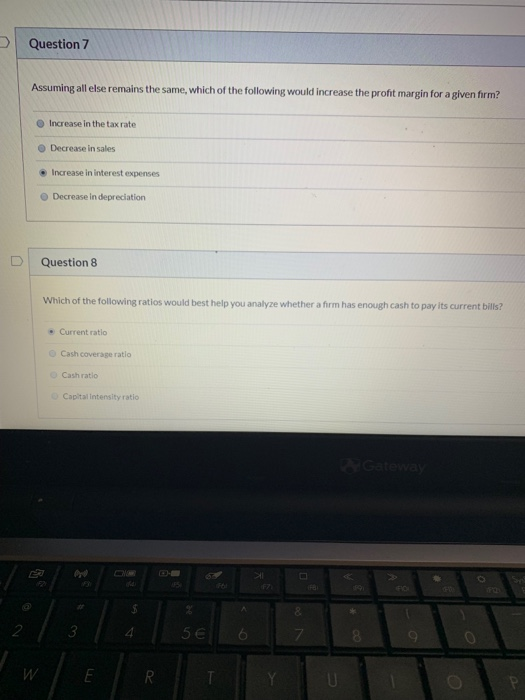

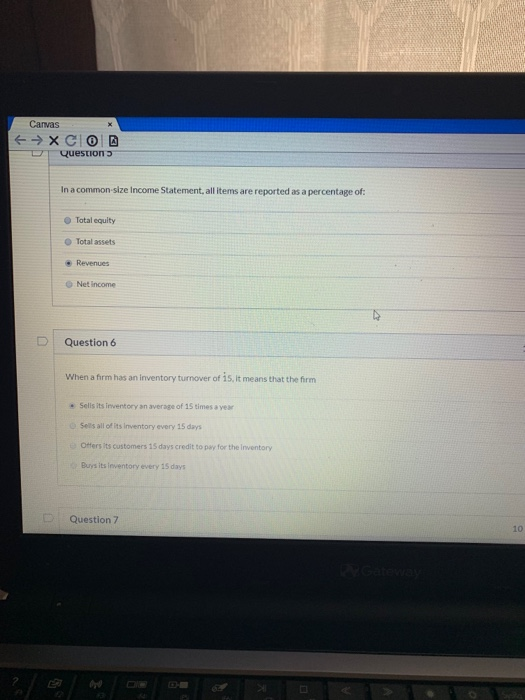

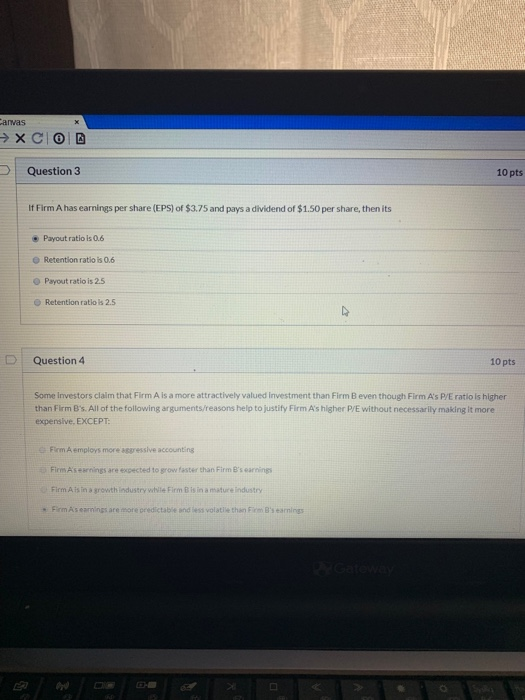

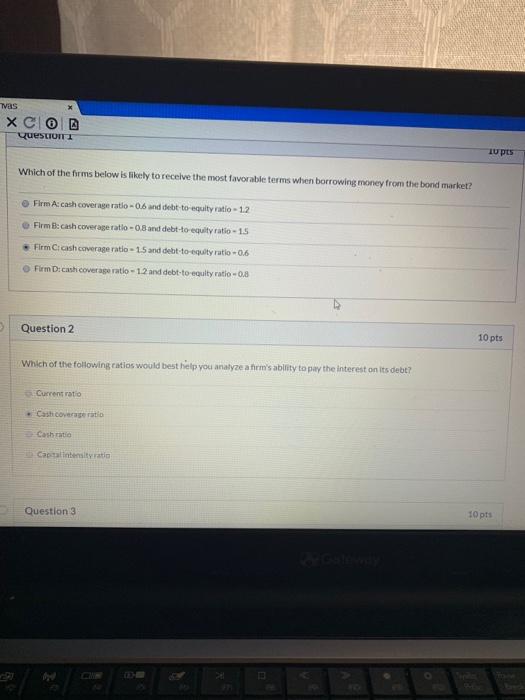

Question 7 Assuming all else remains the same, which of the following would increase the profit margin for a given firm? O Increase in the tax rate O Decrease in sales Increase in interest expenses O Decrease in depreciation DI Question 8 Which of the following ratios would best help you analyze whether a firm has enough cash to pay its current bills? . Current ratio O Cash coverage ratlo Cash ratio Capital Intensity ratio 8 2 56 7 4 Canvas - T-question In a common-size Income Statement, all items are reported as a percentage of Total equity O Total assets Revenues Net income DI Question 6 When a firm has an inventory turnover of 15, it means that the firm Selis its invent ory an average of 15 times a year . Selts all ofits Inventory every 15 days Offers its customers 15 days credit to pay for the Inventory Buys its ieventory every 15 days Di Question 7 10 arwas Question 3 10 pts If Firm A has earnings per share (EPS) of $3.75 and pays a dividend of $1.50 per share, then its Payout ratio is 0.6 O Retention ratio is O6 Payout ratio is 25 Retention ratios 2.5 DI Question 4 10 pts Some Investors claim that Firm A is a more attractively valued investment than Firm B even though Firm A's P/E ratio is higher than Firm B's. All of the following arguments/reasons help to justify Firm A's hlgher P/E without necessarily making it more expensive, EXCEPT Firm A employs more aggressive accounting Firm Asearnings are expected to grow faster than Firm B's earnings Firm Ais in a growth industry whle Firm B is in a mature lindustry - FirmAs earnings are more predictabie and less volatle then Fim B's earnings vas Which of the firms below ls likely to receive the most favorable terms when borrowing money from the bond market? O Firm A: cash coverage ratio-0.6 and debt-to equity ratio-1.2 O Firm 8: cash coverage ratio -0.8 and debt-to-equity ratio-1.5 Firm C: cashcoverage ratio. 1.5 and debt-to-equity ratio-o.6 O Firm D:cash coverage ratio- 1.2 and debt-to equity ratio-0.8 Question 2 10 pts Which of the following ratios would best hielp you analyze a firms abity to pay the interest on its debt? Current ratio Cash coverage ratlo * Cash ratio e Capital intensity ratio 10 pts Question 3