Answered step by step

Verified Expert Solution

Question

1 Approved Answer

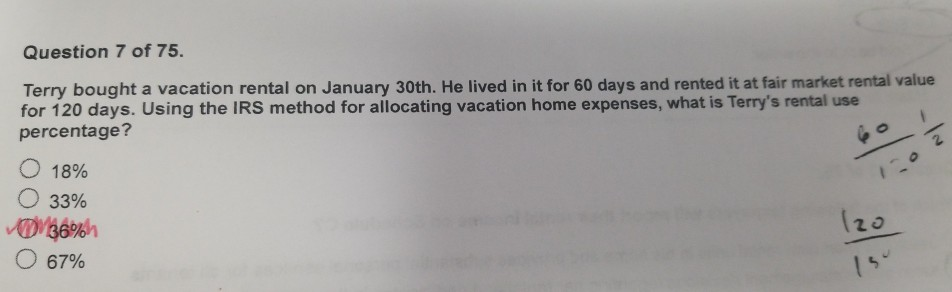

Question 7 of 75. Terry bought a vacation rental on January 30th. He lived in it for 60 days and rented it at fair market

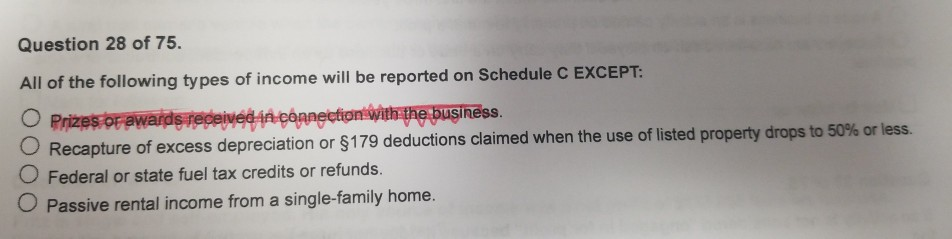

Question 7 of 75. Terry bought a vacation rental on January 30th. He lived in it for 60 days and rented it at fair market rental value for 120 days. Using the IRS method for allocating vacation home expenses, what is Terry's rental use percentage? O 18% O 33% zo DV36% O 67% Question 28 of 75. All of the following types of income will be reported on Schedule C EXCEPT: O Prizes or awards received in connection with the business. O Recapture of excess depreciation or $179 deductions claimed when the use of listed property drops to 50% or less. Federal or state fuel tax credits or refunds. O Passive rental income from a single-family home

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started