Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 7: On January 1, 20X1, a utility building was purchased for $2,190,000. Assuming a 25-year useful life and its worth to be $246,000

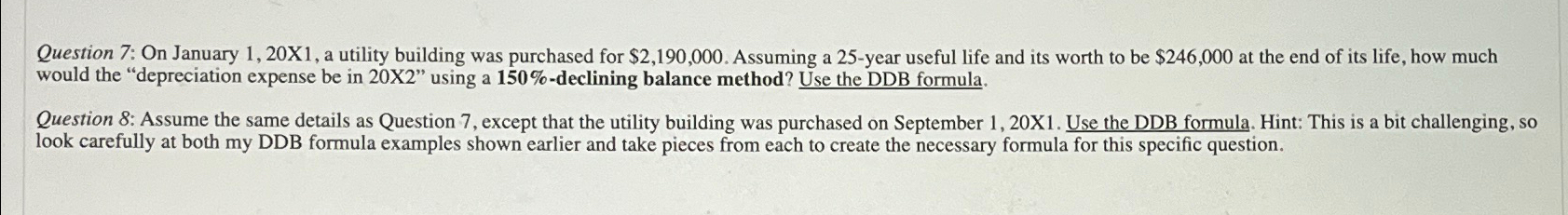

Question 7: On January 1, 20X1, a utility building was purchased for $2,190,000. Assuming a 25-year useful life and its worth to be $246,000 at the end of its life, how much would the "depreciation expense be in 20X2" using a 150%-declining balance method? Use the DDB formula. Question 8: Assume the same details as Question 7, except that the utility building was purchased on September 1, 20X1. Use the DDB formula. Hint: This is a bit challenging, so look carefully at both my DDB formula examples shown earlier and take pieces from each to create the necessary formula for this specific question.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Question 7 To calculate the depreciation expense in 20X2 using the 150declining balance method we first need to determine the annual depreciation rate ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

6642b7ae0f93b_975403.pdf

180 KBs PDF File

6642b7ae0f93b_975403.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started