Answered step by step

Verified Expert Solution

Question

1 Approved Answer

? ?? (a) On 1 January 2018, Magnum acquired 75% of the equity share capital of Picaccio in a share exchange in which Magnum paid

? ??

??

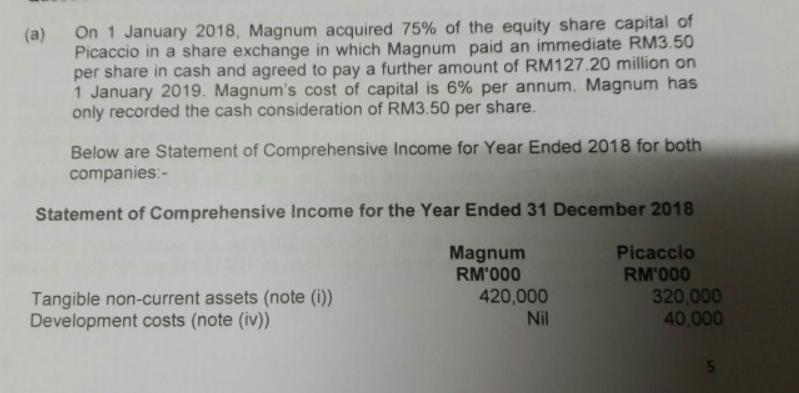

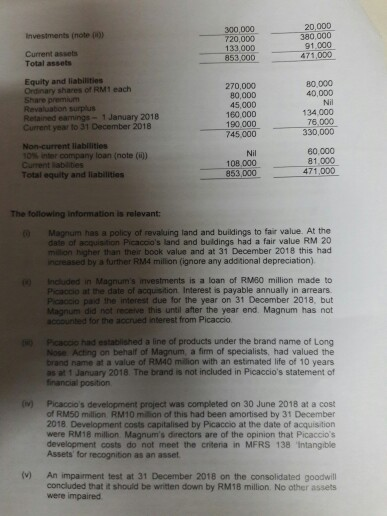

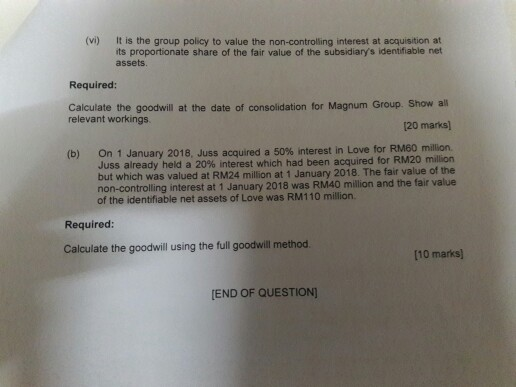

(a) On 1 January 2018, Magnum acquired 75% of the equity share capital of Picaccio in a share exchange in which Magnum paid an immediate RM3.50 per share in cash and agreed to pay a further amount of RM127.20 million on 1 January 2019. Magnum's cost of capital is 6% per annum. Magnum has only recorded the cash consideration of RM3.50 per share. Below are Statement of Comprehensive Income for Year Ended 2018 for both companies:- Statement of Comprehensive Income for the Year Ended 31 December 2018 Magnum Picaccio RM'000 RM'000 Tangible non-current assets (note (i)) Development costs (note (iv)) 420,000 Nil 320,000 40,000 Investments (note (1)) Current assets Total assets Equity and liabilities Ordinary shares of RM1 each Share premium Revaluation surplus Retained earnings- 1 January 2018 Current year to 31 December 2018 Non-current liabilities 10% inter company loan (note (ii)) Current liabilities Total equity and liabilities The following information is relevant: (0 (iv) (v) 300,000 720,000 133,000 853.000 270,000 80,000 45,000 160,000 190,000 745,000 Nil 108,000 853,000 20,000 380,000 91,000 471,000 80,000 40,000 Nil 134,000 76,000 330,000 60,000 81,000 471,000 Magnum has a policy of revaluing land and buildings to fair value. At the date of acquisition Picaccio's land and buildings had a fair value RM 20 million higher than their book value and at 31 December 2018 this had increased by a further RM4 million (ignore any additional depreciation). Included in Magnum's investments is a loan of RM60 million made to Picaccio at the date of acquisition. Interest is payable annually in arrears. Picaccio paid the interest due for the year on 31 December 2018, but Magnum did not receive this until after the year end. Magnum has not accounted for the accrued interest from Picaccio. Picaccio had established a line of products under the brand name of Long Nose Acting on behalf of Magnum, a firm of specialists, had valued the brand name at a value of RM40 million with an estimated life of 10 years as at 1 January 2018. The brand is not included in Picaccio's statement of financial position Picaccio's development project was completed on 30 June 2018 at a cost of RM50 million RM10 million of this had been amortised by 31 December 2018. Development costs capitalised by Picaccio at the date of acquisition were RM18 million. Magnum's directors are of the opinion that Picaccio's development costs do not meet the criteria in MFRS 138 Intangible Assets for recognition as an asset. An impairment test at 31 December 2018 on the consolidated goodwill concluded that it should be written down by RM18 million. No other assets were impaired (vi) It is the group policy to value the non-controlling interest at acquisition at its proportionate share of the fair value of the subsidiary's identifiable net assets. Required: Calculate the goodwill at the date of consolidation for Magnum Group. Show all relevant workings. [20 marks] (b) On 1 January 2018, Juss acquired a 50% interest in Love for RM60 million. Juss already held a 20% interest which had been acquired for RM20 million but which was valued at RM24 million at 1 January 2018. The fair value of the non-controlling interest at 1 January 2018 was RM40 million and the fair value of the identifiable net assets of Love was RM110 million. Required: Calculate the goodwill using the full goodwill method. [END OF QUESTION] [10 marks]

Step by Step Solution

★★★★★

3.41 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Computation of Consideration Shares 80000000 75 60000000 35 210000000 Cash ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started