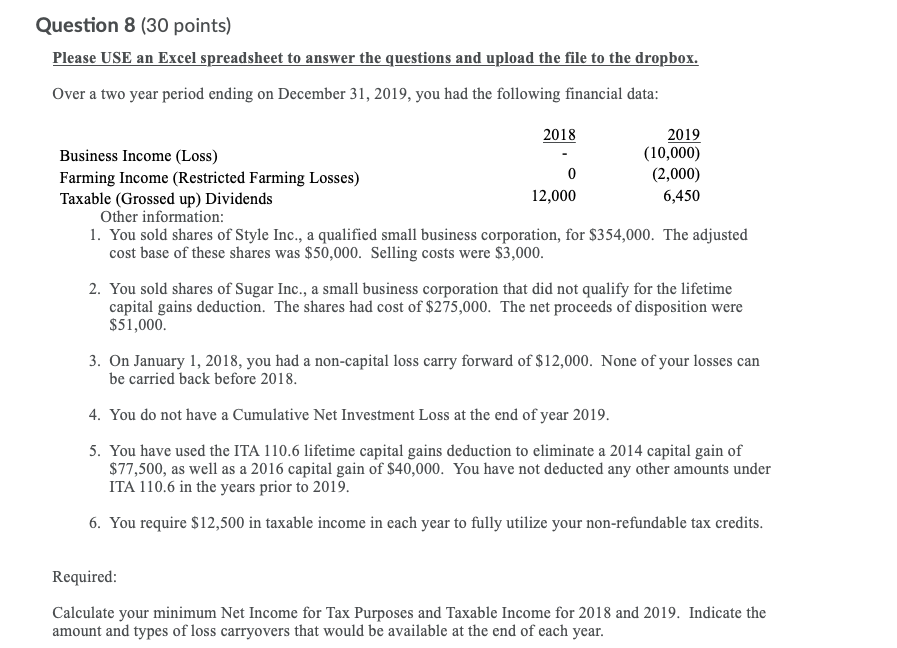

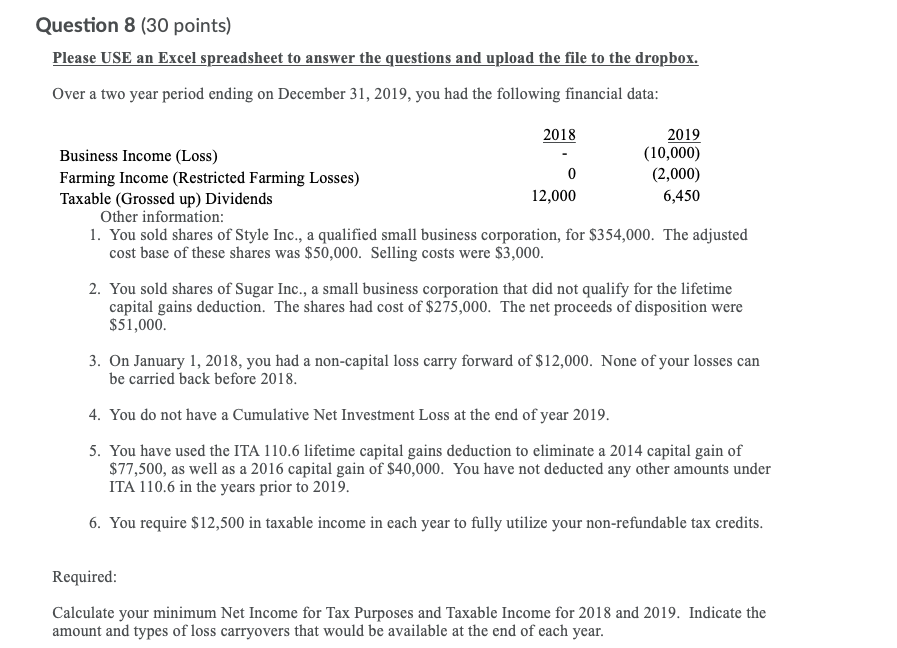

Question 8 (30 points) Please USE an Excel spreadsheet to answer the questions and upload the file to the dropbox. Over a two year period ending on December 31, 2019, you had the following financial data: 2018 2019 Business Income (Loss) (10,000) Farming Income (Restricted Farming Losses) (2,000) Taxable ( Grossed up) Dividends 12,000 Other information: 1. You sold shares of Style Inc., a qualified small business corporation, for $354,000. The adjusted cost base of these shares was $50,000. Selling costs were $3,000. 6,450 2. You sold shares of Sugar Inc., a small business corporation that did not qualify for the lifetime capital gains deduction. The shares had cost of $275,000. The net proceeds of disposition were $51,000. 3. On January 1, 2018, you had a non-capital loss carry forward of $12,000. None of your losses can be carried back before 2018. 4. You do not have a Cumulative Net Investment Loss at the end of year 2019. 5. You have used the ITA 110.6 lifetime capital gains deduction to eliminate a 2014 capital gain of $77,500, as well as a 2016 capital gain of $40,000. You have not deducted any other amounts under ITA 110.6 in the years prior to 2019. 6. You require $12,500 in taxable income in each year to fully utilize your non-refundable tax credits. Required: Calculate your minimum Net Income for Tax Purposes and Taxable Income for 2018 and 2019. Indicate the amount and types of loss carryovers that would be available at the end of each year. Question 8 (30 points) Please USE an Excel spreadsheet to answer the questions and upload the file to the dropbox. Over a two year period ending on December 31, 2019, you had the following financial data: 2018 2019 Business Income (Loss) (10,000) Farming Income (Restricted Farming Losses) (2,000) Taxable ( Grossed up) Dividends 12,000 Other information: 1. You sold shares of Style Inc., a qualified small business corporation, for $354,000. The adjusted cost base of these shares was $50,000. Selling costs were $3,000. 6,450 2. You sold shares of Sugar Inc., a small business corporation that did not qualify for the lifetime capital gains deduction. The shares had cost of $275,000. The net proceeds of disposition were $51,000. 3. On January 1, 2018, you had a non-capital loss carry forward of $12,000. None of your losses can be carried back before 2018. 4. You do not have a Cumulative Net Investment Loss at the end of year 2019. 5. You have used the ITA 110.6 lifetime capital gains deduction to eliminate a 2014 capital gain of $77,500, as well as a 2016 capital gain of $40,000. You have not deducted any other amounts under ITA 110.6 in the years prior to 2019. 6. You require $12,500 in taxable income in each year to fully utilize your non-refundable tax credits. Required: Calculate your minimum Net Income for Tax Purposes and Taxable Income for 2018 and 2019. Indicate the amount and types of loss carryovers that would be available at the end of each year