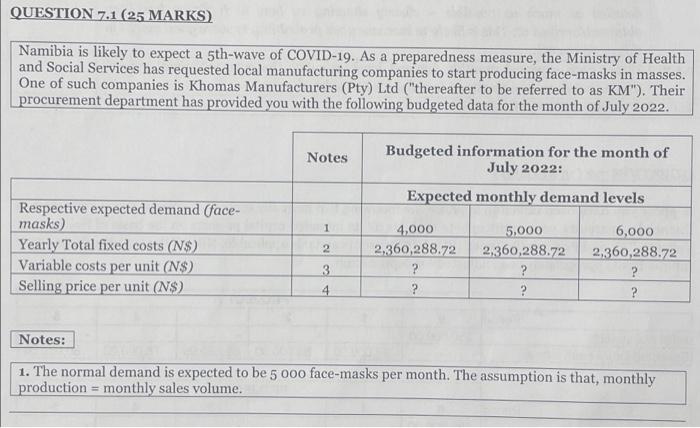

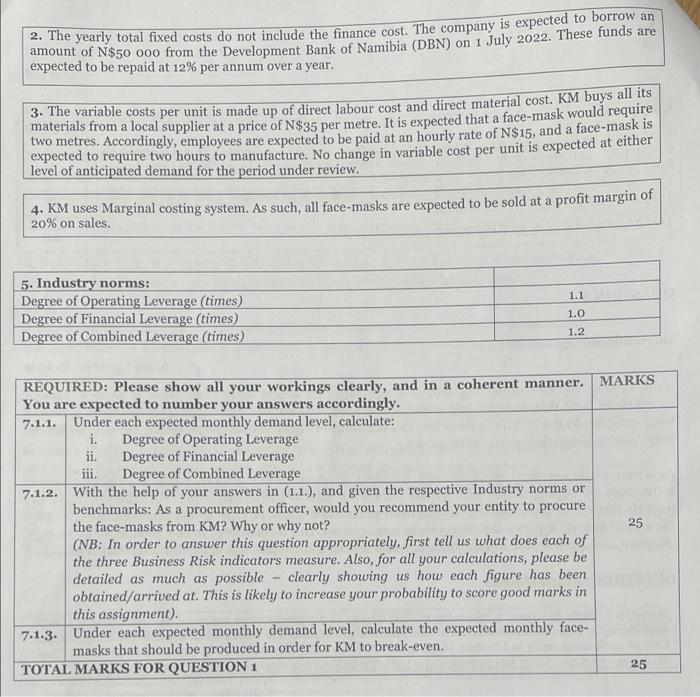

QUESTION 7.1 (25 MARKS) Namibia is likely to expect a 5th-wave of COVID-19. As a preparedness measure, the Ministry of Health and Social Services has requested local manufacturing companies to start producing face-masks in masses. One of such companies is Khomas Manufacturers (Pty) Ltd ("thereafter to be referred to as KM"). Their procurement department has provided you with the following budgeted data for the month of July 2022. Notes Budgeted information for the month of July 2022: Expected monthly demand levels Respective expected demand (face- masks) 4,000 5,000 000 2 2,360,288.72 2,360,288.72 Yearly Total fixed costs (N$) Variable costs per unit (N$) Selling price per unit (N$) 2,360,288.72 ? 3 ? ? ? ? ? Notes: 1. The normal demand is expected to be 5 000 face-masks per month. The assumption is that, monthly production monthly sales volume. 2. The yearly total fixed costs do not include the finance cost. The company is expected to borrow an amount of N$50 000 from the Development Bank of Namibia (DBN) on 1 July 2022. These funds are expected to be repaid at 12% per annum over a year. 3. The variable costs per unit is made up of direct labour cost and direct material cost. KM buys all its materials from a local supplier at a price of N$35 per metre. It is expected that a face-mask would require two metres. Accordingly, employees are expected to be paid at an hourly rate of N$15, and a face-mask is expected to require two hours to manufacture. No change in variable cost per unit is expected at either level of anticipated demand for the period under review. 4. KM uses Marginal costing system. As such, all face-masks are expected to be sold at a profit margin of 20% on sales. 5. Industry norms: Degree of Operating Leverage (times) 1.1 1.0 Degree of Financial Leverage (times) Degree of Combined Leverage (times) 1.2 REQUIRED: Please show all your workings clearly, and in a coherent manner. You are expected to number your answers accordingly. 7.1.1. Under each expected monthly demand level, calculate: i. Degree of Operating Leverage ii. Degree of Financial Leverage Degree of Combined Leverage iii. 7.1.2. With the help of your answers in (1.1.), and given the respective Industry norms or benchmarks: As a procurement officer, would you recommend your entity to procure the face-masks from KM? Why or why not? (NB: In order to answer this question appropriately, first tell us what does each of the three Business Risk indicators measure. Also, for all your calculations, please be detailed as much as possible clearly showing us how each figure has been obtained/arrived at. This is likely to increase your probability to score good marks in this assignment). 7.1.3. Under each expected monthly demand level, calculate the expected monthly face- masks that should be produced in order for KM to break-even. TOTAL MARKS FOR QUESTION 1 MARKS 25 25 QUESTION 7.1 (25 MARKS) Namibia is likely to expect a 5th-wave of COVID-19. As a preparedness measure, the Ministry of Health and Social Services has requested local manufacturing companies to start producing face-masks in masses. One of such companies is Khomas Manufacturers (Pty) Ltd ("thereafter to be referred to as KM"). Their procurement department has provided you with the following budgeted data for the month of July 2022. Notes Budgeted information for the month of July 2022: Expected monthly demand levels Respective expected demand (face- masks) 4,000 5,000 000 2 2,360,288.72 2,360,288.72 Yearly Total fixed costs (N$) Variable costs per unit (N$) Selling price per unit (N$) 2,360,288.72 ? 3 ? ? ? ? ? Notes: 1. The normal demand is expected to be 5 000 face-masks per month. The assumption is that, monthly production monthly sales volume. 2. The yearly total fixed costs do not include the finance cost. The company is expected to borrow an amount of N$50 000 from the Development Bank of Namibia (DBN) on 1 July 2022. These funds are expected to be repaid at 12% per annum over a year. 3. The variable costs per unit is made up of direct labour cost and direct material cost. KM buys all its materials from a local supplier at a price of N$35 per metre. It is expected that a face-mask would require two metres. Accordingly, employees are expected to be paid at an hourly rate of N$15, and a face-mask is expected to require two hours to manufacture. No change in variable cost per unit is expected at either level of anticipated demand for the period under review. 4. KM uses Marginal costing system. As such, all face-masks are expected to be sold at a profit margin of 20% on sales. 5. Industry norms: Degree of Operating Leverage (times) 1.1 1.0 Degree of Financial Leverage (times) Degree of Combined Leverage (times) 1.2 REQUIRED: Please show all your workings clearly, and in a coherent manner. You are expected to number your answers accordingly. 7.1.1. Under each expected monthly demand level, calculate: i. Degree of Operating Leverage ii. Degree of Financial Leverage Degree of Combined Leverage iii. 7.1.2. With the help of your answers in (1.1.), and given the respective Industry norms or benchmarks: As a procurement officer, would you recommend your entity to procure the face-masks from KM? Why or why not? (NB: In order to answer this question appropriately, first tell us what does each of the three Business Risk indicators measure. Also, for all your calculations, please be detailed as much as possible clearly showing us how each figure has been obtained/arrived at. This is likely to increase your probability to score good marks in this assignment). 7.1.3. Under each expected monthly demand level, calculate the expected monthly face- masks that should be produced in order for KM to break-even. TOTAL MARKS FOR QUESTION 1 MARKS 25 25