Question 8 only!

Question 8 only!

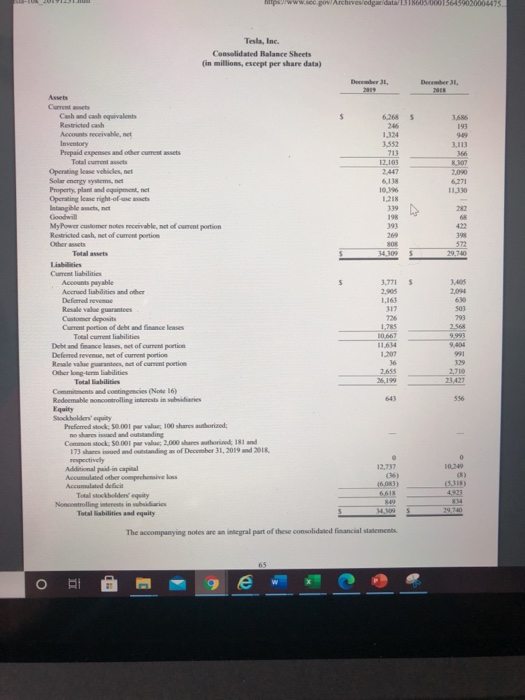

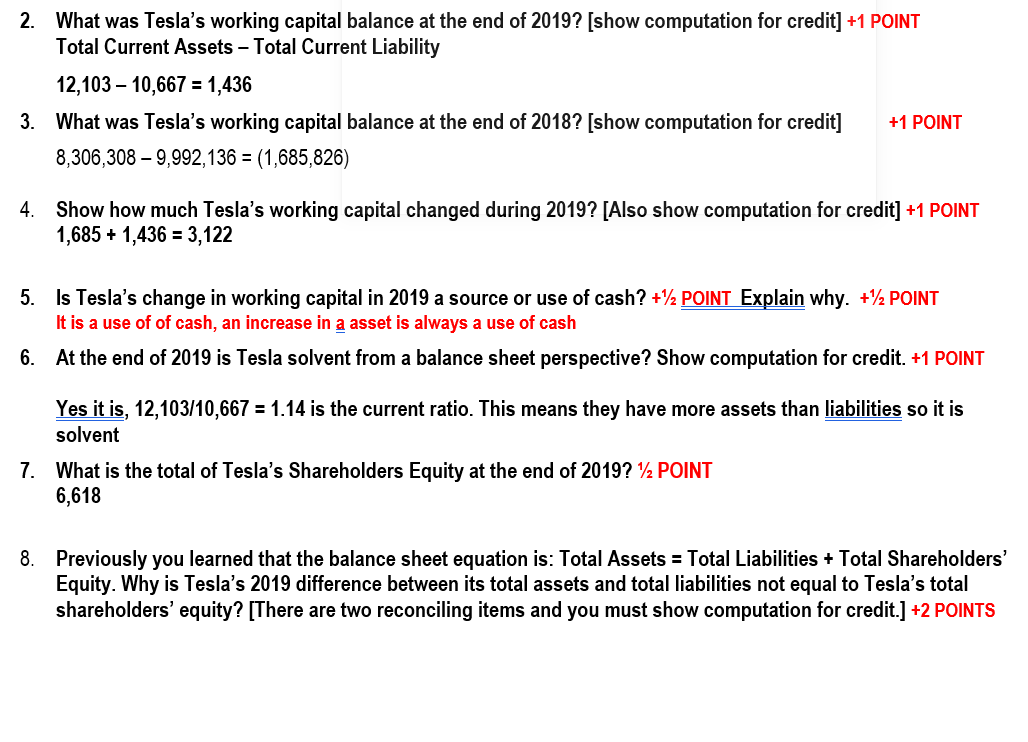

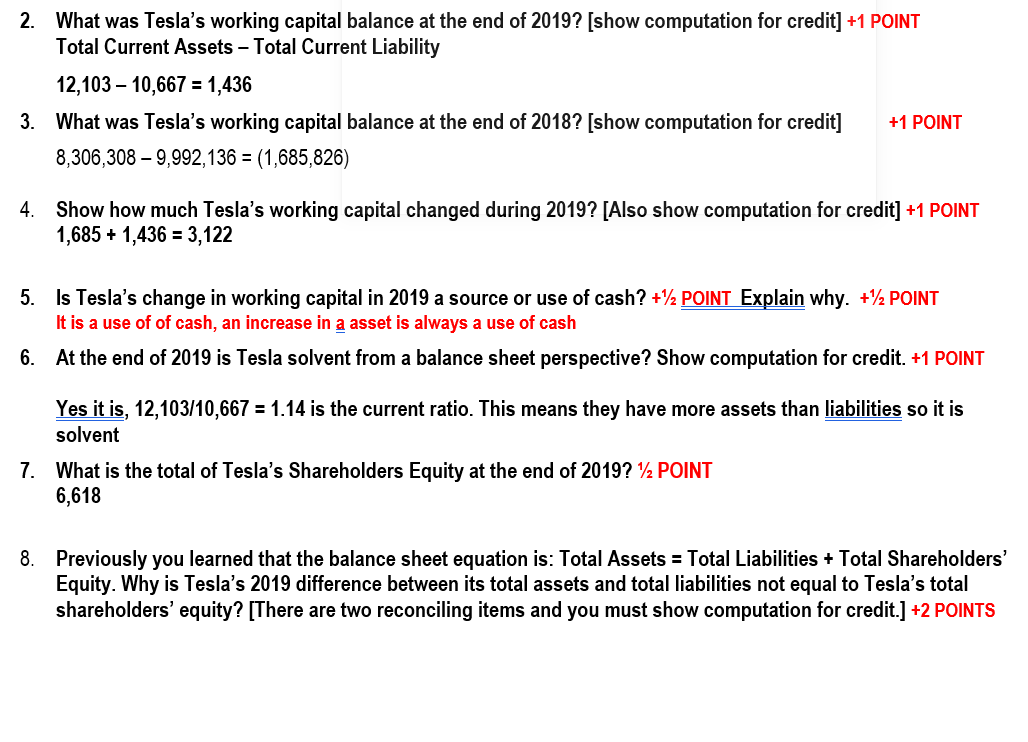

2. What was Tesla's working capital balance at the end of 2019? (show computation for credit] +1 POINT Total Current Assets Total Current Liability 12,103 - 10,667 = 1,436 3. What was Tesla's working capital balance at the end of 2018? (show computation for credit] +1 POINT 8,306,308 - 9,992,136 = (1,685,826) 4. Show how much Tesla's working capital changed during 2019? [Also show computation for credit] +1 POINT 1,685 + 1,436 = 3,122 5. Is Tesla's change in working capital in 2019 a source or use of cash? + 2 POINT Explain why. +/2 POINT It is a use of of cash, an increase in a asset is always a use of cash 6. At the end of 2019 is Tesla solvent from a balance sheet perspective? Show computation for credit. +1 POINT Yes it is, 12,103/10,667 = 1.14 is the current ratio. This means they have more assets than liabilities so it is solvent 7. What is the total of Tesla's Shareholders Equity at the end of 2019? 1/2 POINT 6,618 8. Previously you learned that the balance sheet equation is: Total Assets - Total Liabilities + Total Shareholders' Equity. Why is Tesla's 2019 difference between its total assets and total liabilities not equal to Tesla's total shareholders' equity? [There are two reconciling items and you must show computation for credit.] +2 POINTS hilpswww.sec.gov/Archives/edgar data/13180000156439020004475 Tesla, Inc. Consolidated Balance Sheets (in millions, exeept per share data) Dec , 2009 Der I. $ s 193 246 1,334 3.552 713 12.103 2447 6.13 10.16 1.21 366 Ron 2.000 6271 11.330 282 393 422 395 572 29,740 34.309 5 5 Assets Current Cash and cash equivalents Restricted cash Accounts receivable, net Inventory Prepaid expenses and other current sets Total current Operating lase vehicles, net Solar energy systems, Property, plant and equipment, net Operating lae right-of- Intangible acts, net Goodwill MyPower customer notes receivable, met of current portion Restricted cash, net of current portion Others Total Liabilities Current liabilities Accounts payable Accrued liabilities and other Deferred Resale value guarantee Customer deposits Current portion of debt and finance leases Total current liabilities Debt and finance ass, nct of current portion Deferred revenue, net of current portion Resale value antes et of current portion Other long-term labilities Total liabilities Commitments and contingencies (Note 16) Redeemable no controlling interests in subsidiaries Equity Stockholders' equity Preferred stock 50.00 per valor 100 shares authorized no share issued and outstanding Common stock: 50.001 par values 2.000 shares wuthorized 181 and 173 res med and outstanding of December 31, 2019 and 2018 respectively Additional paid in capital Accumulated other comprehensive los Accumulated deficit Total stockholders' equity Noncontrolling interests in subsidiaries Total abilities and equity 3.771 2.90s 1.163 317 726 1.785 10.67 1164 1.200 36 2.655 26.199 2,09 610 503 793 2.568 9.993 900 329 2,710 23,427 643 356 0 10.149 12.737 (6.001) 6,618 8.40 H10 29,740 The accompanying notes are an integral part of these consolidated financial statements 65 e

Question 8 only!

Question 8 only!