Answered step by step

Verified Expert Solution

Question

1 Approved Answer

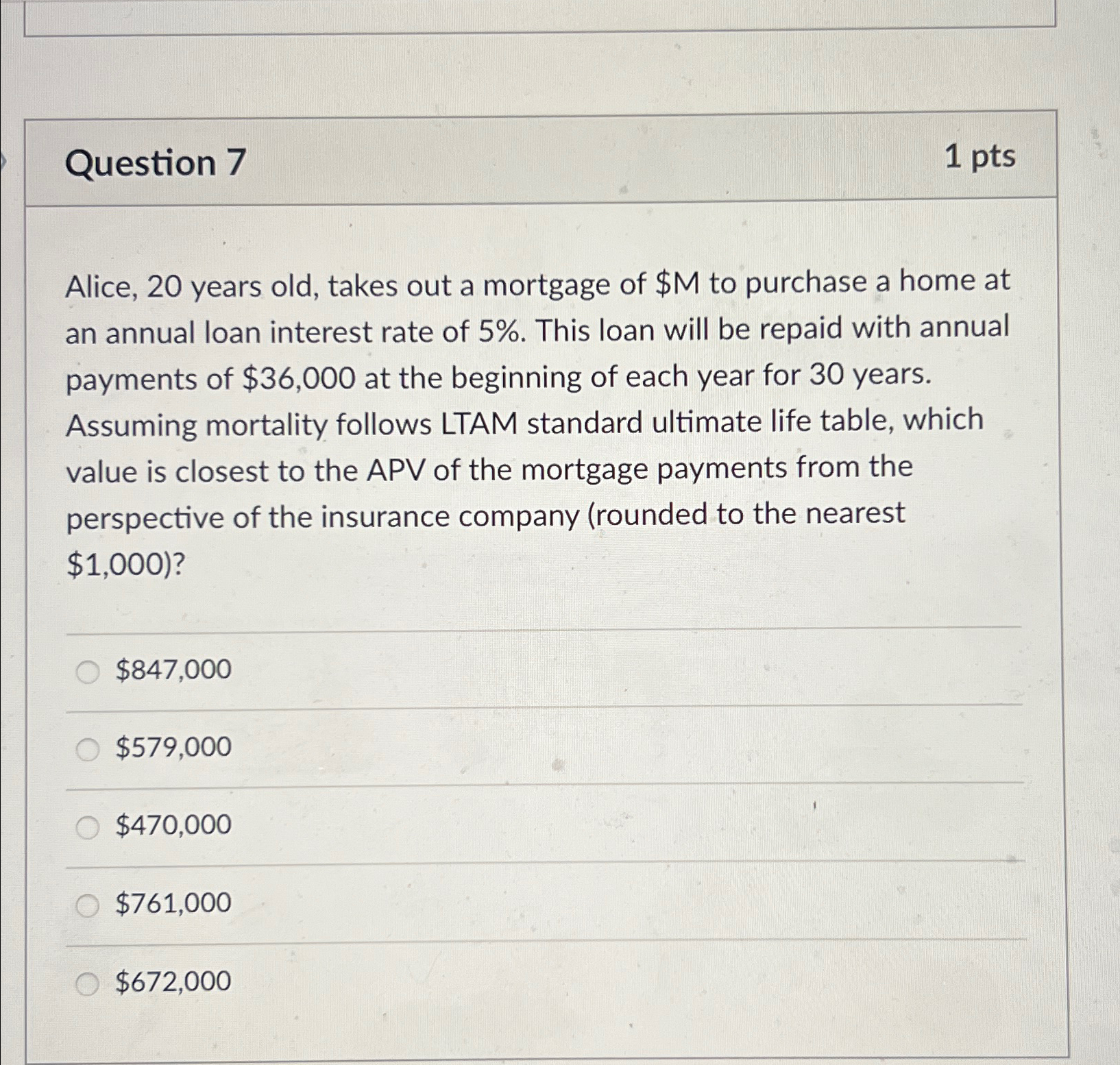

Question 7 1 p t s Alice, 2 0 years old, takes out a mortgage of $ M to purchase a home at an annual

Question

Alice, years old, takes out a mortgage of $ to purchase a home at an annual loan interest rate of This loan will be repaid with annual payments of $ at the beginning of each year for years. Assuming mortality follows LTAM standard ultimate life table, which value is closest to the APV of the mortgage payments from the perspective of the insurance company rounded to the nearest $

$

$

$

$

$

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started