Answered step by step

Verified Expert Solution

Question

1 Approved Answer

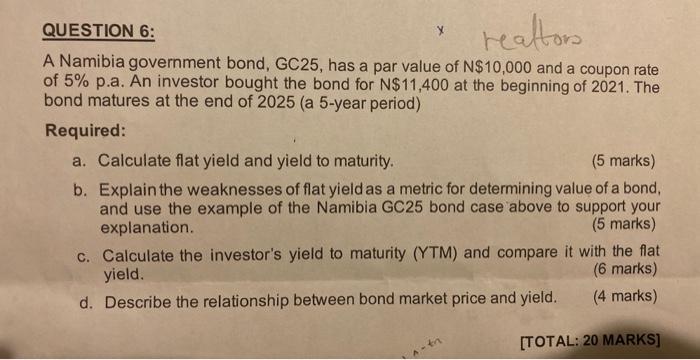

QUESTION 6: realtors. A Namibia government bond, GC25, has a par value of N$10,000 and a coupon rate of 5% p.a. An investor bought

QUESTION 6: realtors. A Namibia government bond, GC25, has a par value of N$10,000 and a coupon rate of 5% p.a. An investor bought the bond for N$11,400 at the beginning of 2021. The bond matures at the end of 2025 (a 5-year period) Required: a. Calculate flat yield and yield to maturity. (5 marks) b. Explain the weaknesses of flat yield as a metric for determining value of a bond, and use the example of the Namibia GC25 bond case above to support your explanation. (5 marks) c. Calculate the investor's yield to maturity (YTM) and compare it yield. d. Describe the relationship between bond market price and yield. with the flat (6 marks) (4 marks) [TOTAL: 20 MARKS]

Step by Step Solution

★★★★★

3.51 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Ans a To calculate the flat yield of the Namibia GC25 bond we need to first determine the bonds annual interest payment Since the bond has a par value ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started