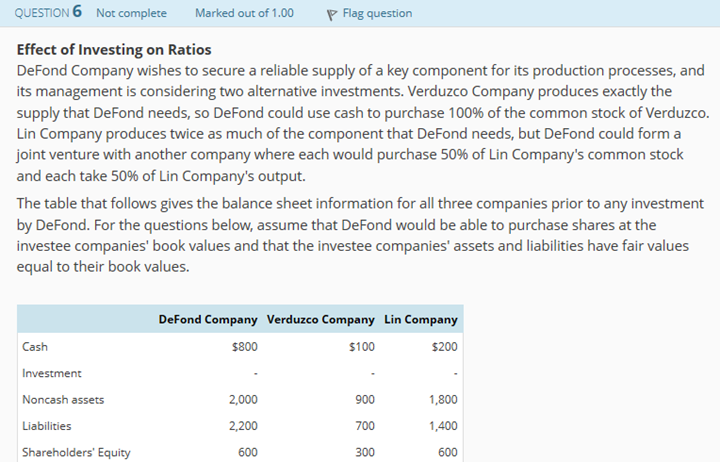

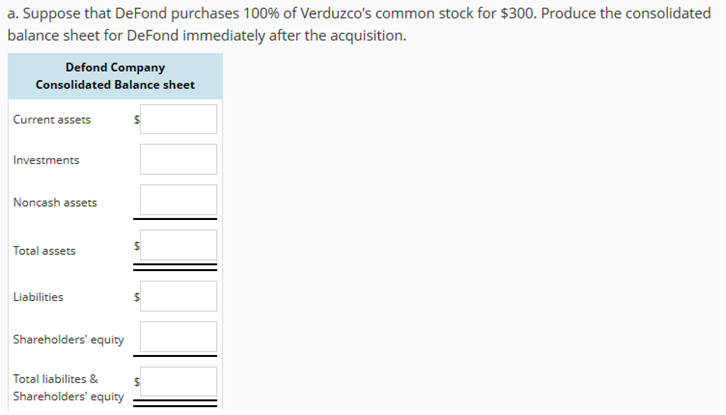

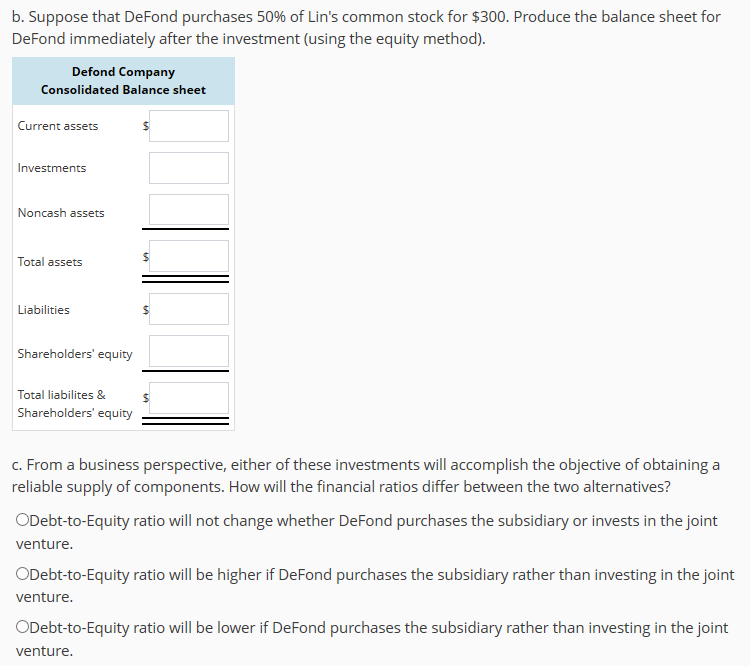

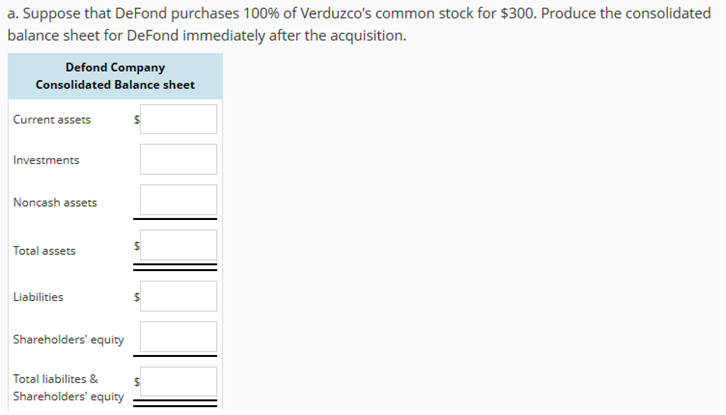

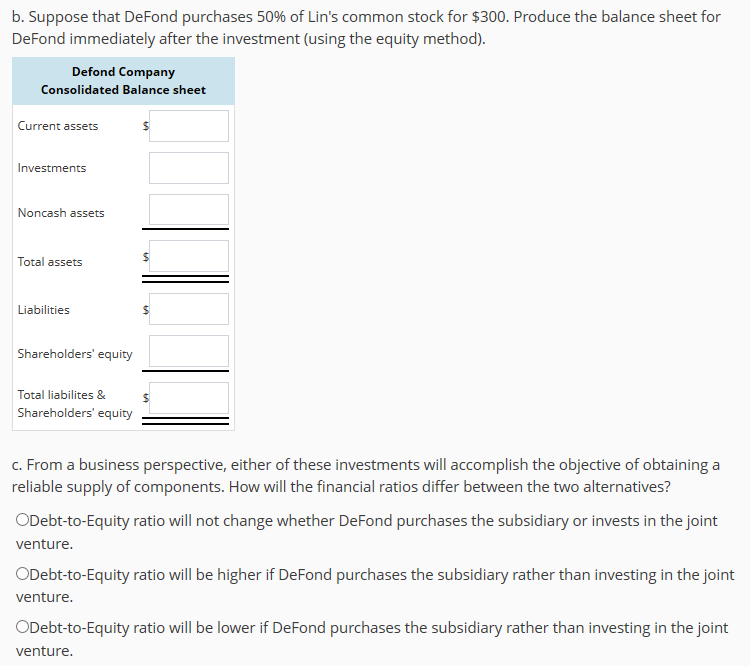

QUESTION 6 Marked out of 1.00 PFlag question Not complete Effect of Investing on Ratios DeFond Company wishes to secure a reliable supply of a key component for its production processes, and its management is considering two alternative investments. Verduzco Company produces exactly the supply that DeFond needs, so DeFond could use cash to purchase 100% of the common stock of Verduzco. Lin Company produces twice as much of the component that DeFond needs, but DeFond could form a joint venture with another company where each would purchase 50% of Lin Company's common stock and each take 50% of Lin Company's output. The table that follows gives the balance sheet information for all three companies prior to any investment by DeFond. For the questions below, assume that DeFond would be able to purchase shares at the investee companies' book values and that the investee companies' assets and liabilities have fair values equal to their book values. DeFond Company Verduzco Company Lin Company Cash Investment Noncash assets Liabilities Shareholders' Equity $100 $200 $800 1,800 1,400 600 2,000 2,200 600 900 700 300 a. Suppose that DeFond purchases 100% of Verduzco's common stock for $300. Produce the consolidated balance sheet for DeFond immediately after the acquisition Defond Company Consolidated Balance sheet Current assets Investments Noncash assets Total assets Liabilities Shareholders' equity Total liabilites & Shareholders' equity b. Suppose that DeFond purchases 50% of Lin's common stock for $300. Produce the balance sheet for DeFond immediately after the investment (using the equity method). Defond Company Consolidated Balance sheet Current assets Investments Noncash assets Total assets Liabilities Shareholders' equity Total liabilites & Shareholders' equity C. From a business perspective, either of these investments will accomplish the objective of obtaining a reliable supply of components. How will the financial ratios differ between the two alternatives? ODebt-to-Equity ratio will not change whether DeFond purchases the subsidiary or invests in the joint venture venture ODebt-to-Equity ratio will be lower if DeFond purchases the subsidiary rather than investing in the joint venture QUESTION 6 Marked out of 1.00 PFlag question Not complete Effect of Investing on Ratios DeFond Company wishes to secure a reliable supply of a key component for its production processes, and its management is considering two alternative investments. Verduzco Company produces exactly the supply that DeFond needs, so DeFond could use cash to purchase 100% of the common stock of Verduzco. Lin Company produces twice as much of the component that DeFond needs, but DeFond could form a joint venture with another company where each would purchase 50% of Lin Company's common stock and each take 50% of Lin Company's output. The table that follows gives the balance sheet information for all three companies prior to any investment by DeFond. For the questions below, assume that DeFond would be able to purchase shares at the investee companies' book values and that the investee companies' assets and liabilities have fair values equal to their book values. DeFond Company Verduzco Company Lin Company Cash Investment Noncash assets Liabilities Shareholders' Equity $100 $200 $800 1,800 1,400 600 2,000 2,200 600 900 700 300 a. Suppose that DeFond purchases 100% of Verduzco's common stock for $300. Produce the consolidated balance sheet for DeFond immediately after the acquisition Defond Company Consolidated Balance sheet Current assets Investments Noncash assets Total assets Liabilities Shareholders' equity Total liabilites & Shareholders' equity b. Suppose that DeFond purchases 50% of Lin's common stock for $300. Produce the balance sheet for DeFond immediately after the investment (using the equity method). Defond Company Consolidated Balance sheet Current assets Investments Noncash assets Total assets Liabilities Shareholders' equity Total liabilites & Shareholders' equity C. From a business perspective, either of these investments will accomplish the objective of obtaining a reliable supply of components. How will the financial ratios differ between the two alternatives? ODebt-to-Equity ratio will not change whether DeFond purchases the subsidiary or invests in the joint venture venture ODebt-to-Equity ratio will be lower if DeFond purchases the subsidiary rather than investing in the joint venture