Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 8 (5 points) Anne is planning her retirement. Once she is retired, she would like to receive $3,500 at the beginning of each month

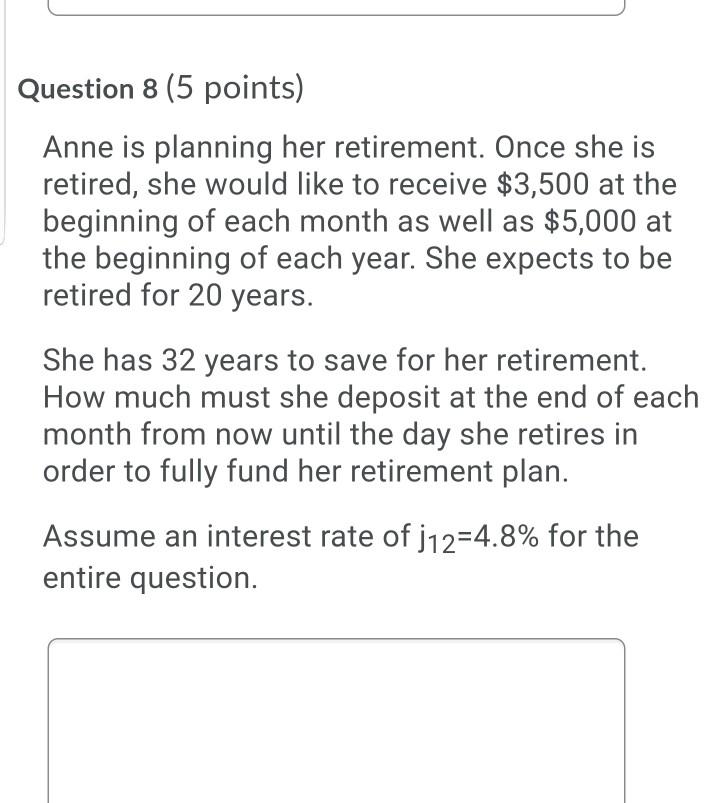

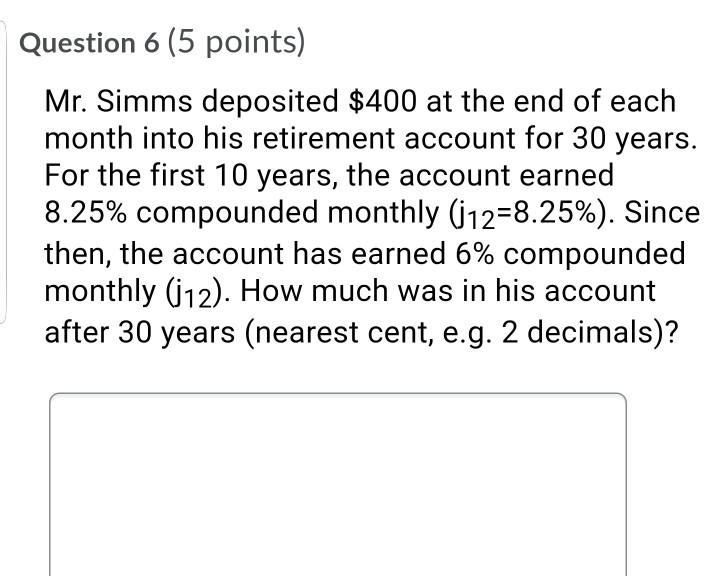

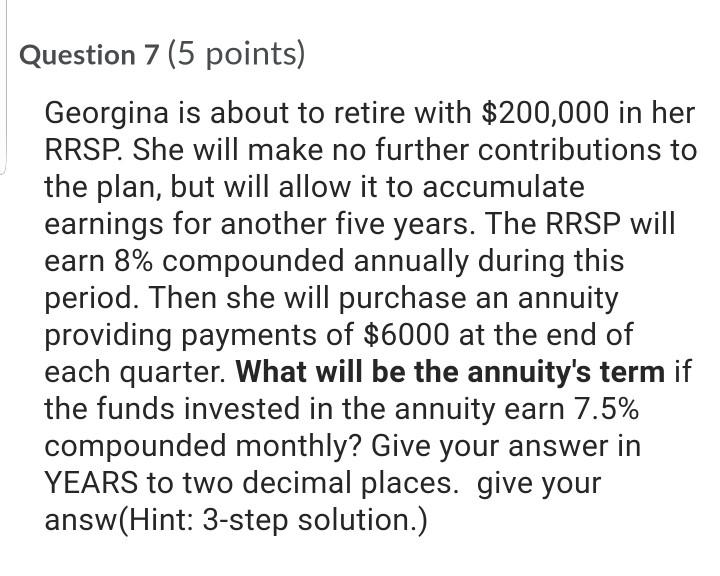

Question 8 (5 points) Anne is planning her retirement. Once she is retired, she would like to receive $3,500 at the beginning of each month as well as $5,000 at the beginning of each year. She expects to be retired for 20 years. She has 32 years to save for her retirement. How much must she deposit at the end of each month from now until the day she retires in order to fully fund her retirement plan. Assume an interest rate of j12=4.8% for the entire question. Question 6 (5 points) Mr. Simms deposited $400 at the end of each month into his retirement account for 30 years. For the first 10 years, the account earned 8.25% compounded monthly (112=8.25%). Since then, the account has earned 6% compounded monthly (12). How much was in his account after 30 years (nearest cent, e.g. 2 decimals)? Question 7 (5 points) Georgina is about to retire with $200,000 in her RRSP. She will make no further contributions to the plan, but will allow it to accumulate earnings for another five years. The RRSP will earn 8% compounded annually during this period. Then she will purchase an annuity providing payments of $6000 at the end of each quarter. What will be the annuity's term if the funds invested in the annuity earn 7.5% compounded monthly? Give your answer in YEARS to two decimal places. give your answ(Hint: 3-step solution.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started