Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 6[12 marks ]. This question is about the Merton model. The total capital F(t) of a company follows the geometric Brownian motion with parameters

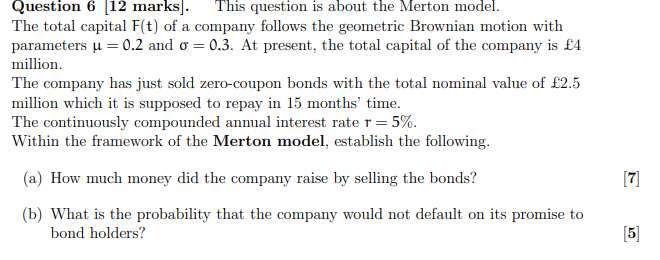

Question 6[12 marks ]. This question is about the Merton model. The total capital F(t) of a company follows the geometric Brownian motion with parameters =0.2 and =0.3. At present, the total capital of the company is 4 million. The company has just sold zero-coupon bonds with the total nominal value of 2.5 million which it is supposed to repay in 15 months' time. The continuously compounded annual interest rate r=5%. Within the framework of the Merton model, establish the following. (a) How much money did the company raise by selling the bonds? (b) What is the probability that the company would not default on its promise to bond holders

Question 6[12 marks ]. This question is about the Merton model. The total capital F(t) of a company follows the geometric Brownian motion with parameters =0.2 and =0.3. At present, the total capital of the company is 4 million. The company has just sold zero-coupon bonds with the total nominal value of 2.5 million which it is supposed to repay in 15 months' time. The continuously compounded annual interest rate r=5%. Within the framework of the Merton model, establish the following. (a) How much money did the company raise by selling the bonds? (b) What is the probability that the company would not default on its promise to bond holders

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started