Question

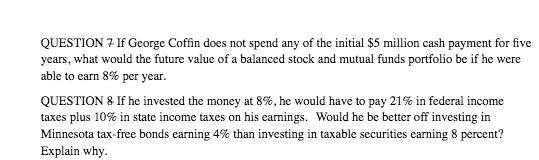

QUESTION 7 If George Coffin does not spend any of the initial $5 million cash payment for five years, what would the future value

QUESTION 7 If George Coffin does not spend any of the initial $5 million cash payment for five years, what would the future value of a balanced stock and mutual funds portfolio be if he were able to earn 8% per year. QUESTION & If he invested the money at 8%, he would have to pay 21% in federal income taxes plus 10% in state income taxes on his earnings. Would he be better off investing in Minnesota tax-free bonds earning 4% than investing in taxable securities earning 8 percent? Explain why.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

ANSWER This analysis assumes all oth...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Research Methods For Business Students

Authors: Mark N.K. Saunders, Philip Lewis, Adrian Thornhill

7th Edition

1292016620, 9781292016627

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App