Answered step by step

Verified Expert Solution

Question

1 Approved Answer

OCL Industries discontinued the use of two assets during the fiscal year 2022 (the year end is December 31, 2022): a) A piece of

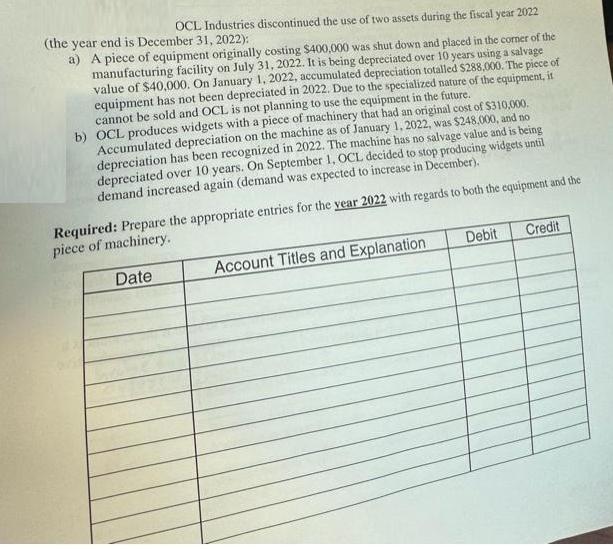

OCL Industries discontinued the use of two assets during the fiscal year 2022 (the year end is December 31, 2022): a) A piece of equipment originally costing $400,000 was shut down and placed in the corner of the manufacturing facility on July 31, 2022. It is being depreciated over 10 years using a salvage value of $40,000. On January 1, 2022, accumulated depreciation totalled $288,000. The piece of equipment has not been depreciated in 2022. Due to the specialized nature of the equipment, it cannot be sold and OCL is not planning to use the equipment in the future. b) OCL produces widgets with a piece of machinery that had an original cost of $310,000. Accumulated depreciation on the machine as of January 1, 2022, was $248,000, and no depreciation has been recognized in 2022. The machine has no salvage value and is being depreciated over 10 years. On September 1, OCL decided to stop producing widgets until demand increased again (demand was expected to increase in December). Required: Prepare the appropriate entries for the year 2022 with regards to both the equipment and the piece of machinery. Date Account Titles and Explanation Debit Credit

Step by Step Solution

★★★★★

3.42 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started