Answered step by step

Verified Expert Solution

Question

1 Approved Answer

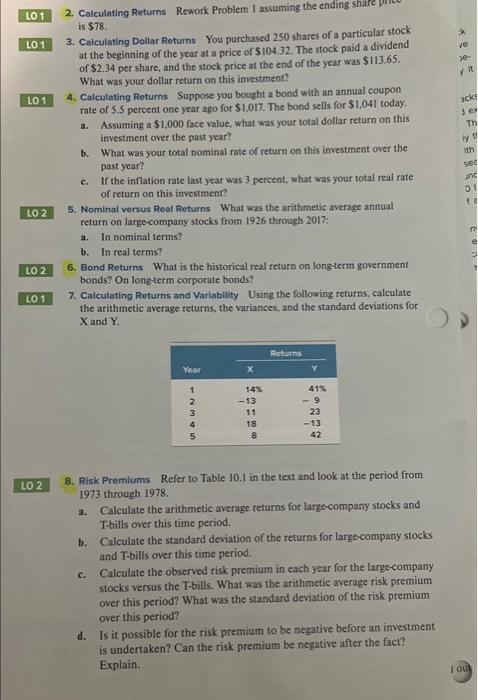

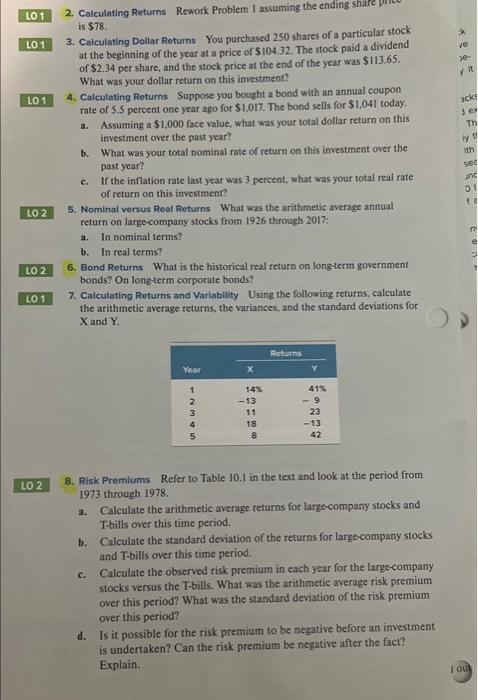

question 6 and 8 please LO 1 LO 1 LO 1 LO 2 LO 2 LO 1 LO 2 2. Calculating Returns Rework Problem 1

question 6 and 8 please

LO 1 LO 1 LO 1 LO 2 LO 2 LO 1 LO 2 2. Calculating Returns Rework Problem 1 assuming the ending shi is $78. 3. Calculating Dollar Returns You purchased 250 shares of a particular stock at the beginning of the year at a price of $104.32. The stock paid a dividend of $2.34 per share, and the stock price at the end of the year was $113.65. What was your dollar return on this investment? 4. Calculating Returns Suppose you bought a bond with an annual coupon rate of 5.5 percent one year ago for $1.017. The bond sells for $1,041 today. a. Assuming a $1,000 face value, what was your total dollar return on this investment over the past year? b. What was your total nominal rate of return on this investment over the past year? C. If the inflation rate last year was 3 percent, what was your total real rate of return on this investment? 5. Nominal versus Real Returns What was the arithmetic average annual return on large-company stocks from 1926 through 2017: a. In nominal terms? b. In real terms? 6. Bond Returns What is the historical real return on long-term government bonds? On long-term corporate bonds? 7. Calculating Returns and Variability Using the following returns, calculate the arithmetic average returns, the variances, and the standard deviations for X and Y. Returns Year 1 2

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started