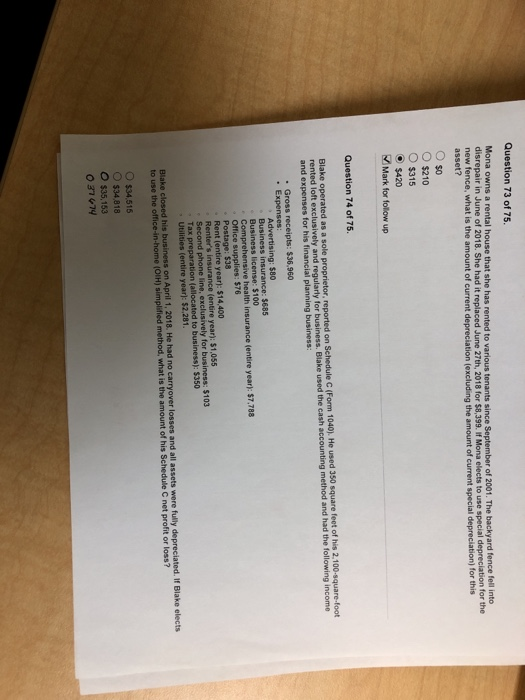

Question 73 of 75. wona owns a rental house that she has rented to various tenants since September of 2001. The backyard fence Fem into disrepair in June of 2018. She had it replaced June 27th, 2018 for $8,399. If Mona elects to use special depreciation for the new fence, what is the amount of current depreciation (excluding the amount of current special depreciation for this asset? O $0 O $210 O $315 $420 Mark for follow up Question 74 of 75. Blake operated as a sole proprietor, reported on Schedule C (Form 1040). He used 350 square feet of his 2.100-square foot rented loft exclusively and regularly for business. Blake used the cash accounting method and had the following income and expenses for his financial planning business: . Gross receipts: $36.960 Expenses: Advertising: $80 Business Insurance: $685 Business license: $100 Comprehensive health insurance fentire year): $7.788 Office supplies: 576 Postage: 538 Rent (entire year): $14,400 Renter's Insurance (entire year): $1,055 Second phone line, exclusively for business: $103 Tax preparation allocated to business): 5350 Utilities (entire year: 52,281. Blake closed his business on April 1, 2016. He had no carryover losses and all assets were fully depreciated. If Blake elects to use the office-in-home (OIH) simplified method, what is the amount of his Schedule C net profit or loss? O $34.515 O $34,818 $35,153 0 3774 Question 73 of 75. wona owns a rental house that she has rented to various tenants since September of 2001. The backyard fence Fem into disrepair in June of 2018. She had it replaced June 27th, 2018 for $8,399. If Mona elects to use special depreciation for the new fence, what is the amount of current depreciation (excluding the amount of current special depreciation for this asset? O $0 O $210 O $315 $420 Mark for follow up Question 74 of 75. Blake operated as a sole proprietor, reported on Schedule C (Form 1040). He used 350 square feet of his 2.100-square foot rented loft exclusively and regularly for business. Blake used the cash accounting method and had the following income and expenses for his financial planning business: . Gross receipts: $36.960 Expenses: Advertising: $80 Business Insurance: $685 Business license: $100 Comprehensive health insurance fentire year): $7.788 Office supplies: 576 Postage: 538 Rent (entire year): $14,400 Renter's Insurance (entire year): $1,055 Second phone line, exclusively for business: $103 Tax preparation allocated to business): 5350 Utilities (entire year: 52,281. Blake closed his business on April 1, 2016. He had no carryover losses and all assets were fully depreciated. If Blake elects to use the office-in-home (OIH) simplified method, what is the amount of his Schedule C net profit or loss? O $34.515 O $34,818 $35,153 0 3774