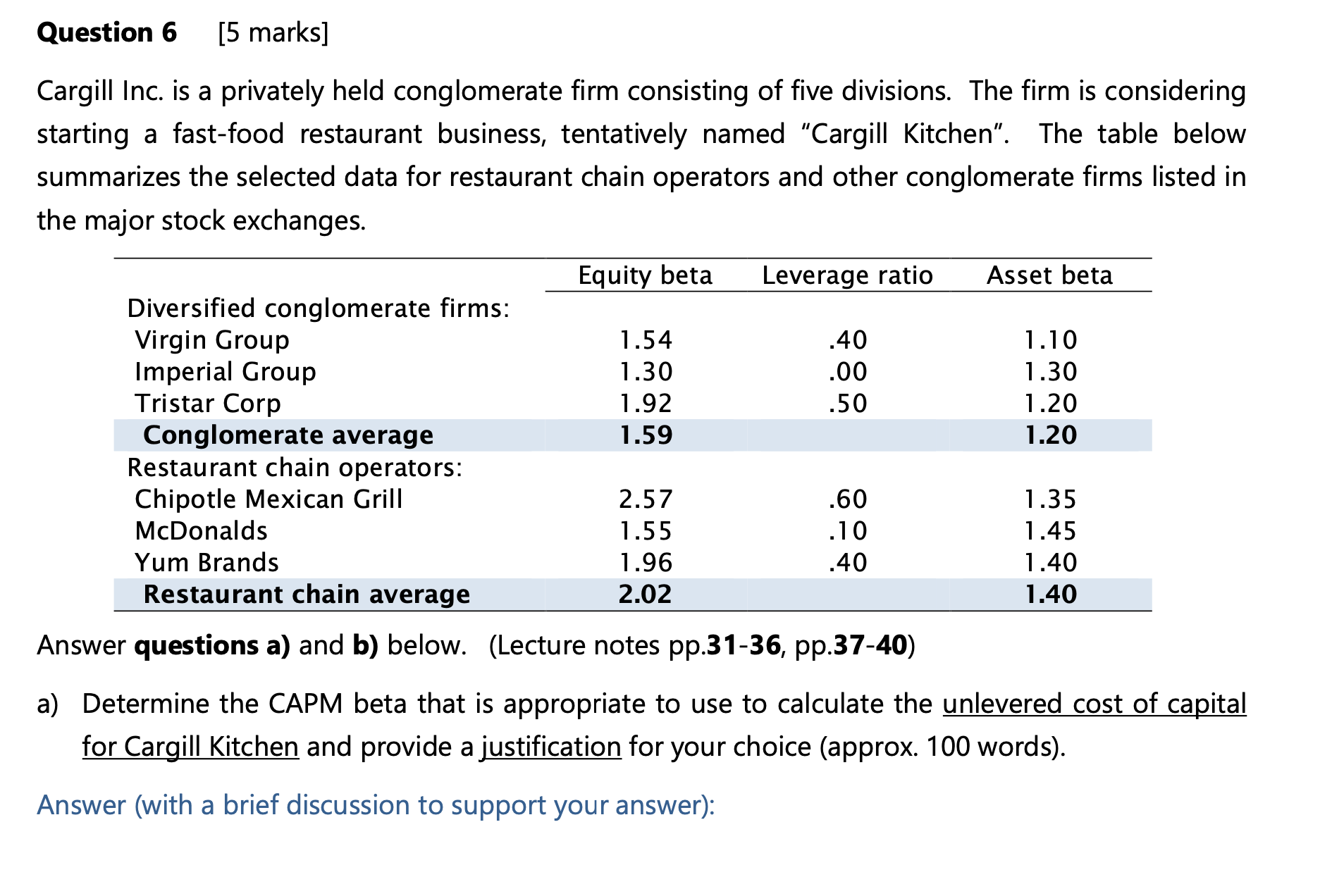

Question 6 [5 marks] Cargill Inc. is a privately held conglomerate firm consisting of five divisions. The firm is considering starting a fast-food restaurant

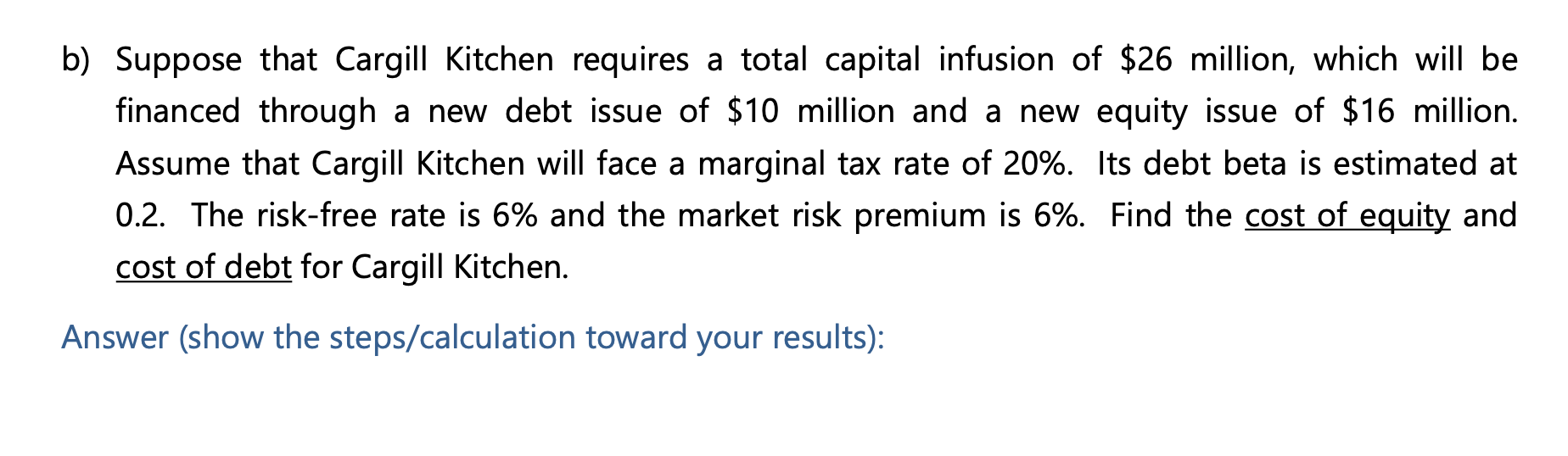

Question 6 [5 marks] Cargill Inc. is a privately held conglomerate firm consisting of five divisions. The firm is considering starting a fast-food restaurant business, tentatively named "Cargill Kitchen". The table below summarizes the selected data for restaurant chain operators and other conglomerate firms listed in the major stock exchanges. Diversified conglomerate firms: Virgin Group Imperial Group Tristar Corp Conglomerate average Restaurant chain operators: Chipotle Mexican Grill McDonalds Equity betal 1.54 1.30 1.92 1.59 2.57 1.55 1.96 2.02 Leverage ratio .40 .00 .50 .60 .10 .40 Yum Brands Restaurant chain average Answer questions a) and b) below. (Lecture notes pp.31-36, pp.37-40) Asset beta 1.10 1.30 1.20 1.20 1.35 1.45 1.40 1.40 a) Determine the CAPM beta that is appropriate to use to calculate the unlevered cost of capital for Cargill Kitchen and provide a justification for your choice (approx. 100 words). Answer (with a brief discussion to support your answer): b) Suppose that Cargill Kitchen requires a total capital infusion of $26 million, which will be financed through a new debt issue of $10 million and a new equity issue of $16 million. Assume that Cargill Kitchen will face a marginal tax rate of 20%. Its debt beta is estimated at 0.2. The risk-free rate is 6% and the market risk premium is 6%. Find the cost of equity and cost of debt for Cargill Kitchen. Answer (show the steps/calculation toward your results):

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a The appropriate CAPM beta to use for calculating the unlevered cost of capital for Cargill Kitchen ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started