Answered step by step

Verified Expert Solution

Question

1 Approved Answer

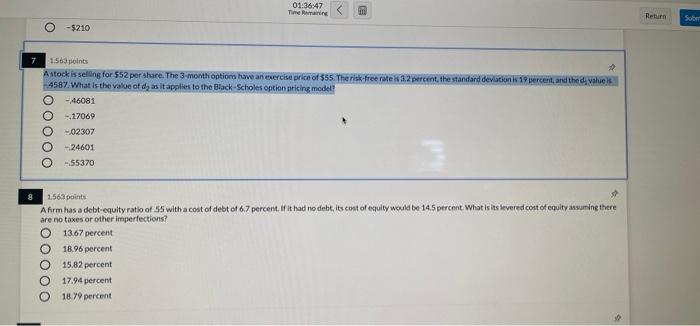

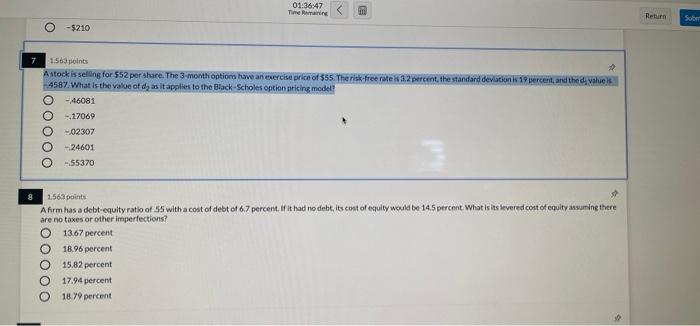

question 7 01:36:47 Tinang Return Sober o -$210 OOOO 1.563 points Astock is selling for 552 per share. The 3-month options have an exercise price

question 7

01:36:47 Tinang Return Sober o -$210 OOOO 1.563 points Astock is selling for 552 per share. The 3-month options have an exercise price of $55. The risk-free rate 32 percent, the standard deviation is 19 percent, and the disuels 4587 What is the value of d, as it applies to the Black-Scholes option pricing model? - 46081 -17069 -02307 -24601 --55370 1.563 points A firm has a debt-equity ratio of 55 with a cost of debt of 6.7 percent. If it had no debt, its cost of equity would be 14.5 percent. What is its levered cost of equity assuming there are no taxes or other imperfections? 13.67 percent 18.96 percent 15.82 percent 17.94 percent 18.79 percent

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started