Answered step by step

Verified Expert Solution

Question

1 Approved Answer

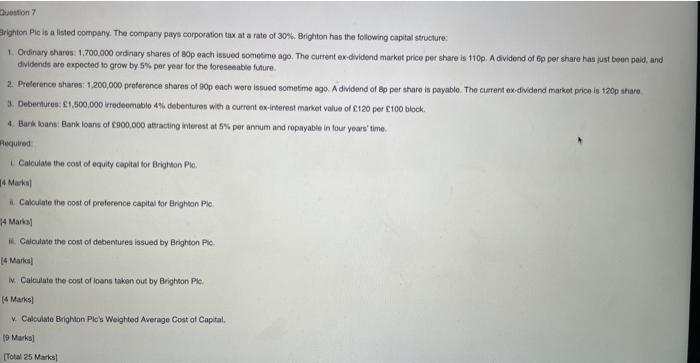

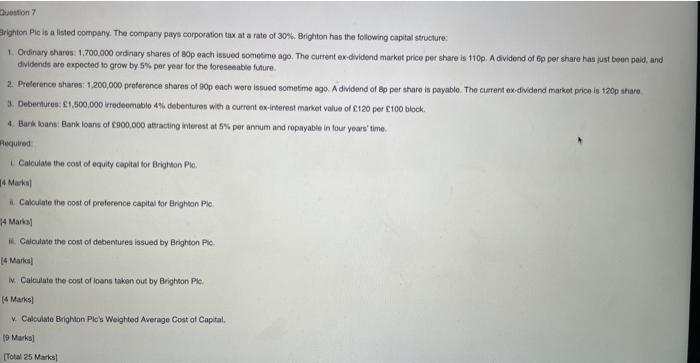

Question 7 Brighton Plc is a listed company. The company pays corporation tax at a rate of 30%. Brighton has the following capital structures 1.

Question 7 Brighton Plc is a listed company. The company pays corporation tax at a rate of 30%. Brighton has the following capital structures 1. Ordinary sharos:1,700,000 ordinary shares of Opoach lesund sometime ago. The current ex dividend market price per share is 110p. A dividend of Gp per sharehas just been paid, and dividends are expected to grow by 5% per year for the foreseeable future. 2. Preference shares 1.200.000 preference shares of op each were issued sometime ago. A dividend of 8p per share in payable. The current ex dividend market price in 120p share 3. Dobertures: 41,500,000 rrodeemablo 4% debertures with a current ex-interont market value of 120 per 100 block. 4. Burk toane: Barik loans of 900.000 attracting interest at 5% per arnum and repayabile in four years' time Required Calculate the cost of equly capital for Brighton Plc. 14 Marks Calculate the cost of proterende capital for Brighton Ple. 14 Mars Calculate the cost of debentures issued by Brighton Pie 14 Marka W. Calculate the cost of loans taken out by Brighton Pie 4 Marks Calculate Brighton Pe's Weighted Average Cost of Capital 19 Marks Total 25 Marks

Question 7 Brighton Plc is a listed company. The company pays corporation tax at a rate of 30%. Brighton has the following capital structures 1. Ordinary sharos:1,700,000 ordinary shares of Opoach lesund sometime ago. The current ex dividend market price per share is 110p. A dividend of Gp per sharehas just been paid, and dividends are expected to grow by 5% per year for the foreseeable future. 2. Preference shares 1.200.000 preference shares of op each were issued sometime ago. A dividend of 8p per share in payable. The current ex dividend market price in 120p share 3. Dobertures: 41,500,000 rrodeemablo 4% debertures with a current ex-interont market value of 120 per 100 block. 4. Burk toane: Barik loans of 900.000 attracting interest at 5% per arnum and repayabile in four years' time Required Calculate the cost of equly capital for Brighton Plc. 14 Marks Calculate the cost of proterende capital for Brighton Ple. 14 Mars Calculate the cost of debentures issued by Brighton Pie 14 Marka W. Calculate the cost of loans taken out by Brighton Pie 4 Marks Calculate Brighton Pe's Weighted Average Cost of Capital 19 Marks Total 25 Marks

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started