Answered step by step

Verified Expert Solution

Question

1 Approved Answer

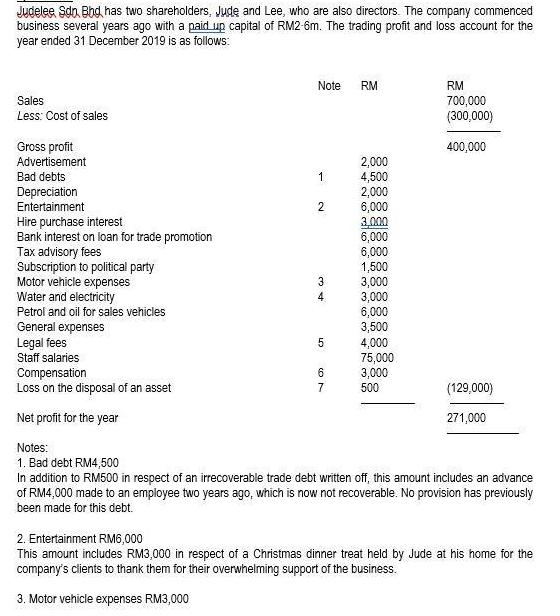

Judelee Sdn. Bhd has two shareholders, Jude and Lee, who are also directors. The company commenced business several years ago with a paid up

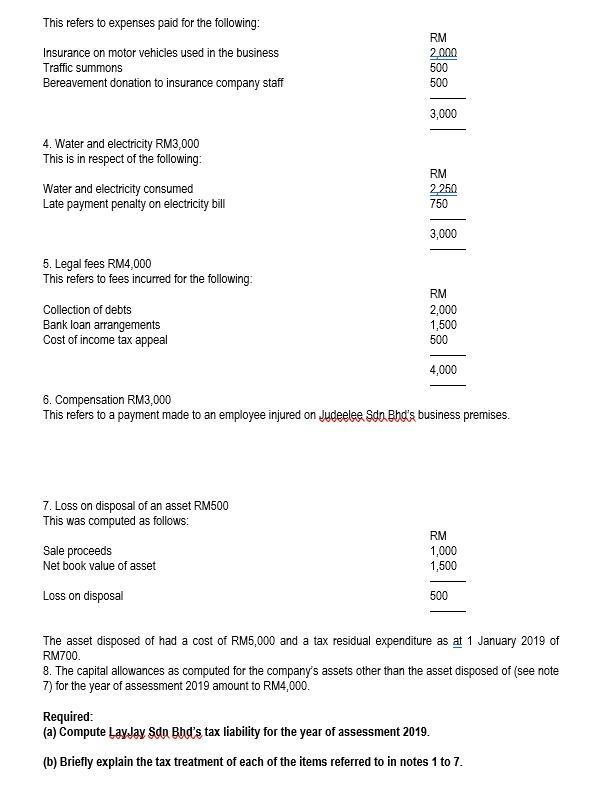

Judelee Sdn. Bhd has two shareholders, Jude and Lee, who are also directors. The company commenced business several years ago with a paid up capital of RM2-6m. The trading profit and loss account for the year ended 31 December 2019 is as follows: Note RM RM 700,000 (300,000) Sales Less: Cost of sales Gross profit Advertisement Bad debts 400,000 2,000 4,500 2,000 6,000 3.000 6,000 6,000 1,500 3,000 3,000 6,000 3,500 4,000 75,000 3,000 1. Depreciation Entertainment Hire purchase interest Bank interest on loan for trade promotion Tax advisory fees Subscription to political party Motor vehicle expenses Water and electricity Petrol and oil for sales vehicles General expenses Legal fees Staff salaries 3 4 Compensation Loss on the disposal of an asset 6 500 (129,000) Net profit for the year 271,000 Notes: 1. Bad debt RM4,500 In addition to RM500 in respect of an irrecoverable trade debt written off, this amount includes an advance of RM4,000 made to an employee two years ago, which is now not recoverable. No provision has previously been made for this debt. 2. Entertainment RM6,000 This amount includes RM3,000 in respect of a Christmas dinner treat held by Jude at his home for the company's clients to thank them for their overwhelming support of the business. 3. Motor vehicle expenses RM3,000 CO7 This refers to expenses paid for the following: RM Insurance on motor vehicles used in the business 2,000 Traffic summons 500 Bereavement donation to insurance company staff 500 3,000 4. Water and electricity RM3,000 This is in respect of the following: RM 2250 Water and electricity consumed Late payment penalty on electricity bill 750 3,000 5. Legal fees RM4,000 This refers to fees incurred for the following: RM Collection of debts Bank loan arrangements Cost of income tax appeal 2,000 1,500 500 4,000 6. Compensation RM3,000 This refers to a payment made to an employee injured on Judeelee Sdo Bhd's business premises. 7. Loss on disposal of an asset RM500 This was computed as follows: RM Sale proceeds Net book value of asset 1,000 1,500 Loss on disposal 500 The asset disposed of had a cost of RM5,000 and a tax residual expenditure as at 1 January 2019 of RM700. 8. The capital allowances as computed for the company's assets other than the asset disposed of (see note 7) for the year of assessment 2019 amount to RM4,000. Required: (a) Compute LayJay Sdn Bbd's tax liability for the year of assessment 2019. (b) Briefly explain the tax treatment of each of the items referred to in notes 1 to 7.

Step by Step Solution

★★★★★

3.44 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started