Answered step by step

Verified Expert Solution

Question

1 Approved Answer

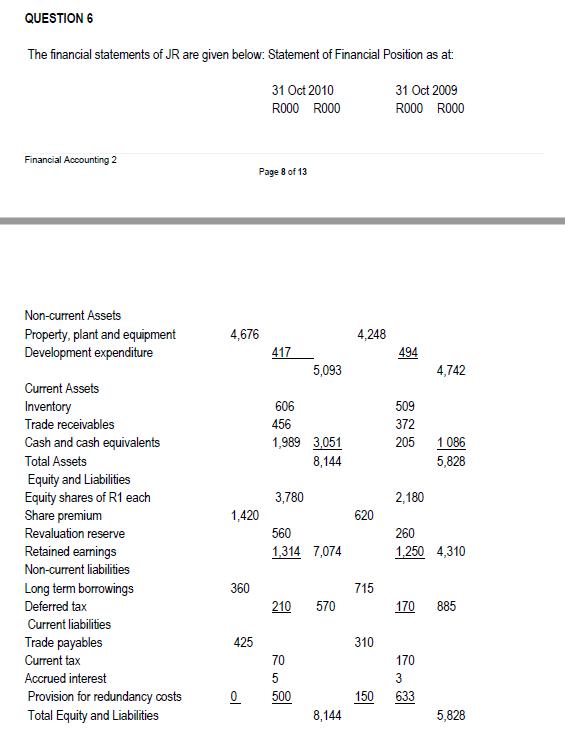

QUESTION 6 The financial statements of JR are given below: Statement of Financial Position as at Financial Accounting 2 Non-current Assets Property, plant and

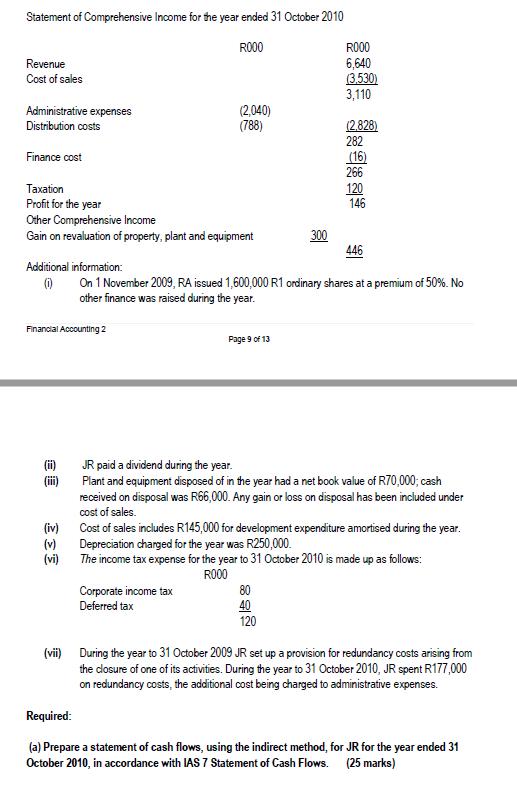

QUESTION 6 The financial statements of JR are given below: Statement of Financial Position as at Financial Accounting 2 Non-current Assets Property, plant and equipment Development expenditure Current Assets Inventory Trade receivables Cash and cash equivalents Total Assets Equity and Liabilities Equity shares of R1 each Share premium Revaluation reserve Retained earnings Non-current liabilities Long term borrowings Deferred tax Current liabilities Trade payables Current tax Accrued interest Provision for redundancy costs Total Equity and Liabilities 4,676 1,420 360 425 0 ol 31 Oct 2010 R000 R000 Page 8 of 13 417 606 456 1,989 3,051 8,144 3,780 5,093 560 1,314 7,074 210 570 70 5 500 8,144 4,248 620 715 310 150 31 Oct 2009 R000 R000 494 509 372 205 2,180 170 4,742 260 1,250 4,310 170 3 633 1086 5,828 885 5,828 Statement of Comprehensive Income for the year ended 31 October 2010 R000 Revenue Cost of sales Administrative expenses Distribution costs Finance cost Taxation Profit for the year Other Comprehensive Income Gain on revaluation of property, plant and equipment Additional information: (1) Financial Accounting 2 (vii) (2,040) (788) Page 9 of 13 Corporate income tax Deferred tax 300 R000 6,640 (3,530) 3,110 (2,828) 282 446 On 1 November 2009, RA issued 1,600,000 R1 ordinary shares at a premium of 50%. No other finance was raised during the year. 80 40 120 (16) 266 120 146 JR paid a dividend during the year. Plant and equipment disposed of in the year had a net book value of R70,000; cash received on disposal was R66,000. Any gain or loss on disposal has been included under cost of sales. (iv) Cost of sales includes R145,000 for development expenditure amortised during the year. (v) Depreciation charged for the year was R250,000. (vi) The income tax expense for the year to 31 October 2010 is made up as follows: R000 During the year to 31 October 2009 JR set up a provision for redundancy costs arising from the closure of one of its activities. During the year to 31 October 2010, JR spent R177,000 on redundancy costs, the additional cost being charged to administrative expenses. Required: (a) Prepare a statement of cash flows, using the indirect method, for JR for the year ended 31 October 2010, in accordance with IAS 7 Statement of Cash Flows. (25 marks)

Step by Step Solution

★★★★★

3.50 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Cash Flows from Operating Activities Net Profit before taxation and extraordinary items Adjustments ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started