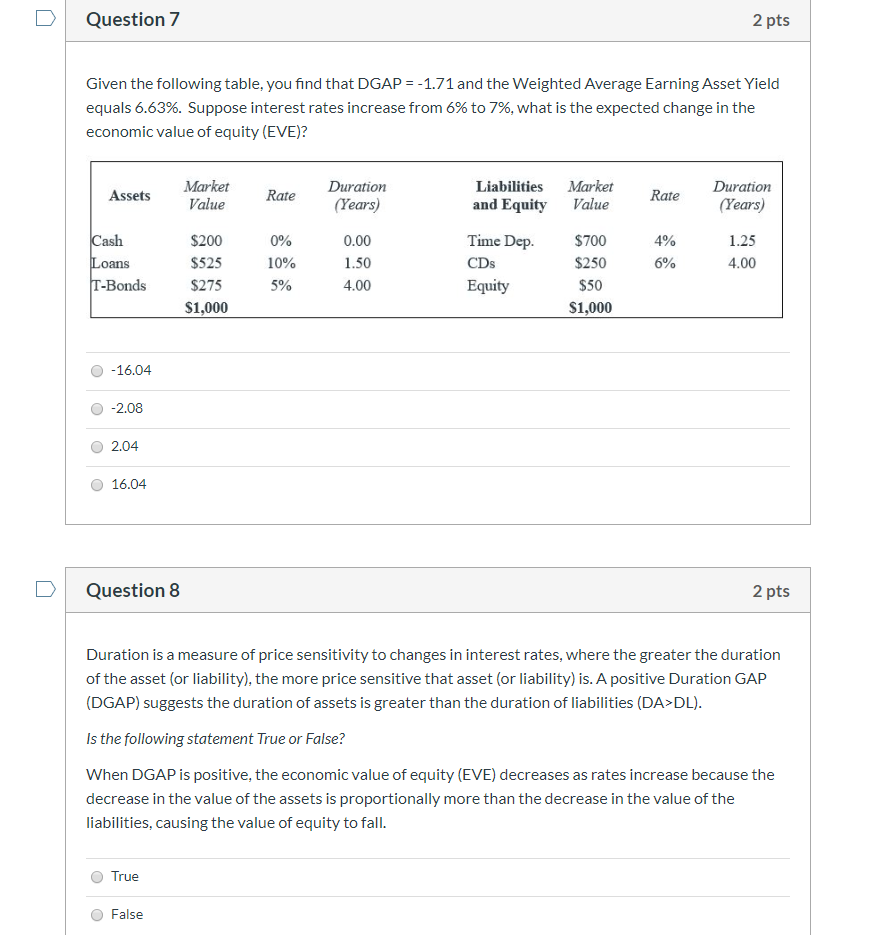

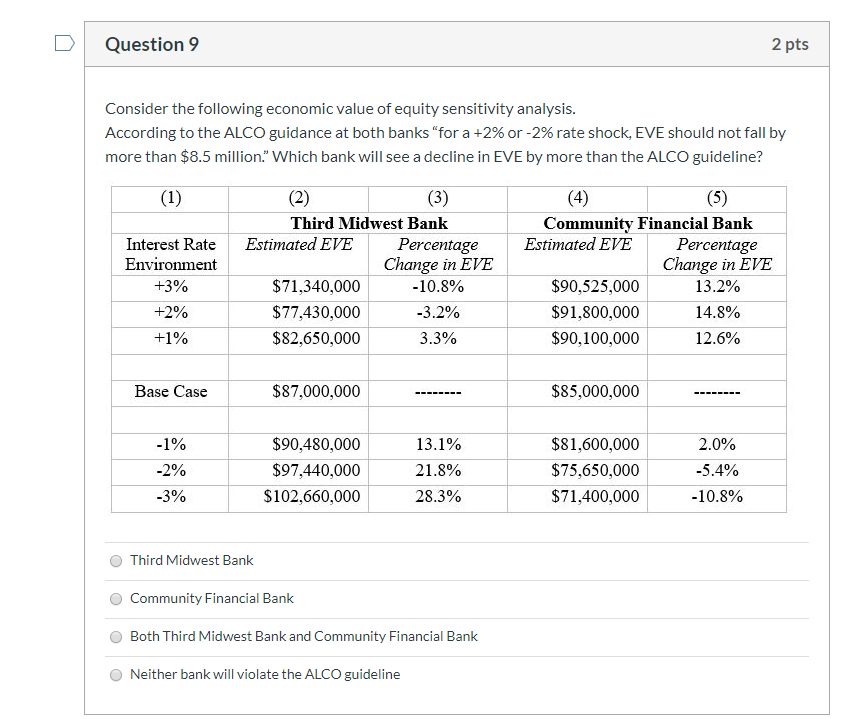

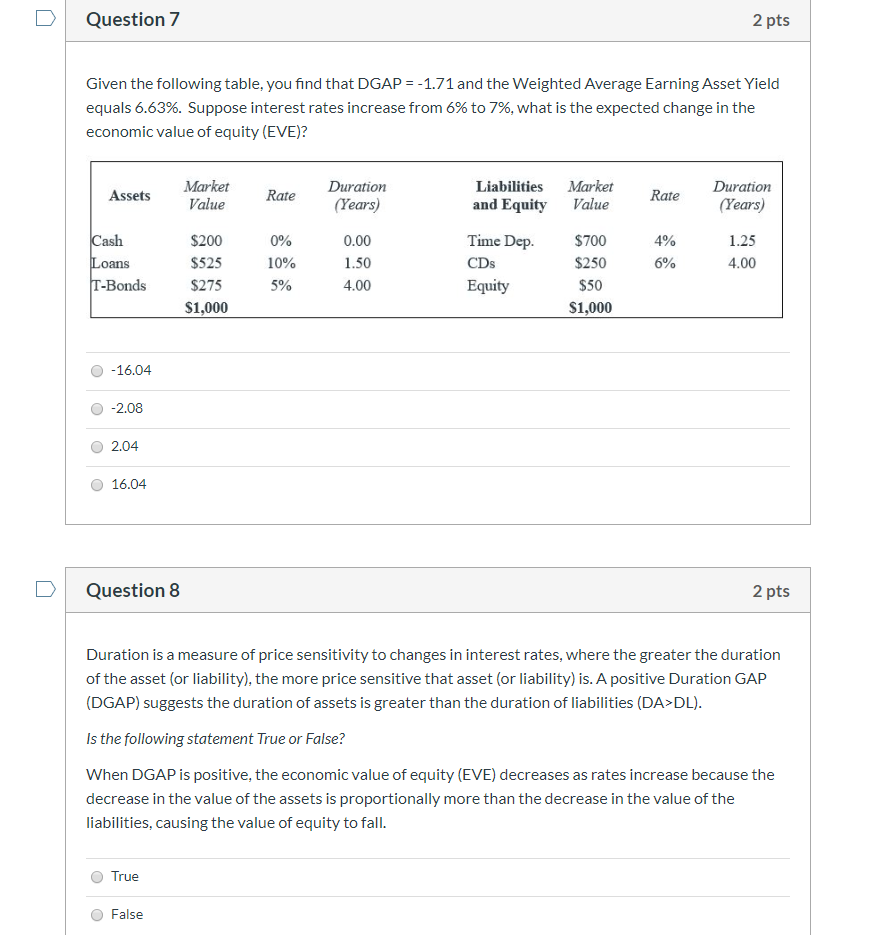

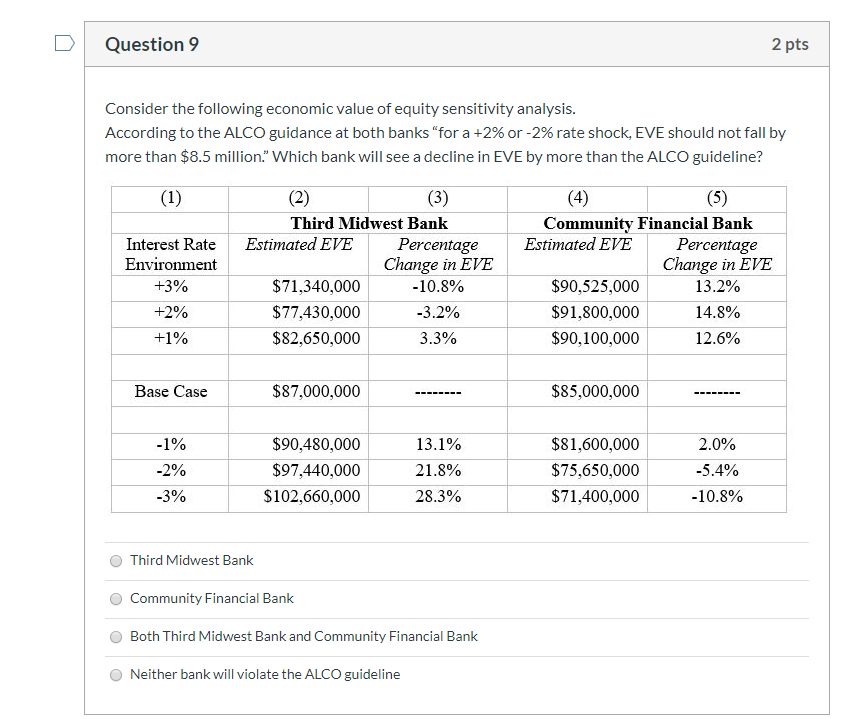

Question 7 2 pts Given the following table, you find that DGAP -1.71 and the Weighted Average Earning Asset Yield equals 6.63%. Suppose interest rates increase from 6% to 7%, what is the expected change in the economic value of equity (EVE)? Market Value Market Value Duration Liabilities Duration Assets Rate Rate and Equity (Years) (Years) Cash Loans T-Bonds Time Dep. $200 0% 0.00 $700 4% 1.25 $525 10% 1.50 CDs $250 6% 4.00 $275 Equity $50 5% 4.00 $1,000 $1,000 -16,04 -2.08 2.04 16.04 Question 8 2 pts Duration is a measure of price sensitivity to changes in interest rates, where the greater the duration of the asset (or liability), the more price sensitive that asset (or liability) is. A positive Duration GAP (DGAP) suggests the duration of assets is greater than the duration of liabilities (DA>DL) Is the following statement True or False? When DGAP is positive, the economic value of equity (EVE) decreases as rates increase because the decrease in the value of the assets is proportionally more than the decrease in the value of the liabilities, causing the value of equity to fall. True False Question 9 2 pts Consider the following economic value of equity sensitivity analysis. According to the ALCO guidance at both banks "for a +2% or -2% rate shock, EVE should not fall by more than $8.5 million." Which bank will see a decline in EVE by more than the ALCO guideline? (1) (2) (3) (4) (5) Community Financial Bank Percentage Change in EVE Third Midwest Bank Estimated EVE Percentage Change in EVE Estimated EVE Interest Rate Environment $71,340,000 $90,525,000 +3% -10.8% 13.2% $77,430,000 $91,800,000 +2% -3.2% 14.8% $82,650,000 $90,100,000 +1% 3.3% 12.6% $87,000,000 $85,000,000 Base Case -1% $90,480,000 $81,600,000 13.1% 2.0% $97,440,000 $75,650,000 -5.4% -2% 21.8% -3% $102,660,000 $71,400,000 28.3% -10.8% Third Midwest Bank Community Financial Bank Both Third Midwest Bank and Community Financial Bank Neither bank will violate the ALCO guideline Question 7 2 pts Given the following table, you find that DGAP -1.71 and the Weighted Average Earning Asset Yield equals 6.63%. Suppose interest rates increase from 6% to 7%, what is the expected change in the economic value of equity (EVE)? Market Value Market Value Duration Liabilities Duration Assets Rate Rate and Equity (Years) (Years) Cash Loans T-Bonds Time Dep. $200 0% 0.00 $700 4% 1.25 $525 10% 1.50 CDs $250 6% 4.00 $275 Equity $50 5% 4.00 $1,000 $1,000 -16,04 -2.08 2.04 16.04 Question 8 2 pts Duration is a measure of price sensitivity to changes in interest rates, where the greater the duration of the asset (or liability), the more price sensitive that asset (or liability) is. A positive Duration GAP (DGAP) suggests the duration of assets is greater than the duration of liabilities (DA>DL) Is the following statement True or False? When DGAP is positive, the economic value of equity (EVE) decreases as rates increase because the decrease in the value of the assets is proportionally more than the decrease in the value of the liabilities, causing the value of equity to fall. True False Question 9 2 pts Consider the following economic value of equity sensitivity analysis. According to the ALCO guidance at both banks "for a +2% or -2% rate shock, EVE should not fall by more than $8.5 million." Which bank will see a decline in EVE by more than the ALCO guideline? (1) (2) (3) (4) (5) Community Financial Bank Percentage Change in EVE Third Midwest Bank Estimated EVE Percentage Change in EVE Estimated EVE Interest Rate Environment $71,340,000 $90,525,000 +3% -10.8% 13.2% $77,430,000 $91,800,000 +2% -3.2% 14.8% $82,650,000 $90,100,000 +1% 3.3% 12.6% $87,000,000 $85,000,000 Base Case -1% $90,480,000 $81,600,000 13.1% 2.0% $97,440,000 $75,650,000 -5.4% -2% 21.8% -3% $102,660,000 $71,400,000 28.3% -10.8% Third Midwest Bank Community Financial Bank Both Third Midwest Bank and Community Financial Bank Neither bank will violate the ALCO guideline