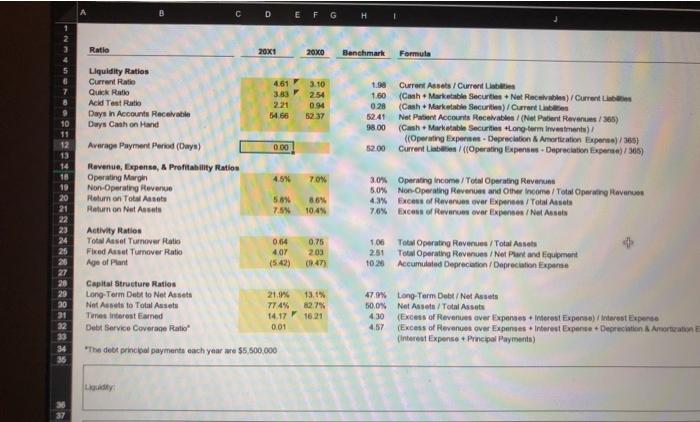

QUESTION 64 10 points Save Aww Please select at least two profitability measures you have already calculated for the operation in the box below, please pply the framework we reviewed in cand incuss your findings with respect to the following Year-over-year trending Performance against benchmark Drivers of change in the metric and management considerations for improvement For the toolbar, press ALT F10 (PC) or ALT.N.F10 Mac) BIVS Paragraph Arial 140K 5 E X X, 93. Te EA N I. X 1 + r 11 11 >> WORDS POWERED BY TINY C D E F G H Ratio 20x1 20x0 Banchmark Formula Liquidity Ratios Current Ratio Quick Ratio Acid Test Ratio Days in Accounts Receivable Days Cash on Hand 4.61 3.10 3.83 254 2.21 0.94 5466 1. Current Assels / Current 1.60 (Cash Marketable Securities .Net Receivable) / Current 0.28 (Cash Marketable Securitie) / Current Libre 52.41 Net Patient Accounts Receivable/(Net Patient Revenues/365) 98.00 (Cash Markwiable Securities Long term Investments) ((Operating Expenses. Depreciation Amortization Experie/365) 52.00 Current Libi/ ((Operating Expenses.Depreciation Exper)/365) 000 Average Payment Period (Onys) Revenue Expens, & Profitability Ration Operating Margin Non-Operating Revenue Rolurn on Total Assets Return on Net Assets 45% 70% 58 7.5 8.6% 10.4% 30% Operating income / Total Operating Raven 5.0% Non-Operating Revenue and Other Income / Tot Operating Haven 43% Excess of Revenues over Expenses/Total Assets 76% Excess of Revenue over Expenses / Nel Asses 9 10 11 12 13 14 18 19 20 21 22 23 24 25 20 27 28 29 30 31 32 33 34 35 Activity Rates Total Asset Turnover Ratio Fixed Asset Turnover Ratio Age of Plant 0.75 0.64 407 (542) 203 100 251 10.23 Total Operating Revenues/Total Assets Total Operating Revenues / Net Prand Equipment Accumulated Depreciation/Depreciation Expanse Capital Structure Ratios Long-Term Det to Net Assets Net Assets to Total Assets Times interest Eamed Debt Service Coverage Ratio 21.9% 77.4% 1417 0.01 13.1% 827% 16.21 47.9% Long Term Debt/Net Assets 50.0% Net Assets/Total Assets 430 (Excess of Revenues aver lexpenses interest Expense) / Interest Expense 4.57 (Excess of Revenues over Expenses Interest Expense Depreciation Amortation (interest Expense + Principal Payment) "The debt principal payments each year are $5.500.000 37