Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 7: Current federal corporate income tax code o has different tax rates for different income levels. o has a rate of 15% for the

Question 7:

Current federal corporate income tax code

o has different tax rates for different income levels.

o has a rate of 15% for the lowest tax rate.

o has the highest rate of 39%.

o All of the above.

o None of the above.

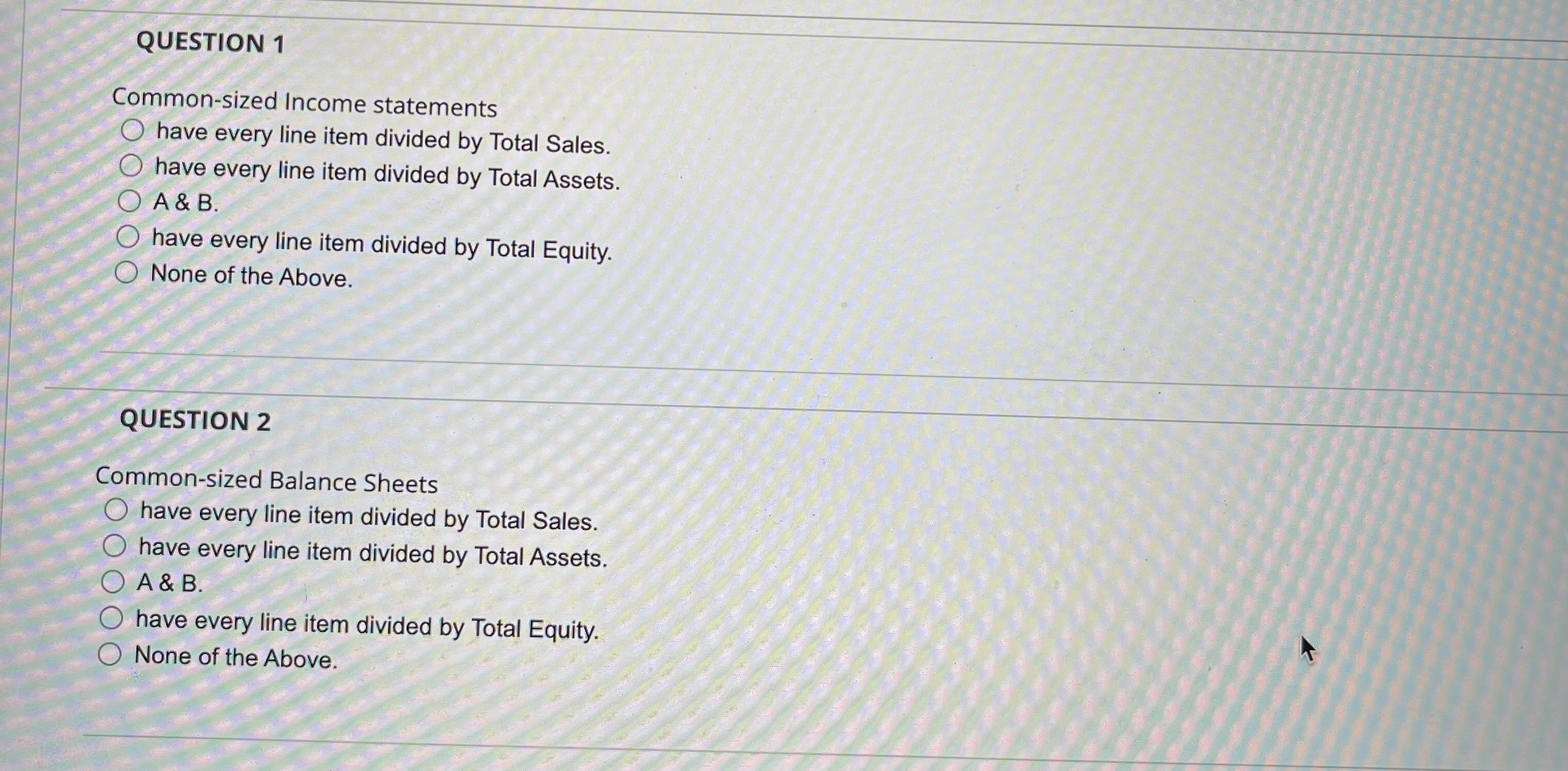

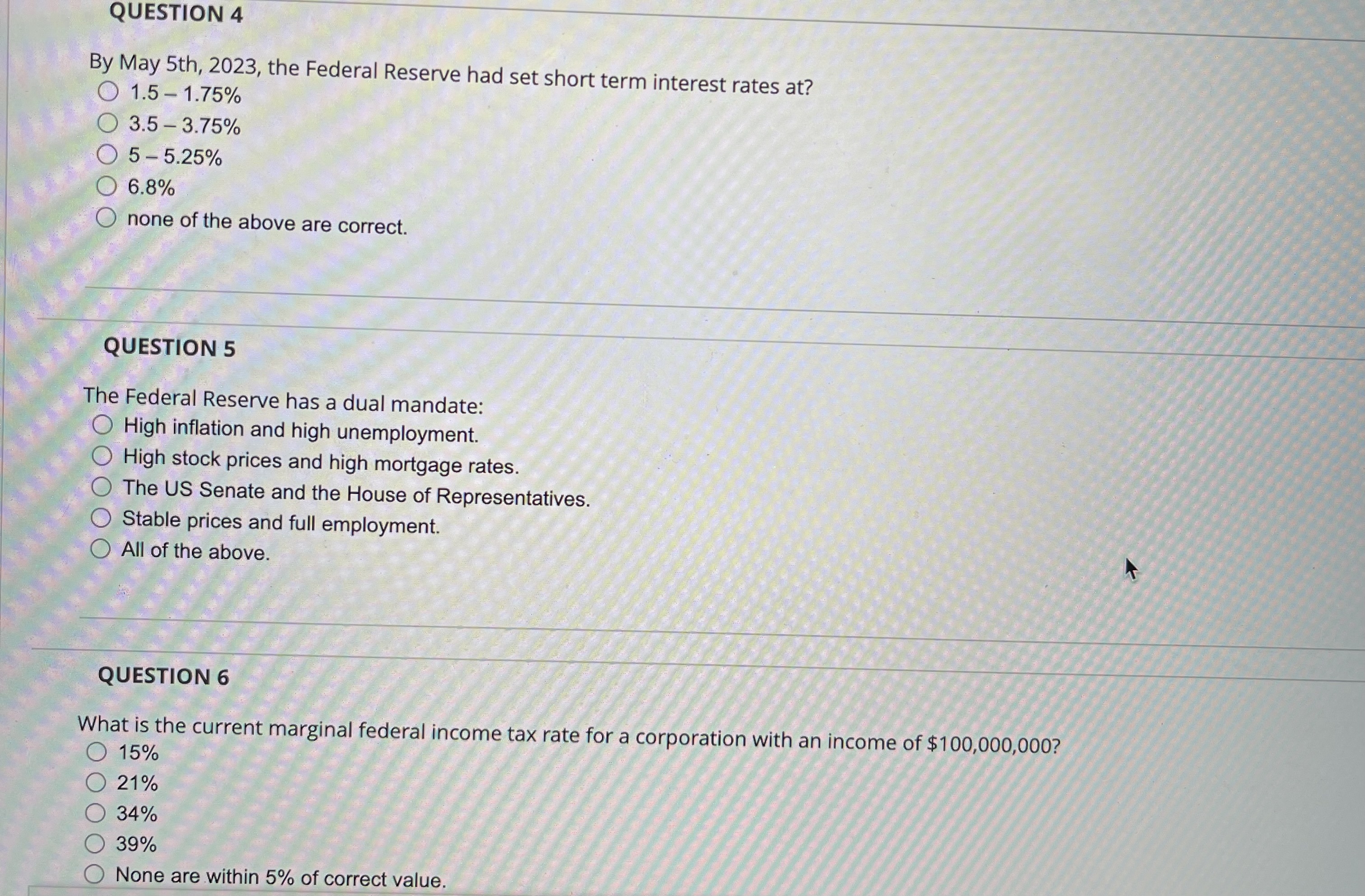

Common-sized Income statements have every line item divided by Total Sales. have every line item divided by Total Assets. A \& B. have every line item divided by Total Equity. None of the Above. QUESTION 2 Common-sized Balance Sheets have every line item divided by Total Sales. have every line item divided by Total Assets. A&B. have every line item divided by Total Equity. None of the Above. By May 5th, 2023, the Federal Reserve had set short term interest rates at? 1.51.75%3.53.75%55.25%6.8% none of the above are correct. QUESTION 5 The Federal Reserve has a dual mandate: High inflation and high unemployment. High stock prices and high mortgage rates. The US Senate and the House of Representatives. Stable prices and full employment. All of the above. QUESTION 6 What is the current marginal federal income tax rate for a corporation with an income of $100,000,000 ? 15% 21% 34% 39% None are within 5% of correct valueStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started