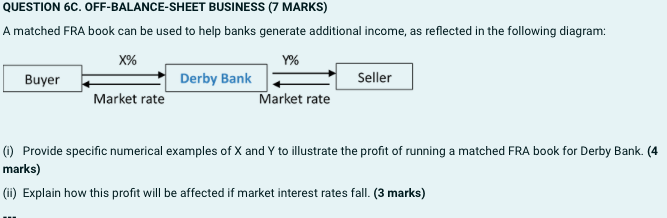

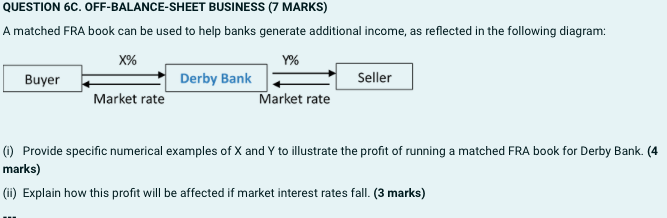

QUESTION 6B. OFF-BALANCE-SHEET BUSINESS (8 MARKS) Normanby Bank expects that one of its wholesale customers will fully repay a loan contract worth $2 million in six months' time. The bank plans to reinvest these proceeds in new 3-month Treasury bills. The bank's managers are concerned that Treasury bill interest rates are falling, hence these securities may become more expensive to purchase. O Should Normanby Bank buy or sell Forward Rate Agreements (FRAS) to hedge this risk and why? (4 marks) (ii) Assume Normanby Bank enters into a 90-day FRA contract (FRA rate = 8%) to hedge its interest rate risk. On the settlement day, the Treasury bill floating rate has fallen to 7%. Will Normanby Bank gain or lose on this FRA? Calculate the compensation payment in dollar terms (show all workings). (4 marks) QUESTION 6C. OFF-BALANCE-SHEET BUSINESS (7 MARKS) A matched FRA book can be used to help banks generate additional income, as reflected in the following diagram: X% Y% Buyer Seller Derby Bank Market rate Market rate 0 Provide specific numerical examples of X and Y to illustrate the profit of running a matched FRA book for Derby Bank. (4 marks) (1) Explain how this profit will be affected if market interest rates fall. (3 marks) QUESTION 6B. OFF-BALANCE-SHEET BUSINESS (8 MARKS) Normanby Bank expects that one of its wholesale customers will fully repay a loan contract worth $2 million in six months' time. The bank plans to reinvest these proceeds in new 3-month Treasury bills. The bank's managers are concerned that Treasury bill interest rates are falling, hence these securities may become more expensive to purchase. O Should Normanby Bank buy or sell Forward Rate Agreements (FRAS) to hedge this risk and why? (4 marks) (ii) Assume Normanby Bank enters into a 90-day FRA contract (FRA rate = 8%) to hedge its interest rate risk. On the settlement day, the Treasury bill floating rate has fallen to 7%. Will Normanby Bank gain or lose on this FRA? Calculate the compensation payment in dollar terms (show all workings). (4 marks) QUESTION 6C. OFF-BALANCE-SHEET BUSINESS (7 MARKS) A matched FRA book can be used to help banks generate additional income, as reflected in the following diagram: X% Y% Buyer Seller Derby Bank Market rate Market rate 0 Provide specific numerical examples of X and Y to illustrate the profit of running a matched FRA book for Derby Bank. (4 marks) (1) Explain how this profit will be affected if market interest rates fall