Answered step by step

Verified Expert Solution

Question

1 Approved Answer

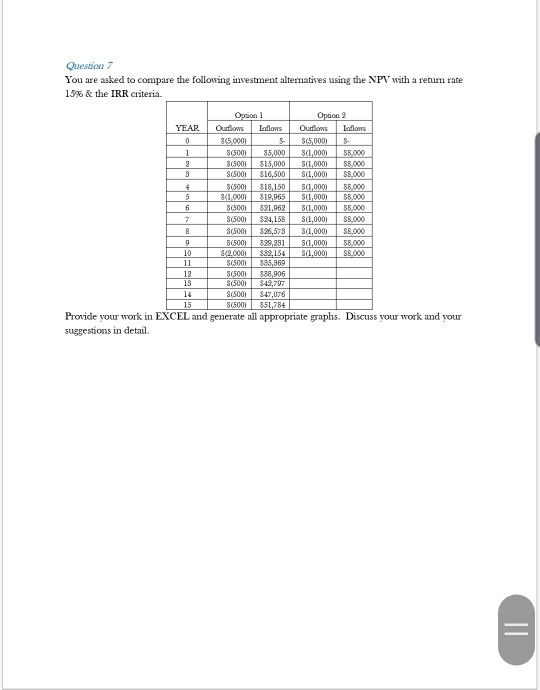

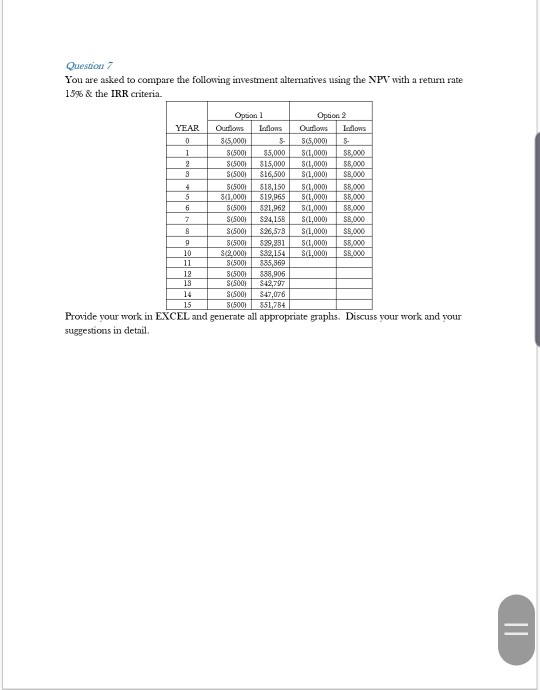

Question 7 You are asked to compare the following investment alternatives using the NPV with a retum rate 13% & the IRR criteria. Opcion 2

Question 7 You are asked to compare the following investment alternatives using the NPV with a retum rate 13% & the IRR criteria. Opcion 2 YEAR O L -dows Outlow Low 35000 35,000 50500 35,000 .0001 58.000 $6500 $15,000 1,000 58.000 $500 $16.500 1.000 .000 $500 $18.150 501.000 5.000 8C1,000 519,065 $(1,000 58.000 $65001 521,962 1.000 55.000 $(500 $94,158 (1,000) SB.000 $150013 286.573 S01.000) S $(500 $99.951 51.000 55.000 $2.0001 392.154 S(1,000) S8.000 $65001 885,369 815001 598,905 Sc5001 $ 42,707 S (500 $47,076 505001 851,784 Provide your work in EXCEL and generate all appropriate graphs. Discuss your work and your suggestions in detail Question 7 You are asked to compare the following investment alternatives using the NPV with a retum rate 13% & the IRR criteria. Opcion 2 YEAR O L -dows Outlow Low 35000 35,000 50500 35,000 .0001 58.000 $6500 $15,000 1,000 58.000 $500 $16.500 1.000 .000 $500 $18.150 501.000 5.000 8C1,000 519,065 $(1,000 58.000 $65001 521,962 1.000 55.000 $(500 $94,158 (1,000) SB.000 $150013 286.573 S01.000) S $(500 $99.951 51.000 55.000 $2.0001 392.154 S(1,000) S8.000 $65001 885,369 815001 598,905 Sc5001 $ 42,707 S (500 $47,076 505001 851,784 Provide your work in EXCEL and generate all appropriate graphs. Discuss your work and your suggestions in detail Question 7 You are asked to compare the following investment alternatives using the NPV with a retum rate 13% & the IRR criteria. Opcion 2 YEAR O L -dows Outlow Low 35000 35,000 50500 35,000 .0001 58.000 $6500 $15,000 1,000 58.000 $500 $16.500 1.000 .000 $500 $18.150 501.000 5.000 8C1,000 519,065 $(1,000 58.000 $65001 521,962 1.000 55.000 $(500 $94,158 (1,000) SB.000 $150013 286.573 S01.000) S $(500 $99.951 51.000 55.000 $2.0001 392.154 S(1,000) S8.000 $65001 885,369 815001 598,905 Sc5001 $ 42,707 S (500 $47,076 505001 851,784 Provide your work in EXCEL and generate all appropriate graphs. Discuss your work and your suggestions in detail Question 7 You are asked to compare the following investment alternatives using the NPV with a retum rate 13% & the IRR criteria. Opcion 2 YEAR O L -dows Outlow Low 35000 35,000 50500 35,000 .0001 58.000 $6500 $15,000 1,000 58.000 $500 $16.500 1.000 .000 $500 $18.150 501.000 5.000 8C1,000 519,065 $(1,000 58.000 $65001 521,962 1.000 55.000 $(500 $94,158 (1,000) SB.000 $150013 286.573 S01.000) S $(500 $99.951 51.000 55.000 $2.0001 392.154 S(1,000) S8.000 $65001 885,369 815001 598,905 Sc5001 $ 42,707 S (500 $47,076 505001 851,784 Provide your work in EXCEL and generate all appropriate graphs. Discuss your work and your suggestions in detail

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started