Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 7 Part 1 Smacktalk Corp. purchases office supplies once a month and prepares monthly financial statements. The asset account Office Supplies on Hand

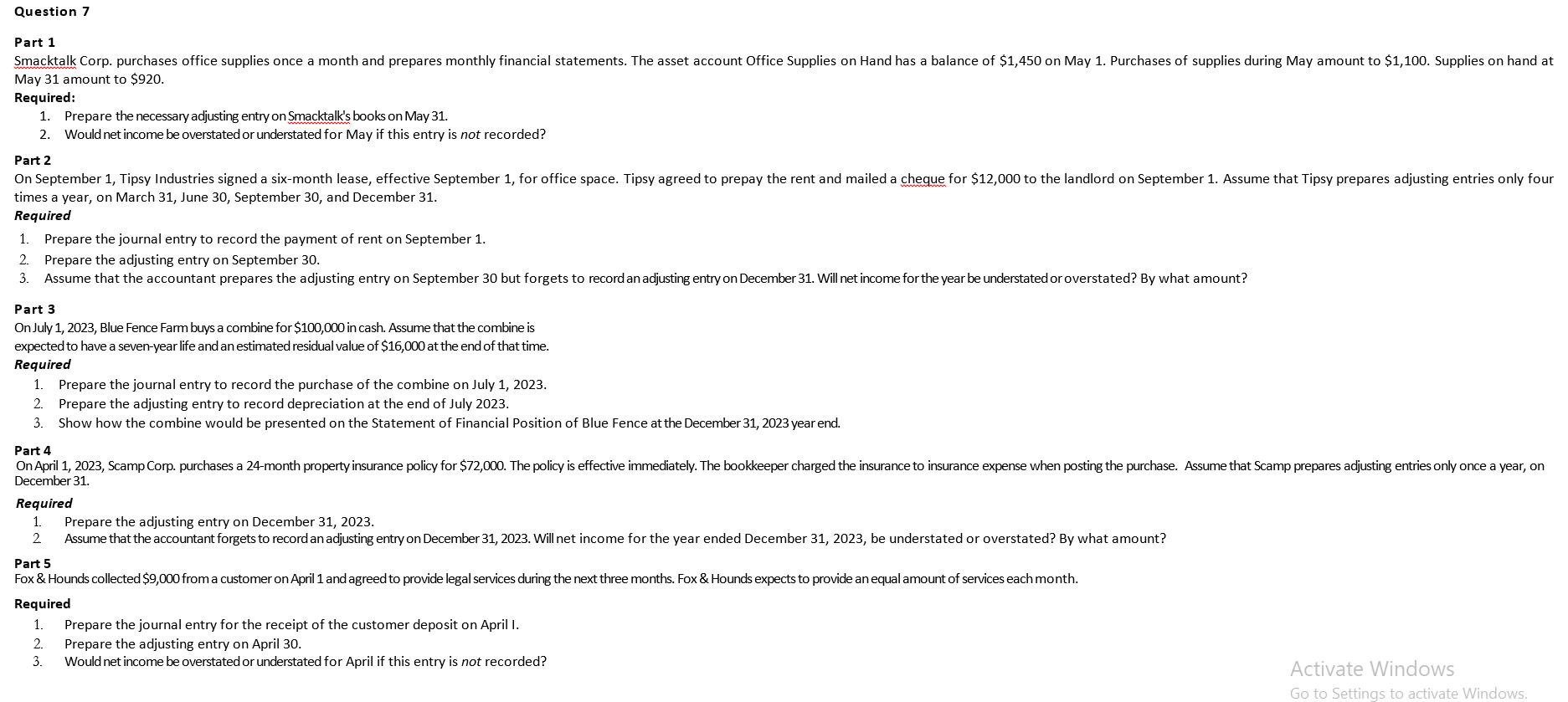

Question 7 Part 1 Smacktalk Corp. purchases office supplies once a month and prepares monthly financial statements. The asset account Office Supplies on Hand has a balance of $1,450 on May 1. Purchases of supplies during May amount to $1,100. Supplies on hand at May 31 amount to $920. Required: 1. Prepare the necessary adjusting entry on Smacktalk's books on May 31. 2. Would net income be overstated or understated for May if this entry is not recorded? Part 2 On September 1, Tipsy Industries signed a six-month lease, effective September 1, for office space. Tipsy agreed to prepay the rent and mailed a cheque for $12,000 to the landlord on September 1. Assume that Tipsy prepares adjusting entries only four times a year, on March 31, June 30, September 30, and December 31. Required 1. Prepare the journal entry to record the payment of rent on September 1. 2. Prepare the adjusting entry on September 30. 3. Assume that the accountant prepares the adjusting entry on September 30 but forgets to record an adjusting entry on December 31. Will net income for the year be understated or overstated? By what amount? Part 3 On July 1, 2023, Blue Fence Farm buys a combine for $100,000 in cash. Assume that the combine is expected to have a seven-year life and an estimated residual value of $16,000 at the end of that time. Required 1. Prepare the journal entry to record the purchase of the combine on July 1, 2023. 2. Prepare the adjusting entry to record depreciation at the end of July 2023. 3. Show how the combine would be presented on the Statement of Financial Position of Blue Fence at the December 31, 2023 year end. Part 4 On April 1, 2023, Scamp Corp. purchases a 24-month property insurance policy for $72,000. The policy is effective immediately. The bookkeeper charged the insurance to insurance expense when posting the purchase. Assume that Scamp prepares adjusting entries only once a year, on December 31. Required 1. Prepare the adjusting entry on December 31, 2023. 2 Assume that the accountant forgets to record an adjusting entry on December 31, 2023. Will net income for the year ended December 31, 2023, be understated or overstated? By what amount? Part 5 Fox & Hounds collected $9,000 from a customer on April 1 and agreed to provide legal services during the next three months. Fox & Hounds expects to provide an equal amount of services each month. Required 1. Prepare the journal entry for the receipt of the customer deposit on April 1. 2. Prepare the adjusting entry on April 30. 3. Would net income be overstated or understated for April if this entry is not recorded? Activate Windows Go to Settings to activate Windows.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started