Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The following trial balance relates to Molly at 31 December 20X1: The following is to be taken into account: Revenue Purchases Distribution costs Administration

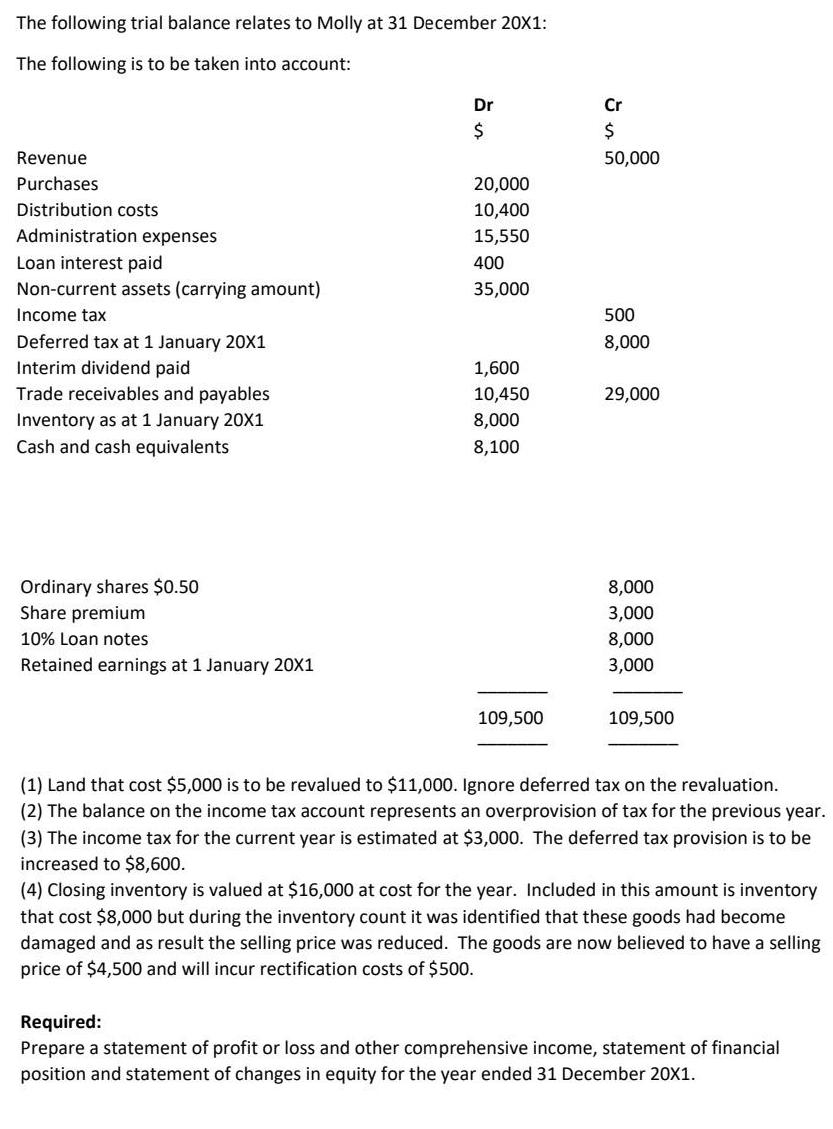

The following trial balance relates to Molly at 31 December 20X1: The following is to be taken into account: Revenue Purchases Distribution costs Administration expenses Loan interest paid Non-current assets (carrying amount) Income tax Deferred tax at 1 January 20X1 Interim dividend paid Trade receivables and payables Inventory as at 1 January 20X1 Cash and cash equivalents Ordinary shares $0.50 Share premium 10% Loan notes Retained earnings at 1 January 20X1 Dr $ 20,000 10,400 15,550 400 35,000 1,600 10,450 8,000 8,100 109,500 Cr $ 50,000 500 8,000 29,000 8,000 3,000 8,000 3,000 109,500 (1) Land that cost $5,000 is to be revalued to $11,000. Ignore deferred tax on the revaluation. (2) The balance on the income tax account represents an overprovision of tax for the previous year. (3) The income tax for the current year is estimated at $3,000. The deferred tax provision is to be increased to $8,600. (4) Closing inventory is valued at $16,000 at cost for the year. Included in this amount is inventory that cost $8,000 but during the inventory count it was identified that these goods had become damaged and as result the selling price was reduced. The goods are now believed to have a selling price of $4,500 and will incur rectification costs of $500. Required: Prepare a statement of profit or loss and other comprehensive income, statement of financial position and statement of changes in equity for the year ended 31 December 20X1.

Step by Step Solution

★★★★★

3.35 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

The ending balance of inventory after adjusting the damaged goods Clos...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started