Answered step by step

Verified Expert Solution

Question

1 Approved Answer

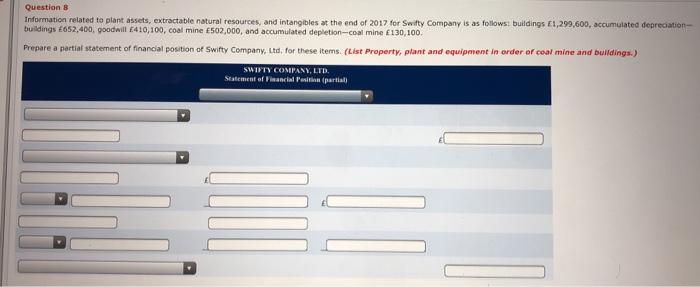

Question 8 Information related to plant assets, extractable natural resources, and intangibles at the end of 2017 for Swifty Company is as follows: buildings

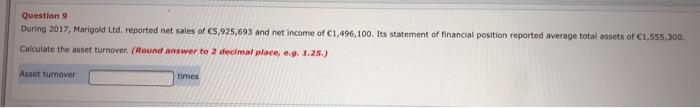

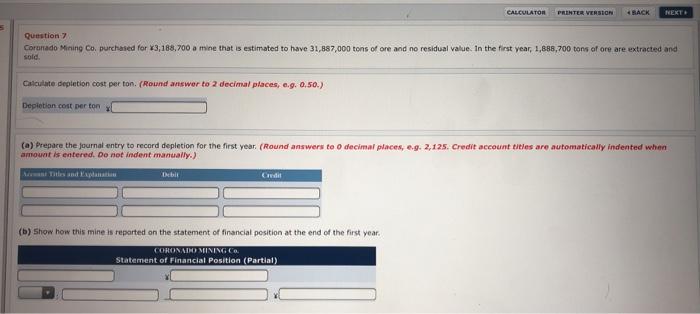

Question 8 Information related to plant assets, extractable natural resources, and intangibles at the end of 2017 for Swifty Company is as follows: buildings 1,299,600, accumulated depreciation- buildings E652,400, goodwill 410,100, coal mine 502,000, and accumulated depletion-coal mine 130,100. Prepare a partial statement of financial position of Swifty Company, Ltd, for these items. (List Property, plant and equipment in order of coal mine and buildings.) SWIFTY COMPANY, LTD. Statement of Financial Position (partial) Question 9 During 2017, Marigold Ltd. reported net sales of C5,925,693 and net income of 1,496,100. Its statement of financial position reported average total assets of C1,555,300. Calculate the asset turnover. (Round answer to 2 decimal place, e.g. 1.25.) Asset turnover times CALCULATOR PRINTER VERSION BACK NEXT Question 7 Coronado Mining Co. purchased for x3,188,700 a mine that is estimated to have 31,887,000 tons of one and no residual value. In the first year, 1,888,700 tons of ore are extracted and sold. Calculate depletion cost per ton. (Round answer to 2 decimal places, e.g. 0.50.) Depletion cost per ton (a) Prepare the journal entry to record depletion for the first year. (Round answers to 0 decimal places, e.g. 2,125. Credit account titles are automatically indented when amount is entered. Do not indent manually.) Avant Titles and Explanation Debit Credit (b) Show how this mine is reported on the statement of financial position at the end of the first year. CORONADO MINING Co. Statement of Financial Position (Partial)

Step by Step Solution

★★★★★

3.53 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

1 Statement of financial position partial Intangible assets ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started