Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 8 (15 points): It is the end of 2019 and you have just been hired as CFO of BREW Inc, the world's leading

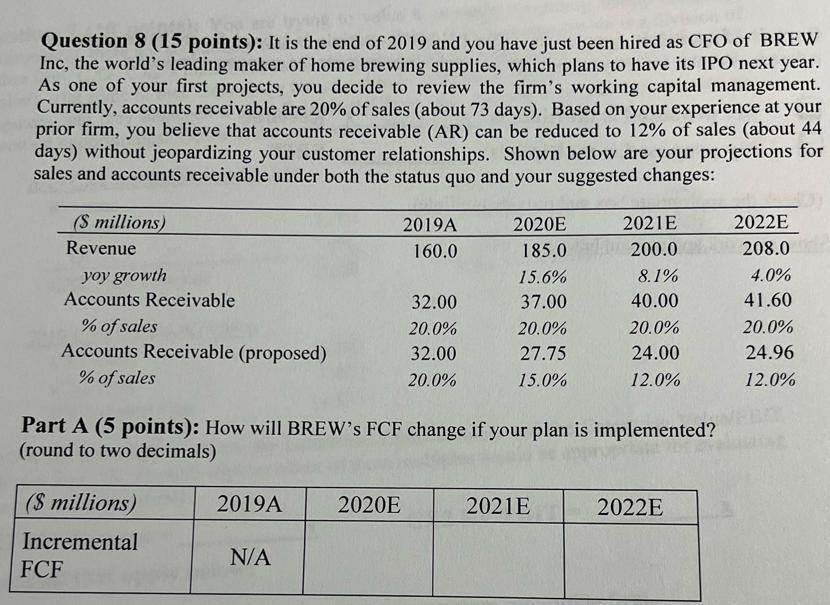

Question 8 (15 points): It is the end of 2019 and you have just been hired as CFO of BREW Inc, the world's leading maker of home brewing supplies, which plans to have its IPO next year. As one of your first projects, you decide to review the firm's working capital management. Currently, accounts receivable are 20% of sales (about 73 days). Based on your experience at your prior firm, you believe that accounts receivable (AR) can be reduced to 12% of sales (about 44 days) without jeopardizing your customer relationships. Shown below are your projections for sales and accounts receivable under both the status quo and your suggested changes: (S millions) Revenue yoy growth Accounts Receivable % of sales Accounts Receivable (proposed) % of sales ($ millions) Incremental FCF 2019A N/A 2019A 160.0 2020E 32.00 20.0% 32.00 20.0% Part A (5 points): How will BREW's FCF change if your plan is implemented? (round to two decimals) 2020E 185.0 15.6% 37.00 20.0% 27.75 15.0% 2021E 200.0 8.1% 40.00 20.0% 24.00 12.0% 2021E 2022E 2022E 208.0 4.0% 41.60 20.0% 24.96 12.0%

Step by Step Solution

★★★★★

3.40 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

2020E The change in FCF due to the proposed plan will be 225 million This is calc...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started