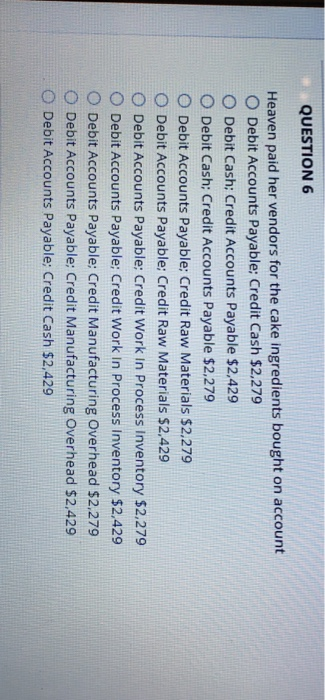

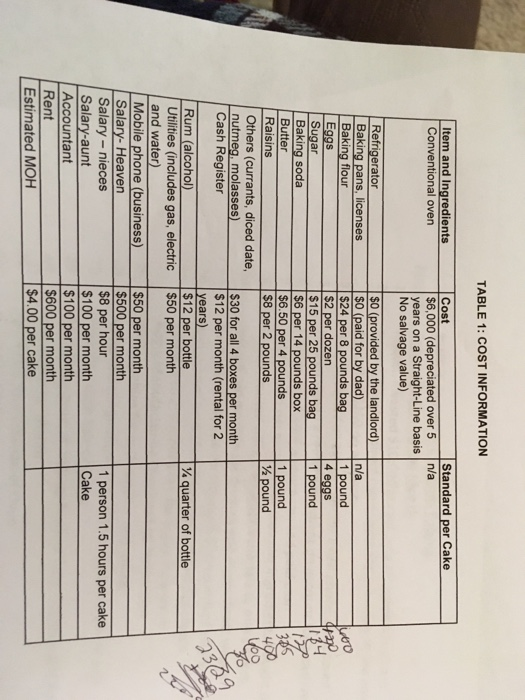

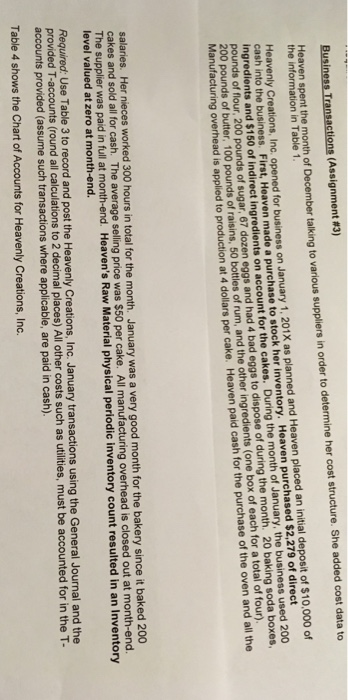

QUESTION 6 Heaven paid her vendors for the cake ingredients bought on account O Debit Accounts Payable: Credit Cash $2.279 O Debit Cash: Credit Accounts Payable $2.429 O Debit Cash; Credit Accounts Payable $2.279 O Debit Accounts Payable: Credit Raw Materials $2.279 O Debit Accounts Payable: Credit Raw Materials $2.429 O Debit Accounts Payable; Credit Work In Process Inventory $2.279 O Debit Accounts Payable; Credit Work in Process inventory $2.429 O Debit Accounts Payable: Credit Manufacturing Overhead $2.279 O Debit Accounts Payable: Credit Manufacturing Overhead $2,429 O Debit Accounts Payable; Credit Cash $2,429 TABLE 1: COST INFORMATION Standard per Cake Item and Ingredients Conventional oven Cost $6,000 (depreciated over 5 n/a years on a Straight-Line basis No salvage value) Refrigerator nla Baking pans, licenses Baking flour $0 (paid for by dad) 524 per 8 pounds bag $2 per dozen 4 eggs Eggs Sugar Baking soda Butter Raisins $15 per 25 pounds bag pound per 14 pounds box Others (currants, diced date nutmeg. Cash Register molasses)$30 for all 4 boxes per month $12 per month (rental for 2 years) $12 per bottle quarter of bottle- Utilities (includes gas, electric $50 per month and water) Mobile phone (business) Salary- Heaven $50 per month 1 person 1.5 hours per cake Cake Salary- nieces Salary-aunt Accountant Rent Estimated MOH $8 per hour $100 per month $100 per month $600 per month $4.00 per cake Busines,Transactions (Assignment #3) Heaven spent the month of December talking to various suppliers in order to determine her cost structure. She added cost data to the information in Table 1 Heavenly Creations, Inc. opened for business on J cash into the business. First, Heaven made ingredients and anuary 1, 201X as planned and Heaven placed an initial deposit of S 10.000 of a purchase to stock her inventory. Heaven purchased $2,279 of direct $150 of indirect ingredients on account for the cakes. During the month of January, the business used 200 ouds of four, 200 pounds of sugar, 67 dozen eggs and had 4 bad eggs to dispose of during the month. 20 baking soda boxes, butter, 100 pounds of raisins, 50 bottles of rum, and the other ingredients (one box of each for a total of four) ring overhead is applied to production at 4 dolla 200 acturing overhead is applied to production at 4 dollars per cake. Heaven paid cash for the purchase of the oven and all the salaries. Her nieces worked 300 hours in total for the month. January was a very good month for the bakery since it baked 200 cakes and sold all for cash. The average selling price was $50 per cake. All manufacturing overhead is closed out at month-end. The supplier was paid in full at month-end. Heaven's Raw Material physical periodic inventory count resulted in an Inventory level valued at zero at month-end. Required: Use Table 3 to record provided T-accounts (round all calculations to 2 decimal places) All other costs such as utilities, must be accounted for in the T- and post the Heavenly Creations, Inc. January transactions using the General Journal and the accounts provided (assume such transactions where applicable, are paid in cash) Table 4 shows the Chart of Accounts for Heavenly Creations, Inc