Question 6: GL03-05 - Based on Problem 3-6A Adventure Travels LO P1, P2, P3, P4, P5

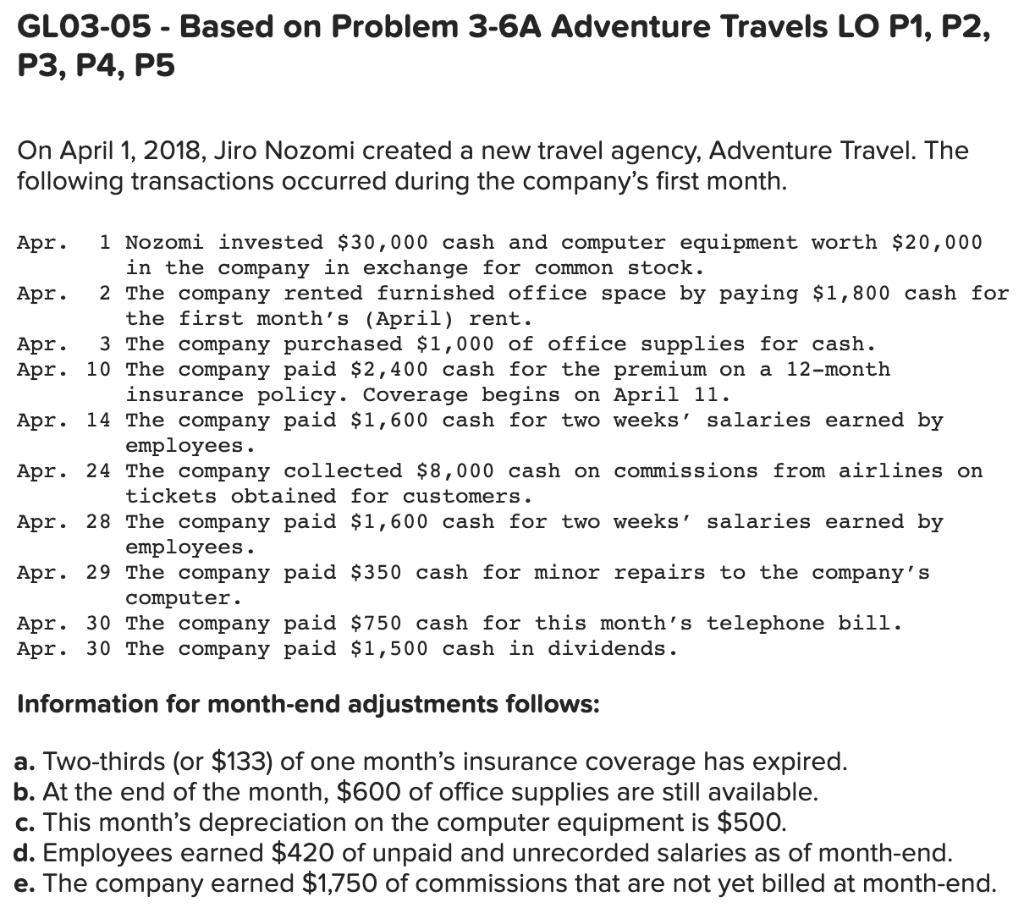

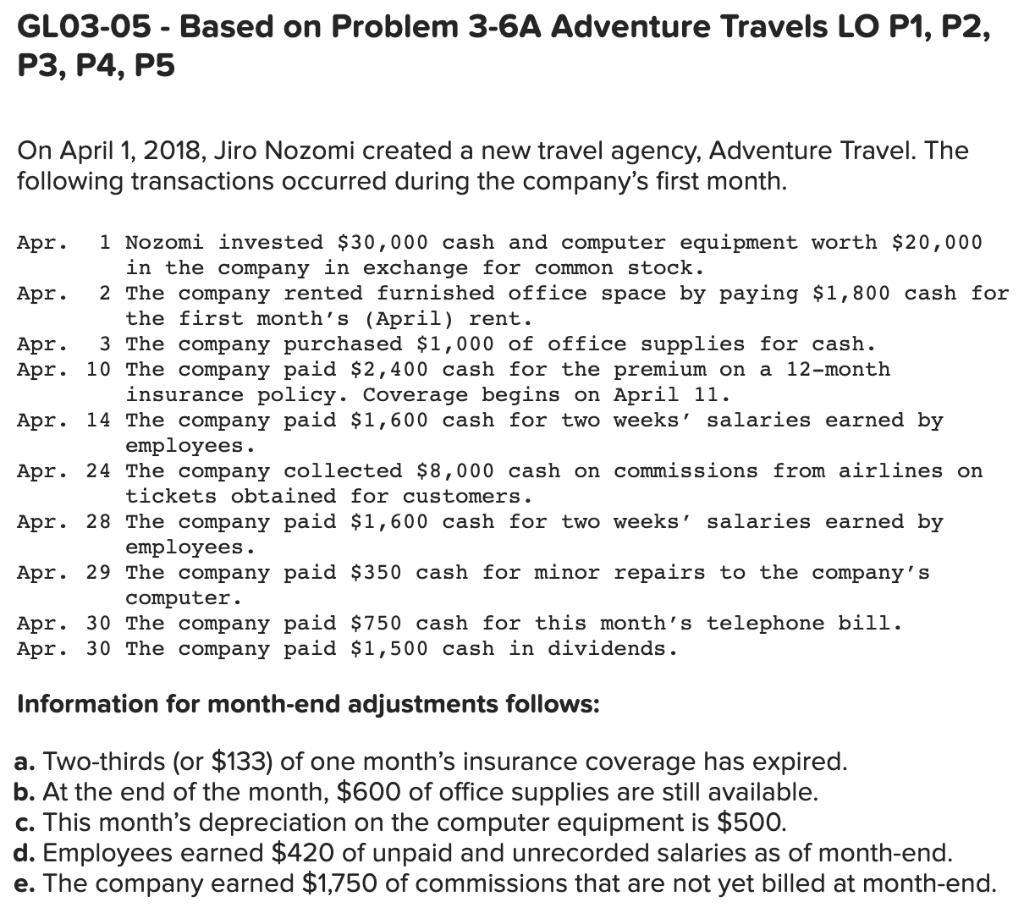

On April 1, 2018, Jiro Nozomi created a new travel agency, Adventure Travel. The following transactions occurred during the companys first month.

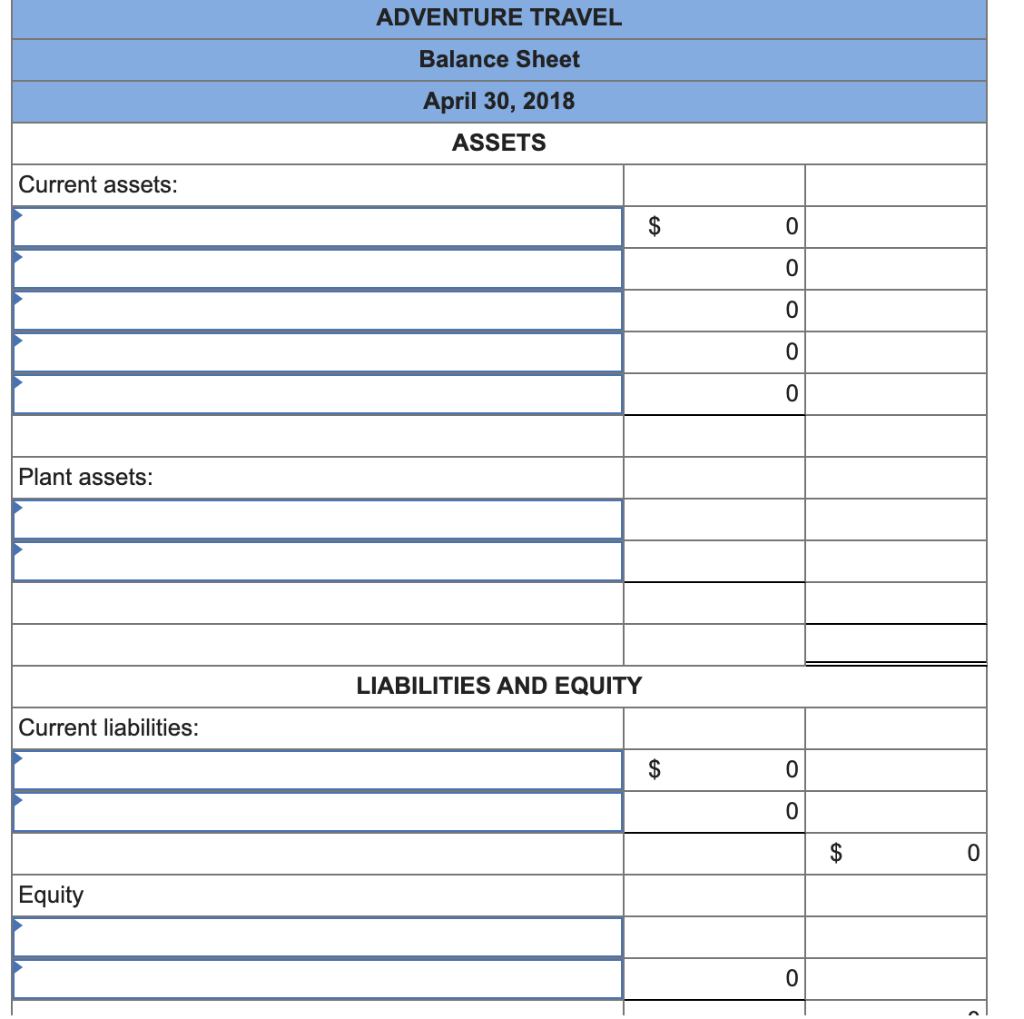

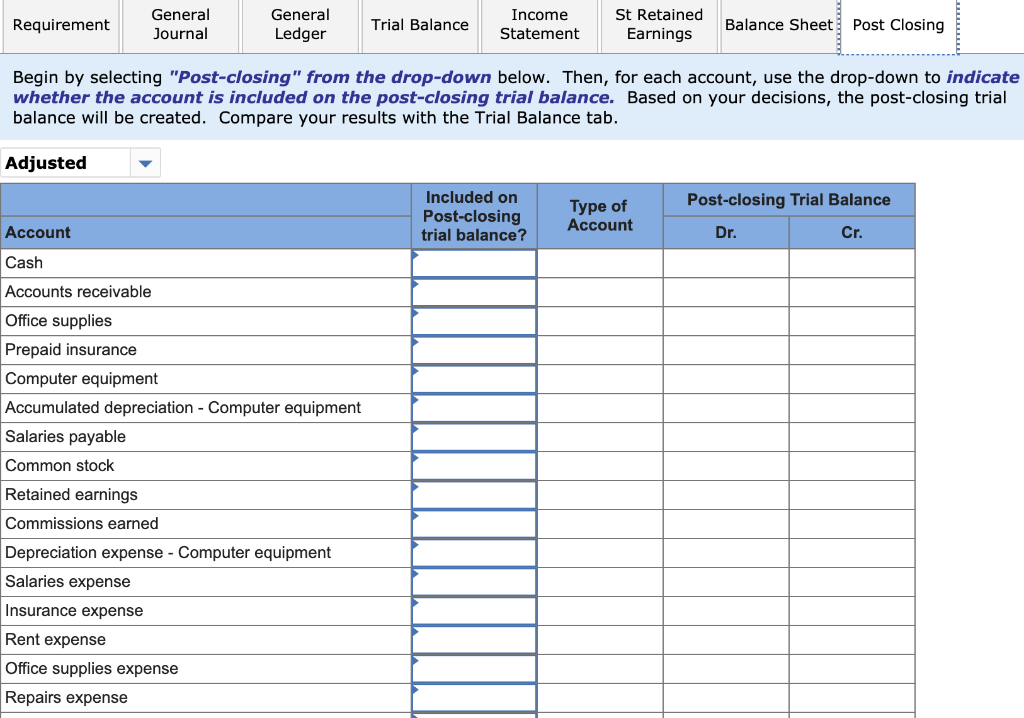

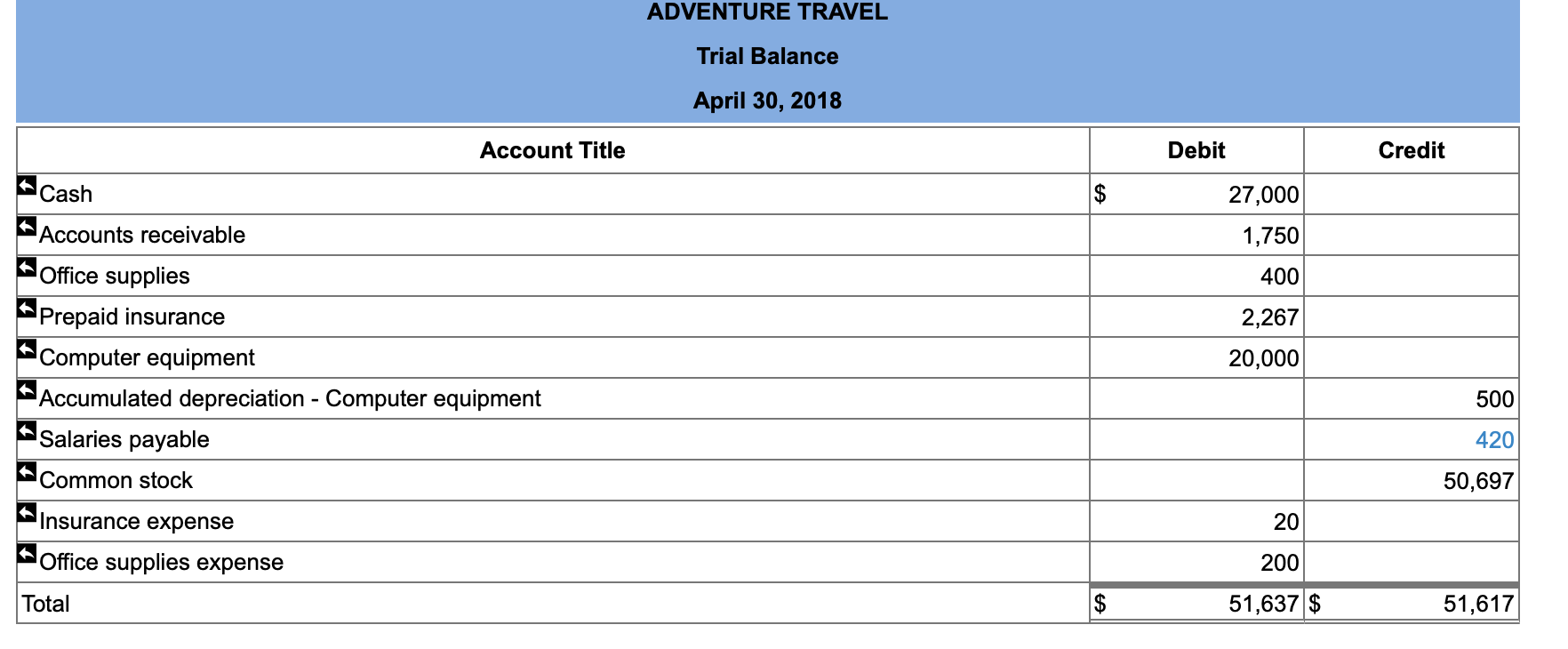

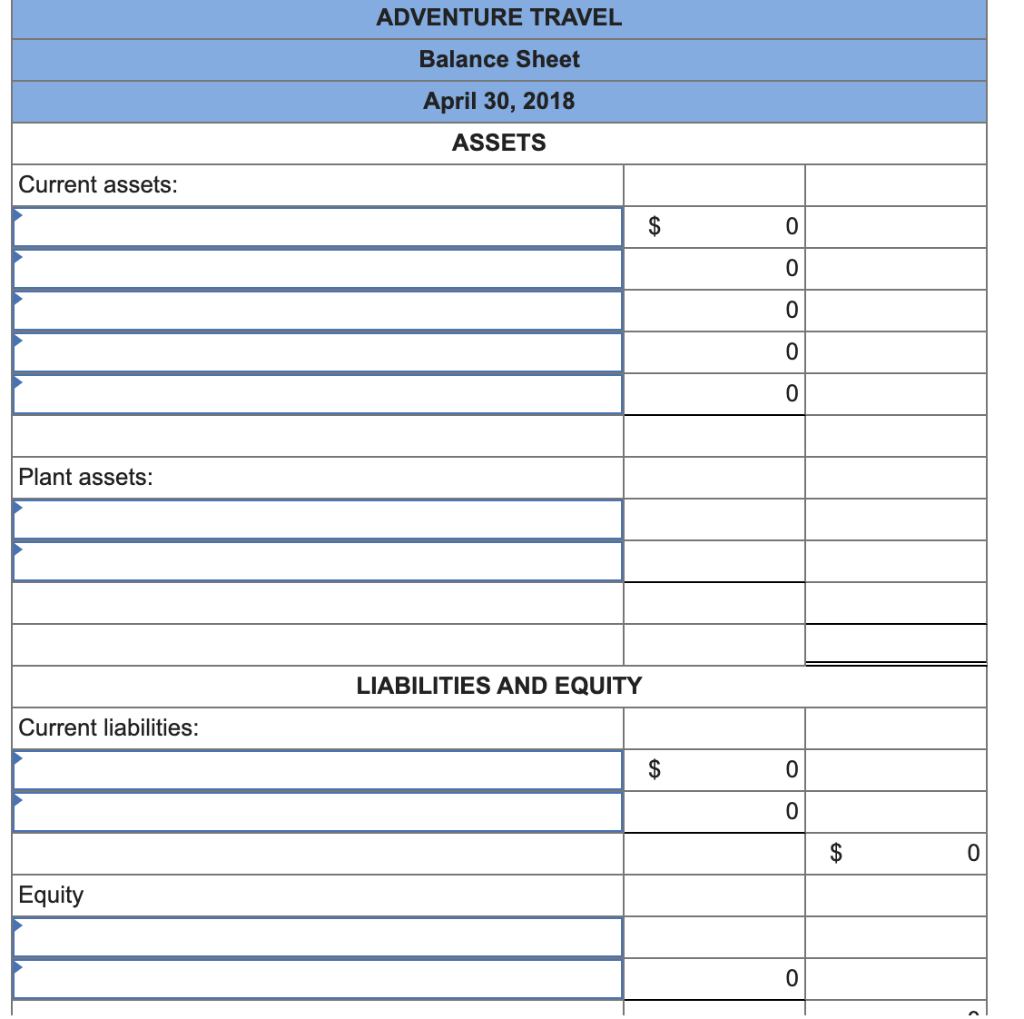

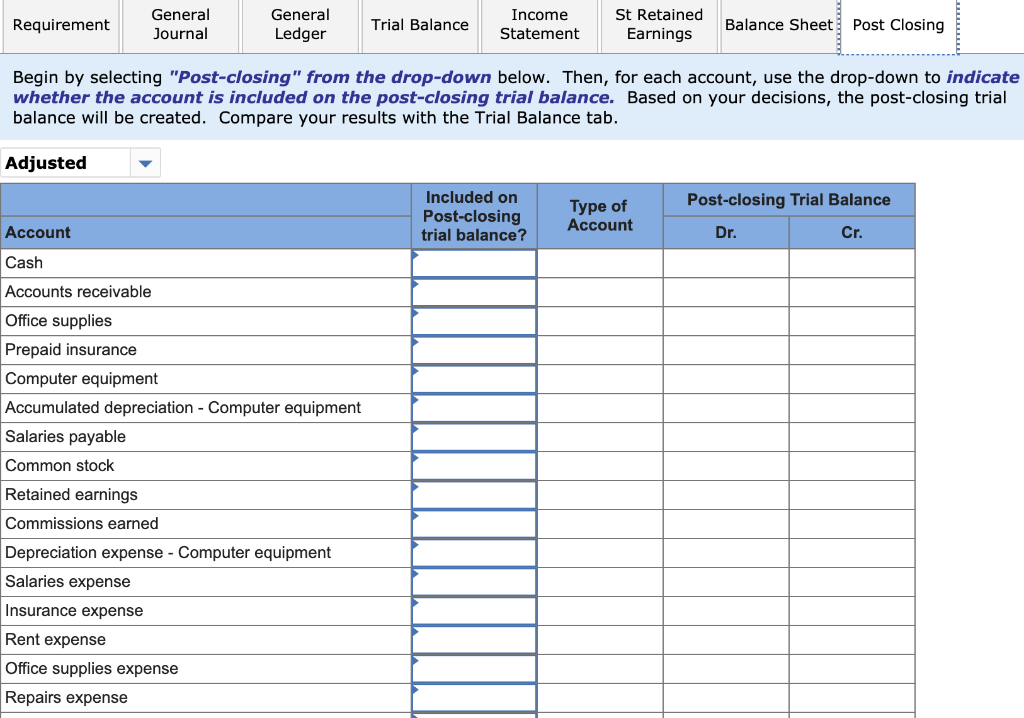

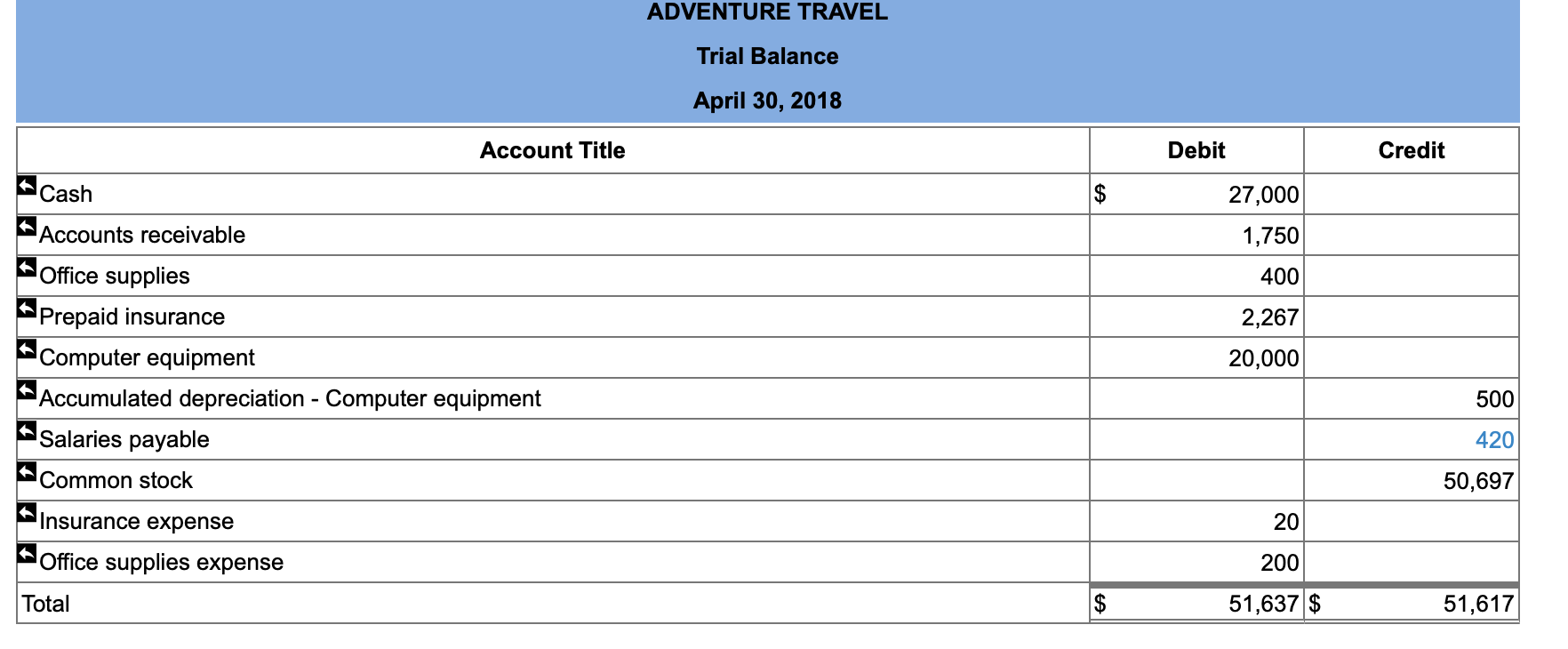

GLO3-05 - Based on Problem 3-6A Adventure Travels LO P1, P2, P3, P4, P5 On April 1, 2018, Jiro Nozomi created a new travel agency, Adventure Travel. The following transactions occurred during the company's first month. Apr. 1 Nozomi invested $30,000 cash and computer equipment worth $20,000 in the company in exchange for common stock. Apr. 2 The company rented furnished office space by paying $1,800 cash for the first month's (April) rent. Apr. 3 The company purchased $1,000 of office supplies for cash. Apr. 10 The company paid $2,400 cash for the premium on a 12-month insurance policy. Coverage begins on April 11. Apr. 14 The company paid $1,600 cash for two weeks' salaries earned by employees. Apr. 24 The company collected $8,000 cash on commissions from airlines on tickets obtained for customers. Apr. 28 The company paid $1,600 cash for two weeks' salaries earned by employees. Apr. 29 The company paid $350 cash for minor repairs to the company's computer. Apr. 30 The company paid $750 cash for this month's telephone bill. Apr. 30 The company paid $1,500 cash in dividends. Information for month-end adjustments follows: a. Two-thirds (or $133) of one month's insurance coverage has expired. b. At the end of the month, $600 of office supplies are still available. c. This month's depreciation on the computer equipment is $500. d. Employees earned $420 of unpaid and unrecorded salaries as of month-end. e. The company earned $1,750 of commissions that are not yet billed at month-end. ADVENTURE TRAVEL Balance Sheet April 30, 2018 ASSETS Current assets: $ 0 0 0 0 0 Plant assets: LIABILITIES AND EQUITY Current liabilities: $ 0 0 $ 0 Equity 0 Requirement General Journal General Ledger Trial Balance Income Statement St Retained Earnings Balance Sheet Post Closing Begin by selecting "Post-closing" from the drop-down below. Then, for each account, use the drop-down to indicate whether the account is included on the post-closing trial balance. Based on your decisions, the post-closing trial balance will be created. Compare your results with the Trial Balance tab. Adjusted Post-closing Trial Balance Included on Post-closing trial balance? Type of Account Account Dr. Cr. Cash Accounts receivable Office supplies Prepaid insurance Computer equipment Accumulated depreciation - Computer equipment Salaries payable Common stock Retained earnings Commissions earned Depreciation expense - Computer equipment Salaries expense Insurance expense Rent expense Office supplies expense Repairs expense ADVENTURE TRAVEL Trial Balance April 30, 2018 Account Title Debit Credit Cash $ 27,000 1,750 Accounts receivable 400 2,267 Office supplies Prepaid insurance Computer equipment Accumulated depreciation - Computer equipment Salaries payable 20,000 500 420 Common stock 50,697 Insurance expense 20 Office supplies expense 200 Total $ 51,637 $ 51,617 GLO3-05 - Based on Problem 3-6A Adventure Travels LO P1, P2, P3, P4, P5 On April 1, 2018, Jiro Nozomi created a new travel agency, Adventure Travel. The following transactions occurred during the company's first month. Apr. 1 Nozomi invested $30,000 cash and computer equipment worth $20,000 in the company in exchange for common stock. Apr. 2 The company rented furnished office space by paying $1,800 cash for the first month's (April) rent. Apr. 3 The company purchased $1,000 of office supplies for cash. Apr. 10 The company paid $2,400 cash for the premium on a 12-month insurance policy. Coverage begins on April 11. Apr. 14 The company paid $1,600 cash for two weeks' salaries earned by employees. Apr. 24 The company collected $8,000 cash on commissions from airlines on tickets obtained for customers. Apr. 28 The company paid $1,600 cash for two weeks' salaries earned by employees. Apr. 29 The company paid $350 cash for minor repairs to the company's computer. Apr. 30 The company paid $750 cash for this month's telephone bill. Apr. 30 The company paid $1,500 cash in dividends. Information for month-end adjustments follows: a. Two-thirds (or $133) of one month's insurance coverage has expired. b. At the end of the month, $600 of office supplies are still available. c. This month's depreciation on the computer equipment is $500. d. Employees earned $420 of unpaid and unrecorded salaries as of month-end. e. The company earned $1,750 of commissions that are not yet billed at month-end. ADVENTURE TRAVEL Balance Sheet April 30, 2018 ASSETS Current assets: $ 0 0 0 0 0 Plant assets: LIABILITIES AND EQUITY Current liabilities: $ 0 0 $ 0 Equity 0 Requirement General Journal General Ledger Trial Balance Income Statement St Retained Earnings Balance Sheet Post Closing Begin by selecting "Post-closing" from the drop-down below. Then, for each account, use the drop-down to indicate whether the account is included on the post-closing trial balance. Based on your decisions, the post-closing trial balance will be created. Compare your results with the Trial Balance tab. Adjusted Post-closing Trial Balance Included on Post-closing trial balance? Type of Account Account Dr. Cr. Cash Accounts receivable Office supplies Prepaid insurance Computer equipment Accumulated depreciation - Computer equipment Salaries payable Common stock Retained earnings Commissions earned Depreciation expense - Computer equipment Salaries expense Insurance expense Rent expense Office supplies expense Repairs expense ADVENTURE TRAVEL Trial Balance April 30, 2018 Account Title Debit Credit Cash $ 27,000 1,750 Accounts receivable 400 2,267 Office supplies Prepaid insurance Computer equipment Accumulated depreciation - Computer equipment Salaries payable 20,000 500 420 Common stock 50,697 Insurance expense 20 Office supplies expense 200 Total $ 51,637 $ 51,617