Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 8 and 9 please 300 111011 uu cu vv111 be $30 million. Thereafter, operating cash flows and investment expenditures are forecast to grow by

Question 8 and 9 please

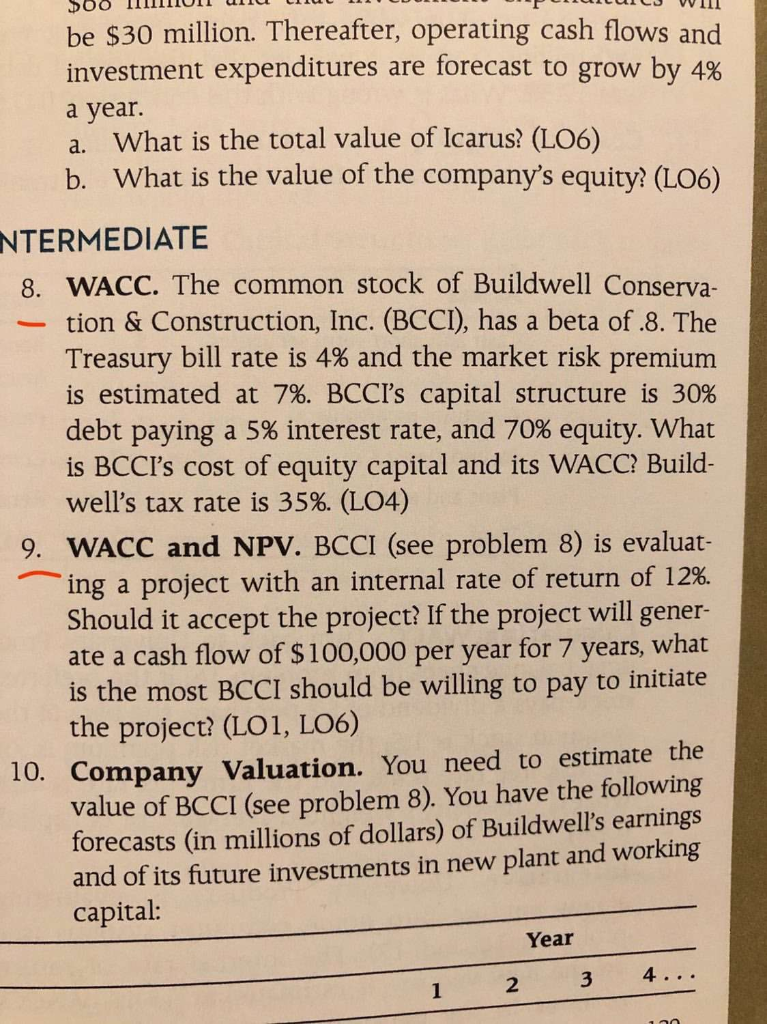

300 111011 uu cu vv111 be $30 million. Thereafter, operating cash flows and investment expenditures are forecast to grow by 4% a year. a. What is the total value of Icarus? (L06) b. What is the value of the company's equity? (L06) NTERMEDIATE 8. WACC. The common stock of Buildwell Conserva- - tion & Construction, Inc. (BCCI), has a beta of.8. The Treasury bill rate is 4% and the market risk premium is estimated at 7%. BCCI's capital structure is 30% debt paying a 5% interest rate, and 70% equity. What is BCCI's cost of equity capital and its WACC? Build- well's tax rate is 35%. (L04) 9. WACC and NPV. BCCI (see problem 8) is evaluat ing a project with an internal rate of return of 12%. Should it accept the project? If the project will gener- ate a cash flow of $100,000 per year for 7 years, what is the most BCCI should be willing to pay to initiate the project? (LOI, LO6) 10. Company Valuation. You need to estimate the value of BCCI (see problem 8). You have the following forecasts (in millions of dollars) of Buildwell's earnings and of its future investments in new plant and working capital: Year 1 2 3 4Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started