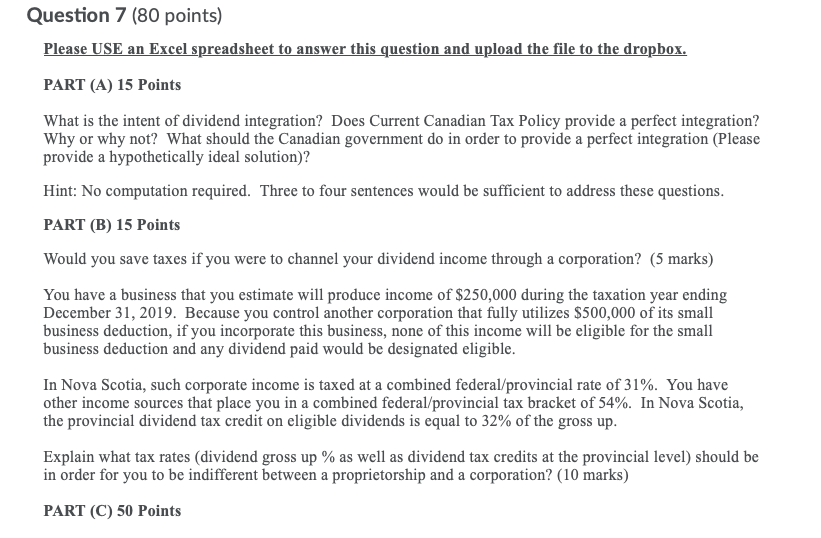

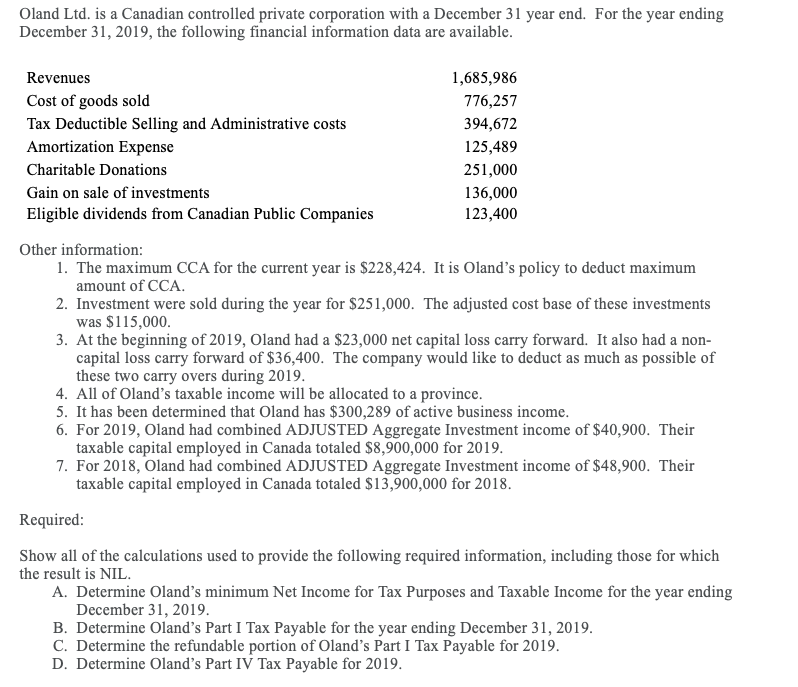

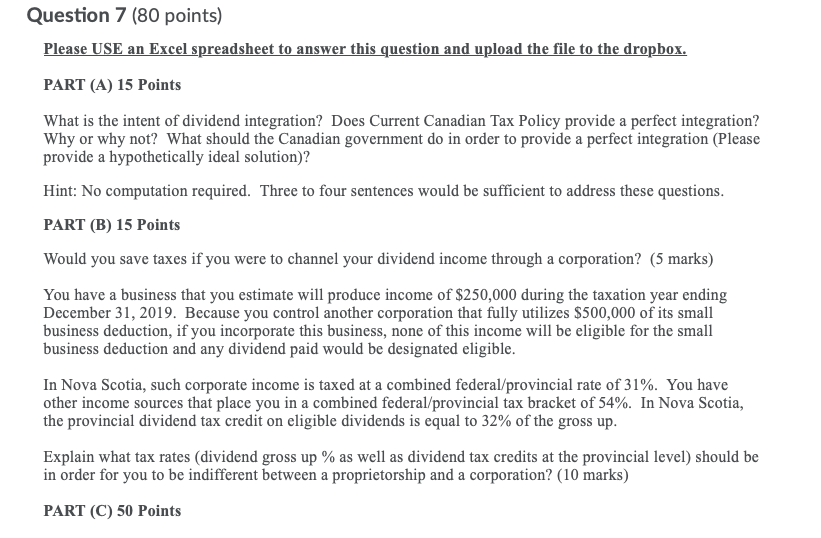

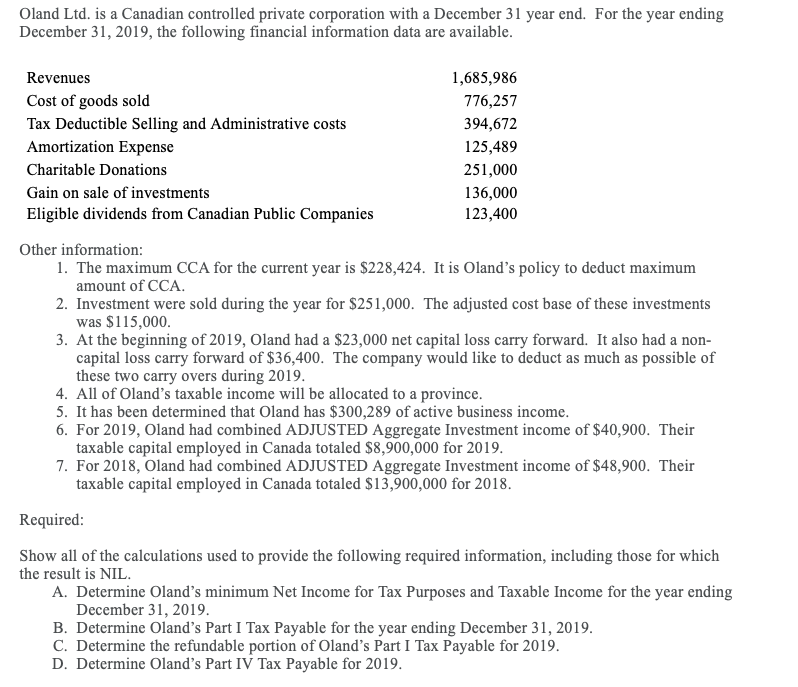

Question 7 (80 points) Please USE an Excel spreadsheet to answer this question and upload the file to the dropbox. PART (A) 15 Points What is the intent of dividend integration? Does Current Canadian Tax Policy provide a perfect integration? Why or why not? What should the Canadian government do in order to provide a perfect integration (Please provide a hypothetically ideal solution)? Hint: No computation required. Three to four sentences would be sufficient to address these questions. PART (B) 15 Points Would you save taxes if you were to channel your dividend income through a corporation? (5 marks) You have a business that you estimate will produce income of $250,000 during the taxation year ending December 31, 2019. Because you control another corporation that fully utilizes $500,000 of its small business deduction, if you incorporate this business, none of this income will be eligible for the small business deduction and any dividend paid would be designated eligible. In Nova Scotia, such corporate income is taxed at a combined federal/provincial rate of 31%. You have other income sources that place you in a combined federal/provincial tax bracket of 54%. In Nova Scotia, the provincial dividend tax credit on eligible dividends is equal to 32% of the gross up. Explain what tax rates (dividend gross up % as well as dividend tax credits at the provincial level) should be in order for you to be indifferent between a proprietorship and a corporation? (10 marks) PART (C) 50 Points Oland Ltd. is a Canadian controlled private corporation with a December 31 year end. For the year ending December 31, 2019, the following financial information data are available. Revenues Cost of goods sold Tax Deductible Selling and Administrative costs Amortization Expense Charitable Donations Gain on sale of investments Eligible dividends from Canadian Public Companies 1,685,986 776,257 394,672 125,489 251,000 136,000 123,400 Other information: 1. The maximum CCA for the current year is $228,424. It is Oland's policy to deduct maximum amount of CCA. 2. Investment were sold during the year for $251,000. The adjusted cost base of these investments was $115,000. 3. At the beginning of 2019, Oland had a $23,000 net capital loss carry forward. It also had a non- capital loss carry forward of $36,400. The company would like to deduct as much as possible of these two carry overs during 2019. 4. All of Oland's taxable income will be allocated to a province. 5. It has been determined that Oland has $300,289 of active business income. 6. For 2019, Oland had combined ADJUSTED Aggregate Investment income of $40,900. Their taxable capital employed in Canada totaled $8,900,000 for 2019. 7. For 2018, Oland had combined ADJUSTED Aggregate Investment income of $48,900. Their taxable capital employed in Canada totaled $13,900,000 for 2018. Required: Show all of the calculations used to provide the following required information, including those for which the result is NIL. A. Determine Oland's minimum Net Income for Tax Purposes and Taxable income for the year ending December 31, 2019. B. Determine Oland's Part I Tax Payable for the year ending December 31, 2019. C. Determine the refundable portion of Oland's Part I Tax Payable for 2019. D. Determine Oland's Part IV Tax Payable for 2019. Question 7 (80 points) Please USE an Excel spreadsheet to answer this question and upload the file to the dropbox. PART (A) 15 Points What is the intent of dividend integration? Does Current Canadian Tax Policy provide a perfect integration? Why or why not? What should the Canadian government do in order to provide a perfect integration (Please provide a hypothetically ideal solution)? Hint: No computation required. Three to four sentences would be sufficient to address these questions. PART (B) 15 Points Would you save taxes if you were to channel your dividend income through a corporation? (5 marks) You have a business that you estimate will produce income of $250,000 during the taxation year ending December 31, 2019. Because you control another corporation that fully utilizes $500,000 of its small business deduction, if you incorporate this business, none of this income will be eligible for the small business deduction and any dividend paid would be designated eligible. In Nova Scotia, such corporate income is taxed at a combined federal/provincial rate of 31%. You have other income sources that place you in a combined federal/provincial tax bracket of 54%. In Nova Scotia, the provincial dividend tax credit on eligible dividends is equal to 32% of the gross up. Explain what tax rates (dividend gross up % as well as dividend tax credits at the provincial level) should be in order for you to be indifferent between a proprietorship and a corporation? (10 marks) PART (C) 50 Points Oland Ltd. is a Canadian controlled private corporation with a December 31 year end. For the year ending December 31, 2019, the following financial information data are available. Revenues Cost of goods sold Tax Deductible Selling and Administrative costs Amortization Expense Charitable Donations Gain on sale of investments Eligible dividends from Canadian Public Companies 1,685,986 776,257 394,672 125,489 251,000 136,000 123,400 Other information: 1. The maximum CCA for the current year is $228,424. It is Oland's policy to deduct maximum amount of CCA. 2. Investment were sold during the year for $251,000. The adjusted cost base of these investments was $115,000. 3. At the beginning of 2019, Oland had a $23,000 net capital loss carry forward. It also had a non- capital loss carry forward of $36,400. The company would like to deduct as much as possible of these two carry overs during 2019. 4. All of Oland's taxable income will be allocated to a province. 5. It has been determined that Oland has $300,289 of active business income. 6. For 2019, Oland had combined ADJUSTED Aggregate Investment income of $40,900. Their taxable capital employed in Canada totaled $8,900,000 for 2019. 7. For 2018, Oland had combined ADJUSTED Aggregate Investment income of $48,900. Their taxable capital employed in Canada totaled $13,900,000 for 2018. Required: Show all of the calculations used to provide the following required information, including those for which the result is NIL. A. Determine Oland's minimum Net Income for Tax Purposes and Taxable income for the year ending December 31, 2019. B. Determine Oland's Part I Tax Payable for the year ending December 31, 2019. C. Determine the refundable portion of Oland's Part I Tax Payable for 2019. D. Determine Oland's Part IV Tax Payable for 2019