Question

Question 8 Answer the following questions relating to time value of money: (a) Alexandria has just been awarded a scholarship that will pay her $28,500

Question 8

Answer the following questions relating to time value of money:

(a) Alexandria has just been awarded a scholarship that will pay her $28,500 per year for the next four years as she pursues her undergraduate studies overseas. Using a discount rate of 9% per annum, what is the value of these payments today? (3 marks)

(b) Jo will be retiring today. The company which Jo works for is offering him a gratuity in recognition of his long service with the company.

Jo has been given the following payout options: Option 1: Receive a lump sum payment of $2,150,000 in twelve years time. Option 2: Receive $115,000 payment per year for the next twelve years.

Given that the interest rate is at 8 percent per year, which alternative would provide Jo with the highest payout based on the present value? (Provide the computation for each of the options.

(c) Robert purchased a new apartment for $980,000. He paid $250,000 in cash and agreed to pay the remaining balance over the next 20 years in 20 equal annual payments. The interest charged is fixed at 4% per annum compounded annually. How much will these equal annual payments be?

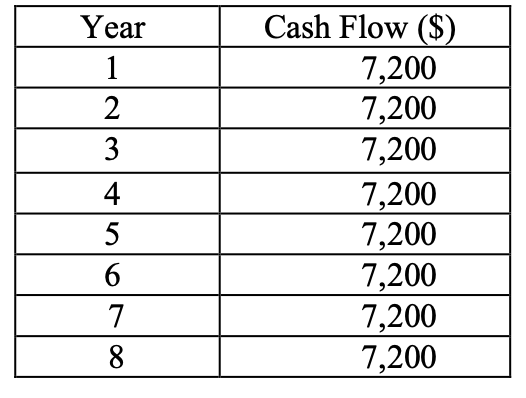

(d) Compute the present value for the following cash flow stream if the business uses a discount rate of 14%:

(e) How many years will it take for an investment of $17,690 to grow to $50,000 if the return is at 16% per annum compounded annually?

Year 1 2 3 4 5 6 7 8 Cash Flow ($) 7,200 7,200 7,200 7,200 7,200 7,200 7,200 7,200Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started