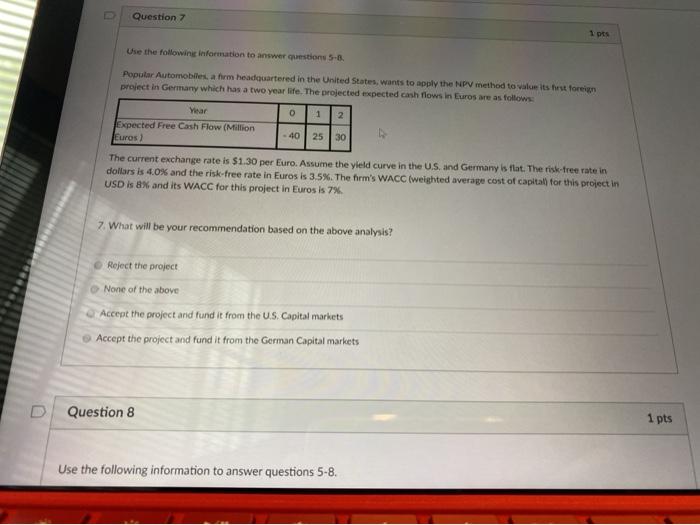

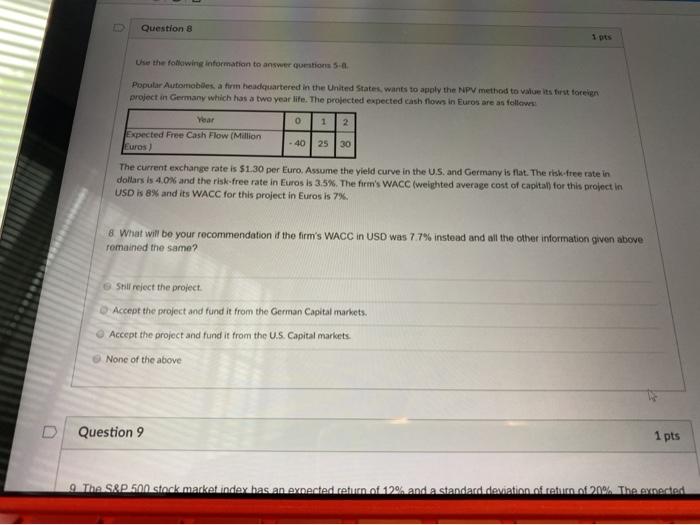

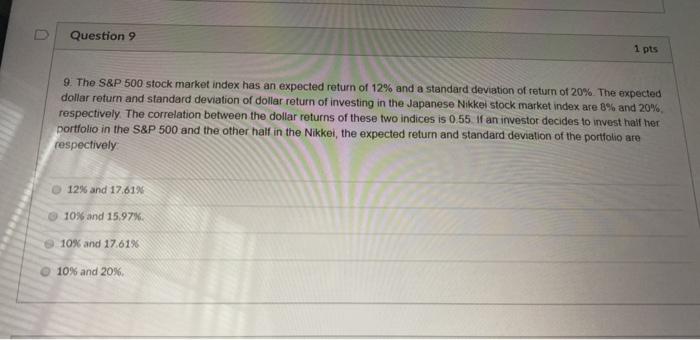

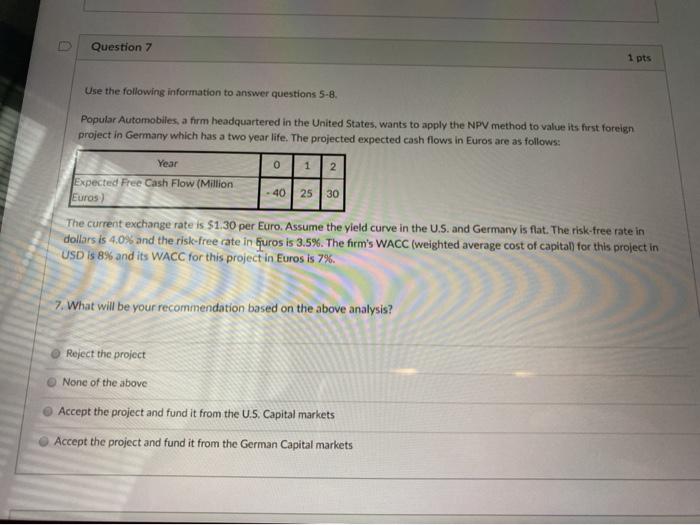

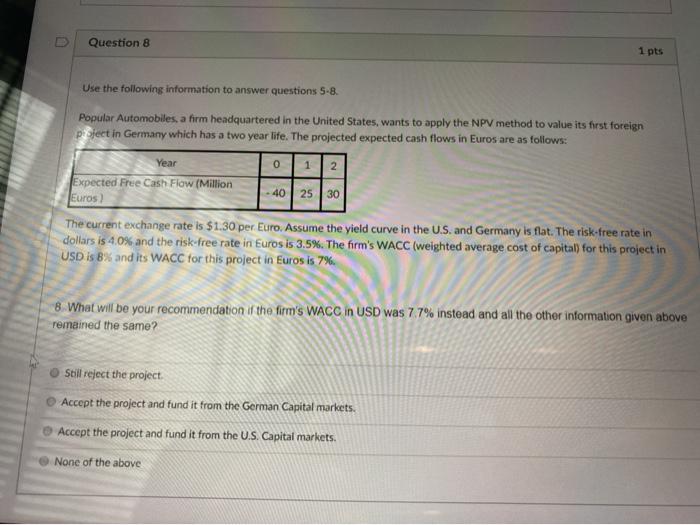

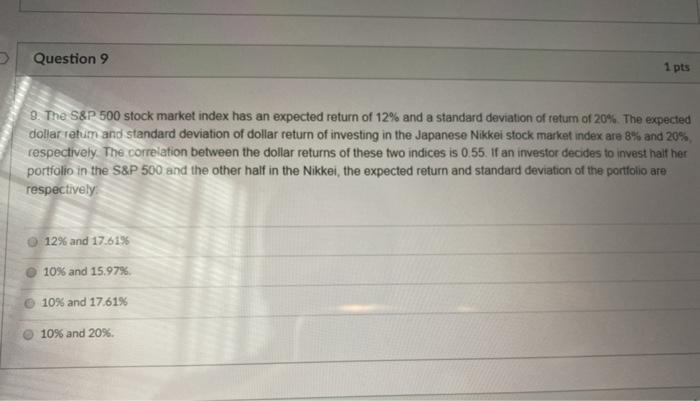

Question 7 1 pts Use the following information to answer questions 5-8. Popular Automobiles arm headquartered in the United States, wants to apply the NPV method to value its first foreign project in Germany which has a two year life. The projected expected cash flows in Euros are as follows: 0 1 2 Year Expected Free Cash Flow (Million Euros) - 40 25 30 The current exchange rate is $1.30 per Euro. Assume the yield curve in the US and Germany is flat. The risk-free rate in dollars is 4.0% and the risk-free rate in Euros is 3.5%. The firm's WACC (weighted average cost of capital for this project in USD is 8x and its WACC for this project in Euros is 7% 7. What will be your recommendation based on the above analysis? Reject the project None of the above Accept the project and fund it from the U.S. Capital markets Accept the project and fund it from the German Capital markets Question 8 1 pts Use the following information to answer questions 5-8. Question 8 Use the following information to answer questions 5.a Popular Automobiles a term headquartered in the United States wants to apply the NPV method to loves torettoreign project in Germany which has a two year life. The projected expected cash flows in Euros are as follows: Year 0 1 2 Expected Free Cash Flow (Million Euros) - 40 25 30 The current exchange rate is $1.30 per Euro. Assume the yield curve in the US and Germany is hat. The risk tree rate in dollars is 4.0% and the risk-free rate in Euros is 3.5%. The firm's WACC (weighted average cost of capital for this project in USD is 8% and its WACC for this project in Euros is 7%. 8 What will be your recommendation at the firm's WACC in USD was 7.7% instead and all the other information given above remained the same? Shill reject the project Accept the project and fund it from the German Capital markets. Accept the project and fund it from the U.S. Capital markets. None of the above D Question 9 1 pts 19. The S&P 500 stock marketindey has an expected return of 12% and a standard deviation of return of 2006 The spected Question 9 1 pts 9. The S&P 500 stock market index has an expected return of 12% and a standard deviation of return of 20%. The expected dollar return and standard deviation of dollar return of investing in the Japanese Nikkel stock market index are 8% and 20% respectively. The correlation between the dollar returns of these two indices is 0.55 If an investor decides to invest half her portfolio in the S&P 500 and the other half in the Nikkel, the expected return and standard deviation of the portfolio are respectively 12% and 17.61% 10% and 15.97% 10% and 17.61% 10% and 20% Question 7 1 pts Year 0 Use the following information to answer questions 5-8. Popular Automobiles, a firm headquartered in the United States, wants to apply the NPV method to value its first foreign project in Germany which has a two year life. The projected expected cash flows in Euros are as follows: 12 Expected Free Cash Flow (Million 40 25 30 Euros) The current exchange rate is $1.30 per Euro. Assume the yield curve in the U.S. and Germany is flat. The risk-free rate dollars is 4.0% and the risk-free rate in Guros is 3.5%. The firm's WACC (weighted average cost of capital for this project in USD $ 8% and its WACC for this project in Euros is 7%. 7. What will be your recommendation based on the above analysis? Reject the project None of the above Accept the project and fund it from the U.S. Capital markets Accept the project and fund it from the German Capital markets Question 8 1 pts Use the following information to answer questions 5-8. Popular Automobiles, a firm headquartered in the United States, wants to apply the NPV method to value its first foreign posjett in Germany which has a two year life. The projected expected cash flows in Euros are as follows: Year 0 | 12 Expected Free Cash Flow (Million 40 25 30 Euros) The current exchange rate is $1.30 per Euro. Assume the yield curve in the U.S. and Germany is flat. The risk-free rate in dollars is 4.0% and the risk-free rate in Euros is 3.5%. The firm's WACC (weighted average cost of capital) for this project in USD is B% and its WACC for this project in Euros is 7% 8. What will be your recommendation of the firm's WACC in USD was 77% instead and all the other information given above remained the same? Still reject the project Accept the project and fund it from the German Capital markets. Accept the project and fund it from the U.S. Capital markets. None of the above Question 9 1 pts 9. The S&P 500 stock market index has an expected return of 12% and a standard deviation of return of 20% The expected dollar retum and standard deviation of dollar return of investing in the Japanese Nikkei stock market index are 8% and 20% respectively. The correlation between the dollar returns of these two indices is 0.55. If an investor decides to invest halt her portfolio in the S&P 500 and the other half in the Nikkei, the expected return and standard deviation of the portfolio are respectively 12% and 17.619 10% and 15.97% 10% and 17.61% 10% and 20%