Answered step by step

Verified Expert Solution

Question

1 Approved Answer

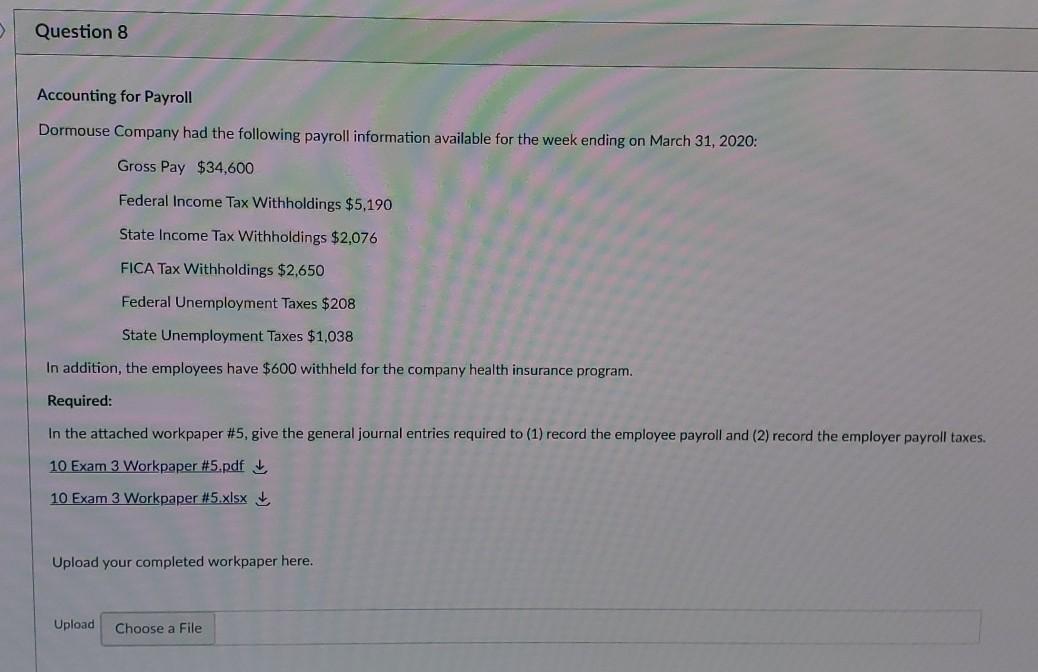

Question 8 Accounting for Payroll Dormouse Company had the following payroll information available for the week ending on March 31, 2020: Gross Pay $34,600 Federal

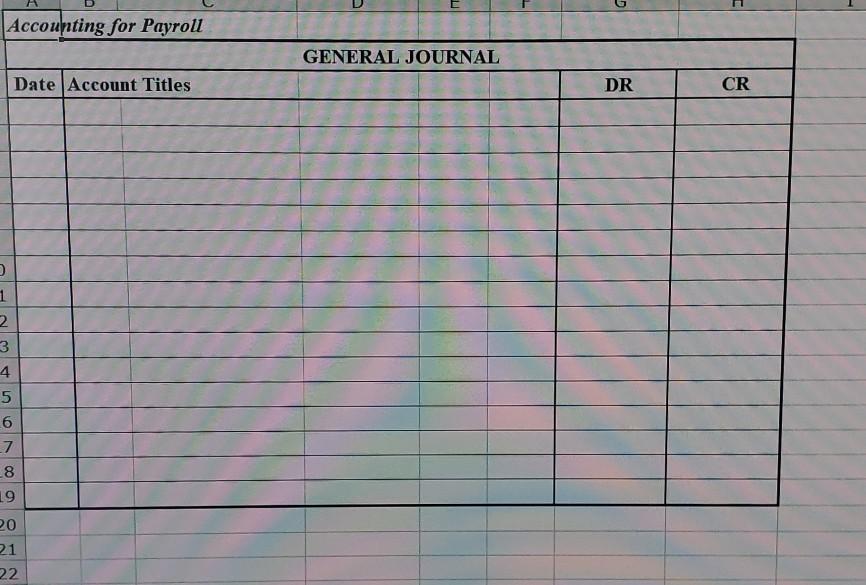

Question 8 Accounting for Payroll Dormouse Company had the following payroll information available for the week ending on March 31, 2020: Gross Pay $34,600 Federal Income Tax Withholdings $5,190 State Income Tax Withholdings $2,076 FICA Tax Withholdings $2,650 Federal Unemployment Taxes $208 State Unemployment Taxes $1,038 In addition, the employees have $600 withheld for the company health insurance program. Required: In the attached workpaper #5, give the general journal entries required to (1) record the employee payroll and (2) record the employer payroll taxes. 10 Exam 3 Workpaper #5.pdf 10 Exam 3 Workpaper #5.xlsx Upload your completed workpaper here. Upload Choose a File Accounting for Payroll GENERAL JOURNAL Date Account Titles DR CR 1 2 3 4 5 6 7 8 19 20 21 22

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started