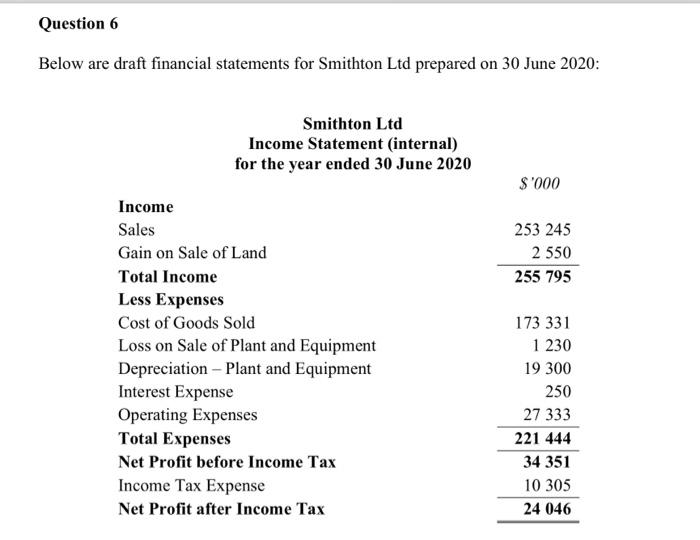

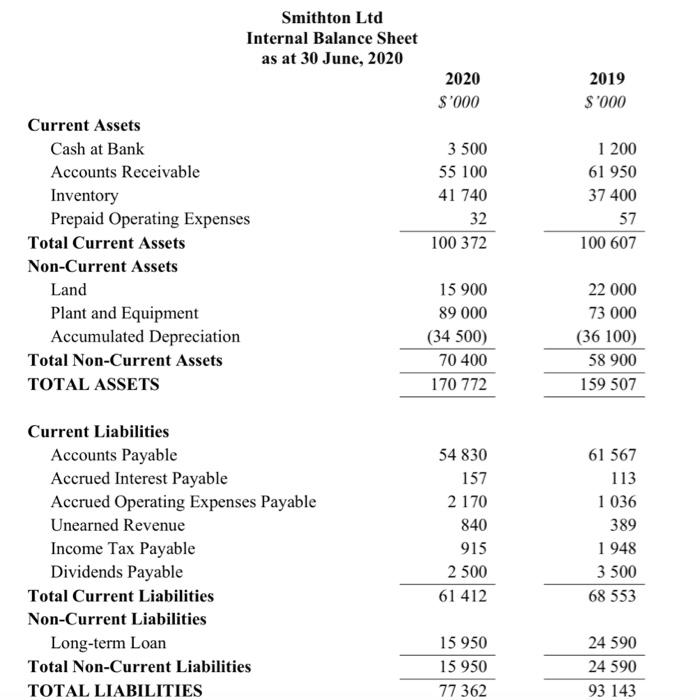

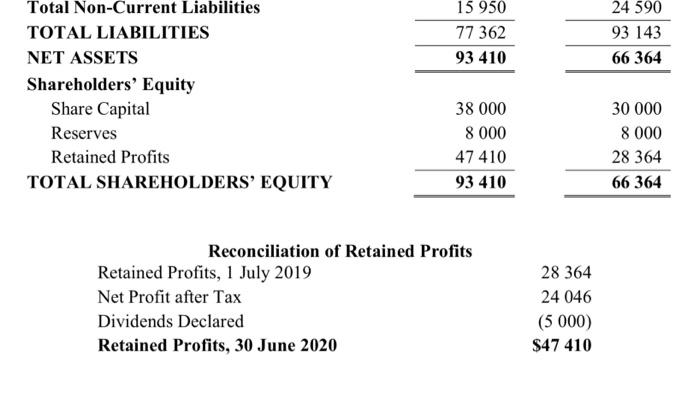

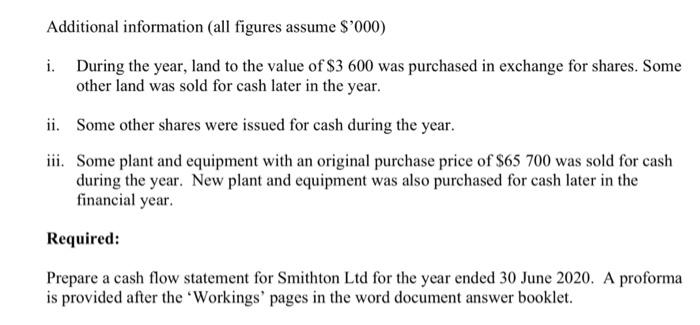

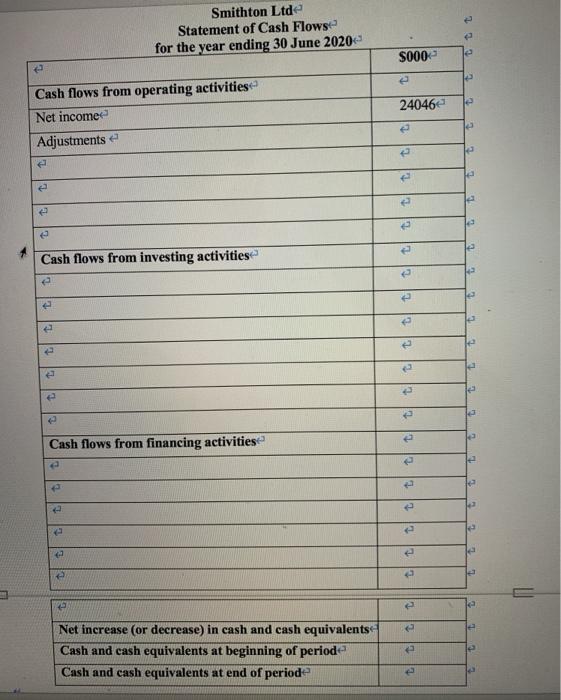

Question 6 Below are draft financial statements for Smithton Ltd prepared on 30 June 2020: Smithton Ltd Income Statement internal) for the year ended 30 June 2020 $'000 253 245 2 550 255 795 Income Sales Gain on Sale of Land Total Income Less Expenses Cost of Goods Sold Loss on Sale of Plant and Equipment Depreciation - Plant and Equipment Interest Expense Operating Expenses Total Expenses Net Profit before Income Tax Income Tax Expense Net Profit after Income Tax 173 331 1 230 19 300 250 27 333 221 444 34 351 10 305 24 046 Smithton Ltd Internal Balance Sheet as at 30 June, 2020 2020 $'000 2019 $'000 3 500 55 100 41 740 32 100 372 1 200 61 950 37 400 57 Current Assets Cash at Bank Accounts Receivable Inventory Prepaid Operating Expenses Total Current Assets Non-Current Assets Land Plant and Equipment Accumulated Depreciation Total Non-Current Assets TOTAL ASSETS 100 607 15 900 89 000 (34 500) 70 400 170 772 22 000 73 000 (36 100) 58 900 159 507 Current Liabilities Accounts Payable Accrued Interest Payable Accrued Operating Expenses Payable Unearned Revenue Income Tax Payable Dividends Payable Total Current Liabilities Non-Current Liabilities Long-term Loan Total Non-Current Liabilities TOTAL LIABILITIES 54830 157 2 170 840 915 2 500 61 412 61 567 113 1 036 389 1948 3 500 68 553 15 950 15 950 77 362 24 590 24 590 93 143 15 950 77 362 93 410 24 590 93 143 66 364 Total Non-Current Liabilities TOTAL LIABILITIES NET ASSETS Shareholders' Equity Share Capital Reserves Retained Profits TOTAL SHAREHOLDERS' EQUITY 38 000 8 000 47 410 93 410 30 000 8 000 28 364 66 364 Reconciliation of Retained Profits Retained Profits, 1 July 2019 Net Profit after Tax Dividends Declared Retained Profits, 30 June 2020 28 364 24 046 (5000) $47 410 Additional information (all figures assume $'000) i. During the year, land to the value of $3 600 was purchased in exchange for shares. Some other land was sold for cash later in the year. ii. Some other shares were issued for cash during the year. iii. Some plant and equipment with an original purchase price of $65 700 was sold for cash during the year. New plant and equipment was also purchased for cash later in the financial year. Required: Prepare a cash flow statement for Smithton Ltd for the year ended 30 June 2020. A proforma is provided after the 'Workings' pages in the word document answer booklet. Smithton Ltde Statement of Cash Flowse for the year ending 30 June 2020 S000 24046 Cash flows from operating activities Net income Adjustments e Cash flows from investing activities e e Cash flows from financing activities ] le 43 le e le Net increase (or decrease) in cash and cash equivalents Cash and cash equivalents at beginning of periode Cash and cash equivalents at end of periode