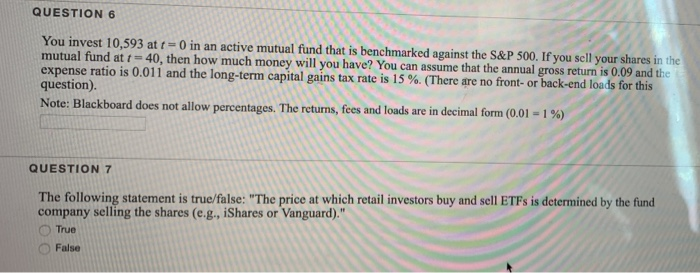

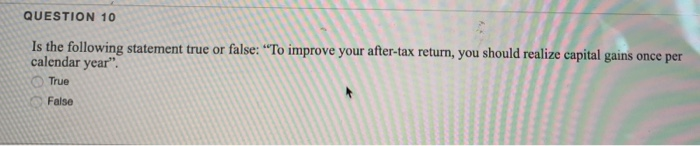

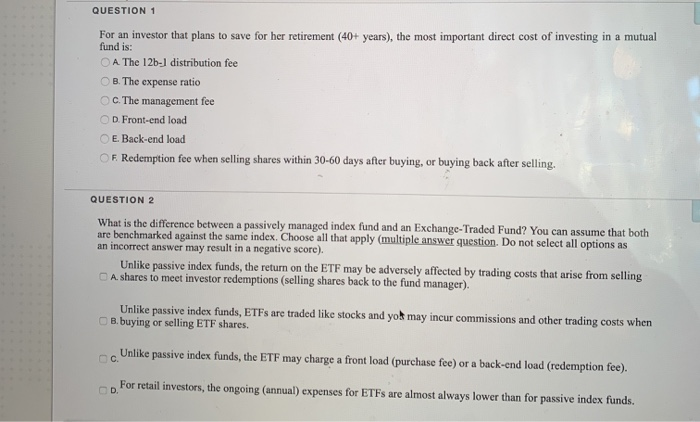

QUESTION 6 You invest 10,593 at t=0 in an active mutual fund that is benchmarked against the S&P 500. If you sell your shares in the mutual fund at t= 40, then how much money will you have? You can assume that the annual gross return is 0.09 and the expense ratio is 0.011 and the long-term capital gains tax rate is 15 %. (There are no front- or back-end loads for this question) Note: Blackboard does not allow percentages. The returns, fees and loads are in decimal form (0.01 - 1%) QUESTION 7 The following statement is true/false: "The price at which retail investors buy and sell ETFs is determined by the fund company selling the shares (e.g., iShares or Vanguard)." True False QUESTION 10 Is the following statement true or false: "To improve your after-tax return, you should realize capital gains once per calendar year". True False QUESTION 1 For an investor that plans to save for her retirement (40+ years), the most important direct cost of investing in a mutual fund is: A The 126-1 distribution fee OB. The expense ratio C. The management fee D. Front-end load E. Back-end load OF Redemption fee when selling shares within 30-60 days after buying, or buying back after selling. QUESTION 2 What is the difference between a passively managed index fund and an Exchange-Traded Fund? You can assume that both are benchmarked against the same index. Choose all that apply (multiple answer question. Do not select all options as an incorrect answer may result in a negative score). Unlike passive index funds, the return on the ETF may be adversely affected by trading costs that arise from selling A shares to meet investor redemptions (selling shares back to the fund manager) Unlike passive index funds, ETFs are traded like stocks and yo may incur commissions and other trading costs when B. buying or selling ETF shares. Unlike passive index funds, the ETF may charge a front load (purchase fee) or a back-end load (redemption fee). D. For retail investors, the ongoing (annual) expenses for ETFs are almost always lower than for passive index funds