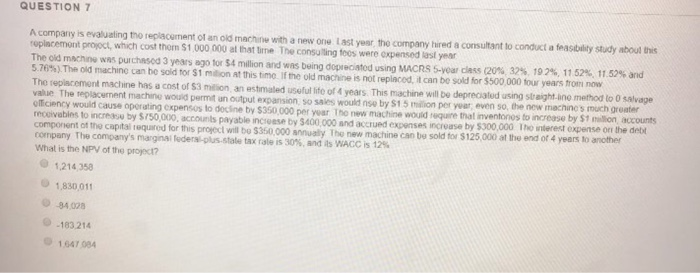

QUESTION 7 A company is evaluating the replacement of an old machine with a new one. Last year the company tired a consultant to conduct a feasibility study about this replacement project, which cost them 51 000 000 at that time The consulting toos were expensed last year The old machine was purchased 3 years ago for $4 million and was being depreciated using MACRS 5-year dess 20% 32% 1924, 1152 11.52% and 5.76%). The old machine can be sold for 1 milion at this time if the old machine is not replaced, it can be sold for $500 000 four years from now The replacement machine has a cost of $3 million an estimated useful life of years. This machine will be depreciated using straighting method to salvage Value The replacement machine would permit un output expansion so sales would nse by St o n per year even so, the new machines much greater officiency would cause operating expenses to docine by $350 000 per year the new machine would require that inventions to increase by Sto ccounts receivables to increase by $750,000, accounts payable incluse by 5400 000 and accrued expenses increase by $300.000 The interest expens on the debt component of the capital required for this proiect will be $350 000 The new machine can be sold $125.000 at the end of 4 years to another company the company's marginal federal-plus-state tax rate is 30% and its WACC is 124 What is the NPV of the project? 1.214 358 1.830.011 34.000 -183214 1841 084 QUESTION 7 A company is evaluating the replacement of an old machine with a new one. Last year the company tired a consultant to conduct a feasibility study about this replacement project, which cost them 51 000 000 at that time The consulting toos were expensed last year The old machine was purchased 3 years ago for $4 million and was being depreciated using MACRS 5-year dess 20% 32% 1924, 1152 11.52% and 5.76%). The old machine can be sold for 1 milion at this time if the old machine is not replaced, it can be sold for $500 000 four years from now The replacement machine has a cost of $3 million an estimated useful life of years. This machine will be depreciated using straighting method to salvage Value The replacement machine would permit un output expansion so sales would nse by St o n per year even so, the new machines much greater officiency would cause operating expenses to docine by $350 000 per year the new machine would require that inventions to increase by Sto ccounts receivables to increase by $750,000, accounts payable incluse by 5400 000 and accrued expenses increase by $300.000 The interest expens on the debt component of the capital required for this proiect will be $350 000 The new machine can be sold $125.000 at the end of 4 years to another company the company's marginal federal-plus-state tax rate is 30% and its WACC is 124 What is the NPV of the project? 1.214 358 1.830.011 34.000 -183214 1841 084