Question

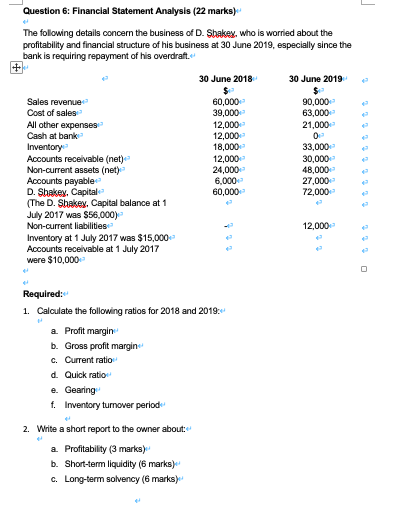

Question 6: Financial Statement Analysis (22 marks) The following details concern the business of D. Shakey, who is worried about the profitability and financial structure

Question 6: Financial Statement Analysis (22 marks)

The following details concern the business of D. Shakey, who is worried about the profitability and financial structure of his business at 30 June 2019, especially since the bank is requiring repayment of his overdraft.

|

| 30 June 2018 $ | 30 June 2019 $ |

| Sales revenue | 60,000 | 90,000 |

| Cost of sales | 39,000 | 63,000 |

| All other expenses | 12,000 | 21,000 |

| Cash at bank | 12,000 | 0 |

| Inventory | 18,000 | 33,000 |

| Accounts receivable (net) | 12,000 | 30,000 |

| Non-current assets (net) | 24,000 | 48,000 |

| Accounts payable | 6,000 | 27,000 |

| D. Shakey, Capital | 60,000 | 72,000 |

| (The D. Shakey, Capital balance at 1 July 2017 was $56,000) |

|

|

| Non-current liabilities | - | 12,000 |

| Inventory at 1 July 2017 was $15,000 |

|

|

| Accounts receivable at 1 July 2017 were $10,000 |

|

|

Required:

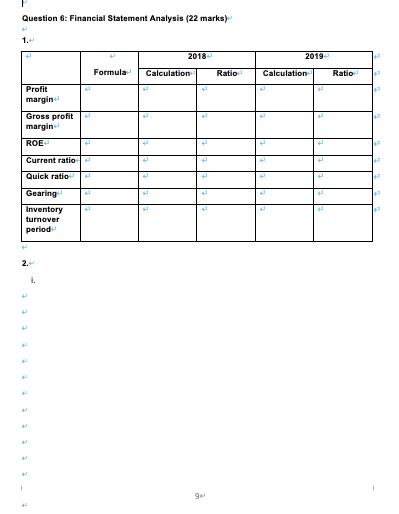

- Calculate the following ratios for 2018 and 2019:

- Profit margin

- Gross profit margin

- Current ratio

- Quick ratio

- Gearing

- Inventory turnover period

- Write a short report to the owner about:

- Profitability (3 marks)

- Short-term liquidity (6 marks)

- Long-term solvency (6 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started