Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 8 of 4 0 . Emily borrowed $ 2 0 , 0 0 0 from her employer's plan. When she left her employer in

Question of

Emily borrowed $ from her employer's plan. When she left her employer in September the loan had an

outstanding balance of $ Without regard to the loan, her account had a balance of $ She requested a tot

distribution from the plan. Her Form R shows a distribution of $ and her employer withheld at a rate of

much did she actually receive?

$

$

Question of

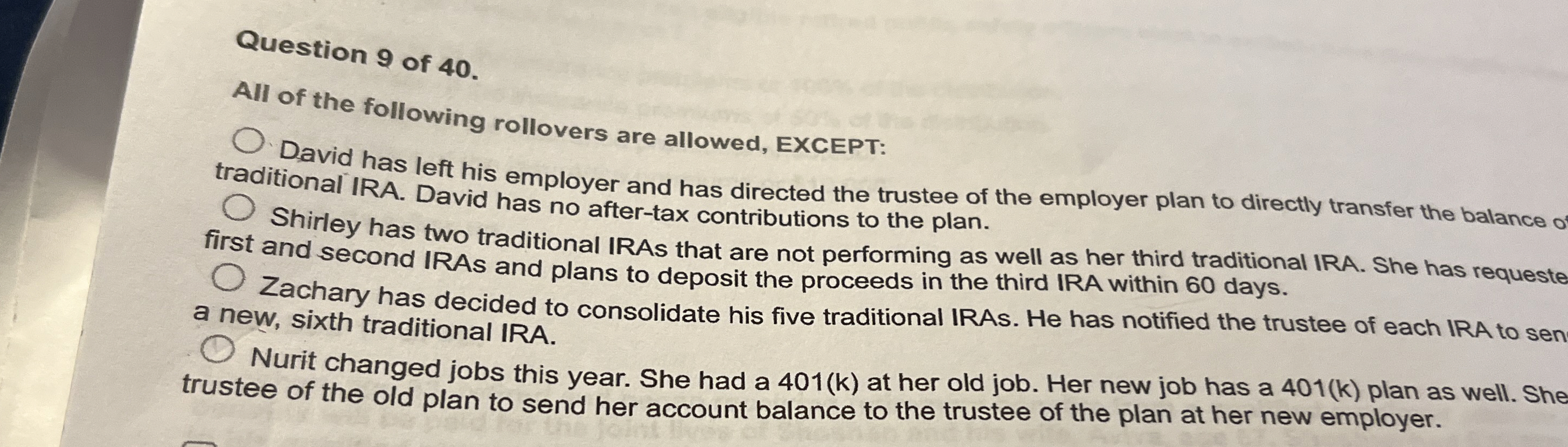

All of the following rollovers are allowed, EXCEPT:

David has left his employer and has directed the trustee of the employer plan to directly transfer the balance

traditional IRA. David has no aftertax contributions to the plan.

Shirley has two traditional IRAs that are not performing as well as her third traditional IRA. She has requeste

first and second IRAs and plans to deposit the proceeds in the third IRA within days.

Zachary has decided to consolidate his five traditional IRAs. He has notified the trustee of each IRA to sen

a new, sixth traditional IRA.

Nurit changed jobs this year. She had a at her old job. Her new job has a plan as well. She

trustee of the old plan to send her account balance to the trustee of the plan at her new employer.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started