Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 8 (2 points) Listen Which of the following statements with respect to capital gains is correct? The inclusion rate for taxable capital gains has

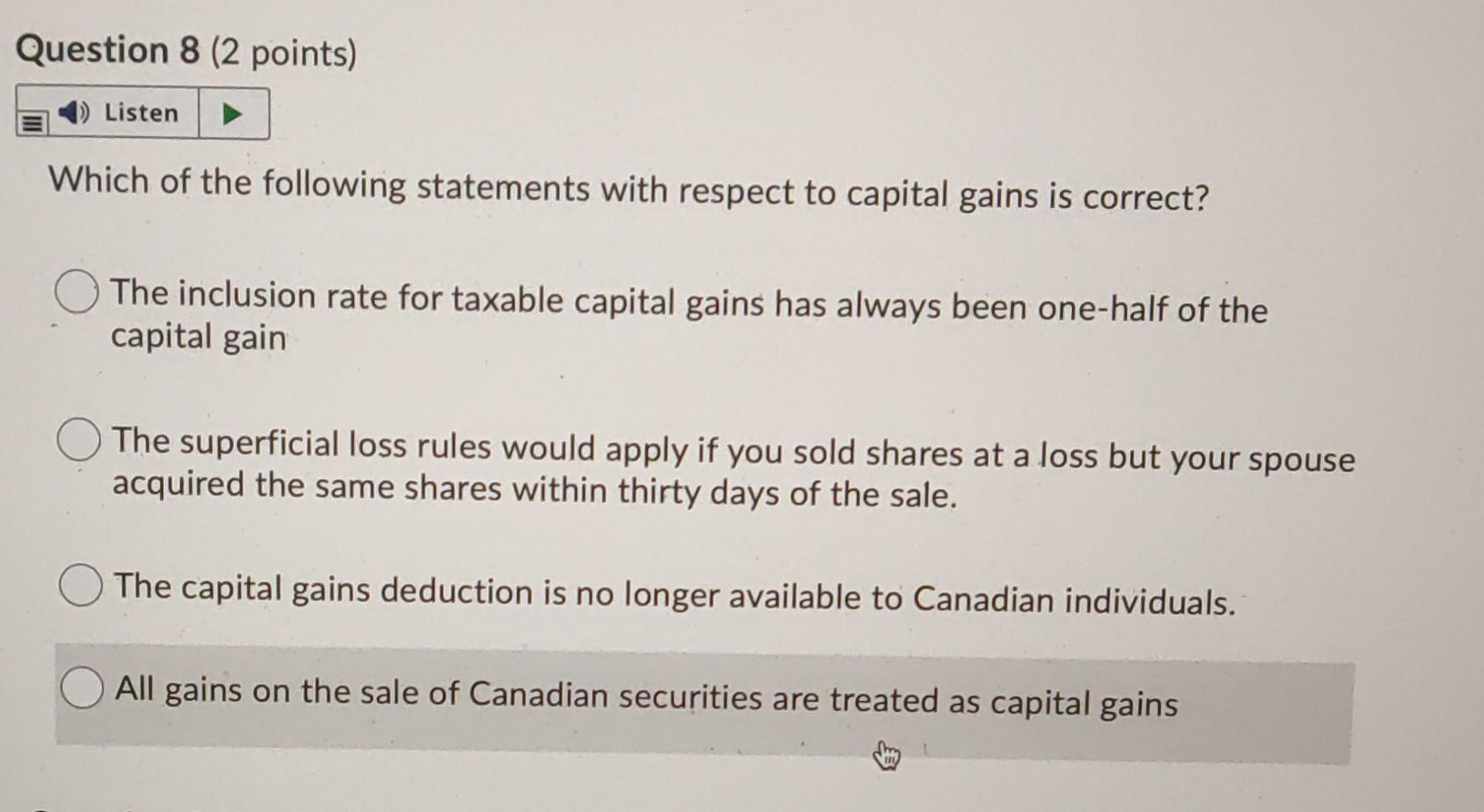

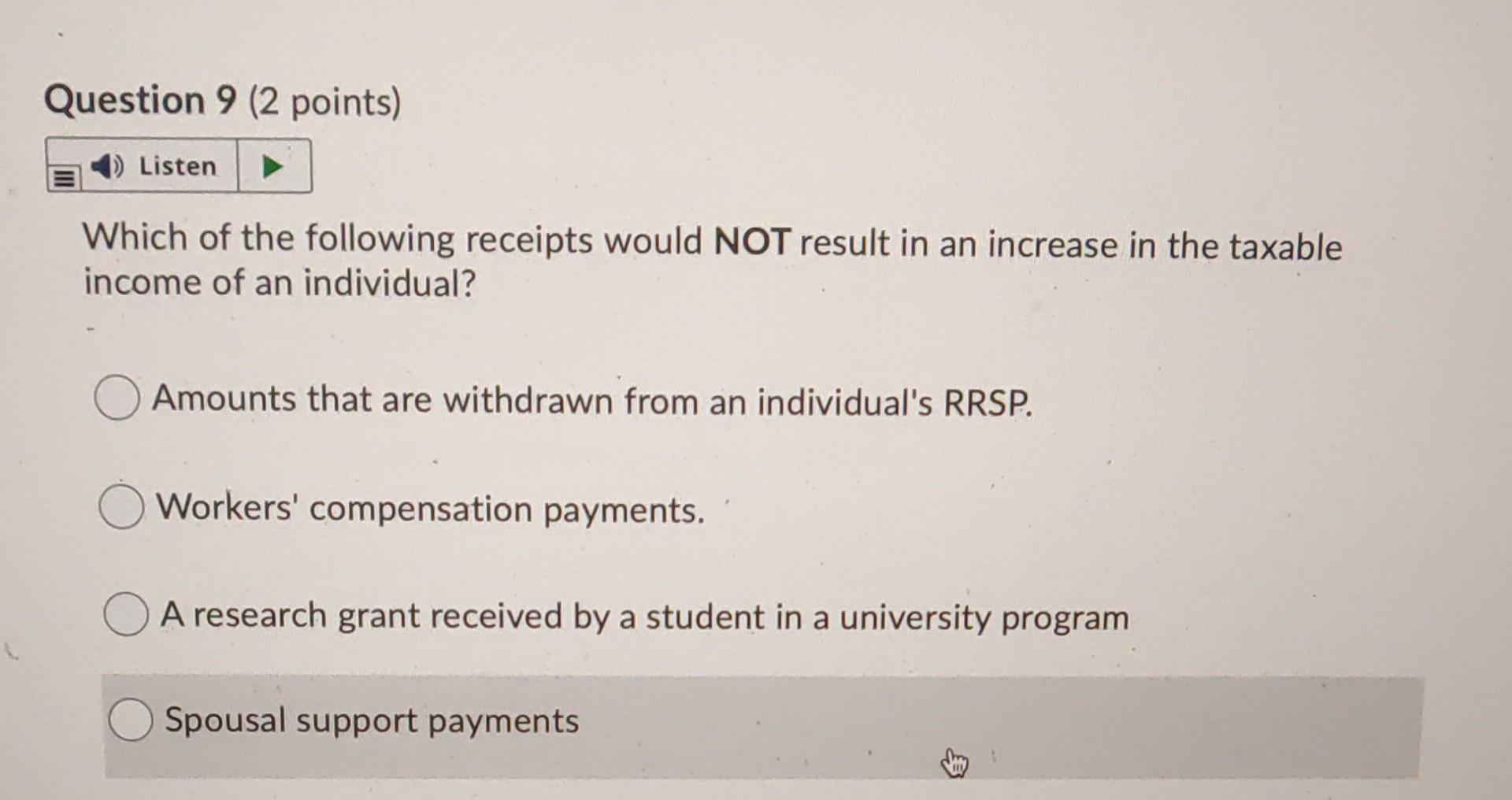

Question 8 (2 points) Listen Which of the following statements with respect to capital gains is correct? The inclusion rate for taxable capital gains has always been one-half of the capital gain The superficial loss rules would apply if you sold shares at a loss but your spouse acquired the same shares within thirty days of the sale. The capital gains deduction is no longer available to Canadian individuals. All gains on the sale of Canadian securities are treated as capital gains au Question 9 (2 points) > Listen Which of the following receipts would NOT result in an increase in the taxable income of an individual? Amounts that are withdrawn from an individual's RRSP. Workers' compensation payments. A research grant received by a student in a university program Spousal support payments

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started