Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Suppose you are a currency speculator in the (hypothetical) country of Macondo, whose currency is the MAC, and you wish to do some currency

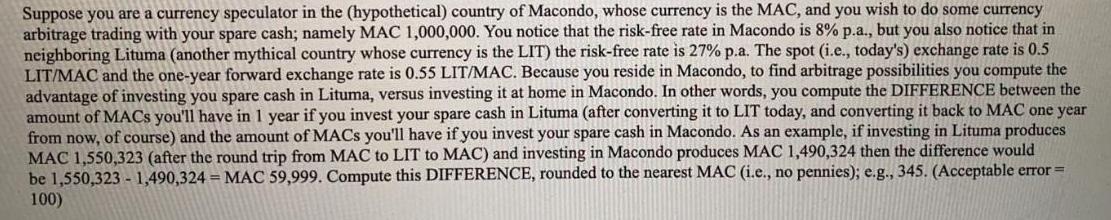

Suppose you are a currency speculator in the (hypothetical) country of Macondo, whose currency is the MAC, and you wish to do some currency arbitrage trading with your spare cash; namely MAC 1,000,000. You notice that the risk-free rate in Macondo is 8% p.a., but you also notice that in neighboring Lituma (another mythical country whose currency is the LIT) the risk-free rate is 27% p.a. The spot (i.e., today's) exchange rate is 0.5 LIT/MAC and the one-year forward exchange rate is 0.55 LIT/MAC. Because you reside in Macondo, to find arbitrage possibilities you compute the advantage of investing you spare cash in Lituma, versus investing it at home in Macondo. In other words, you compute the DIFFERENCE between the amount of MACS you'll have in 1 year if you invest your spare cash in Lituma (after converting it to LIT today, and converting it back to MAC one year from now, of course) and the amount of MACS you'll have if you invest your spare cash in Macondo. As an example, if investing in Lituma produces MAC 1,550,323 (after the round trip from MAC to LIT to MAC) and investing in Macondo produces MAC 1,490,324 then the difference would be 1,550,323 -1,490,324 = MAC 59,999. Compute this DIFFERENCE, rounded to the nearest MAC (i.e., no pennies); e.g., 345. (Acceptable error = 100)

Step by Step Solution

★★★★★

3.35 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

1 Investment in Lituma 1000000 MAC 05 LIT Investment in Lituma 500000 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started