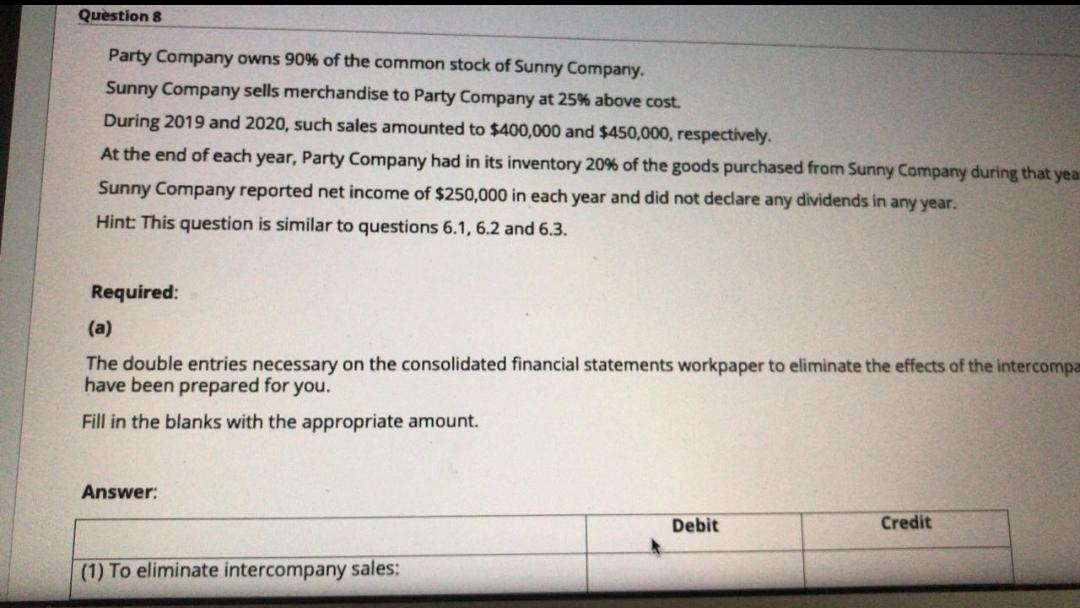

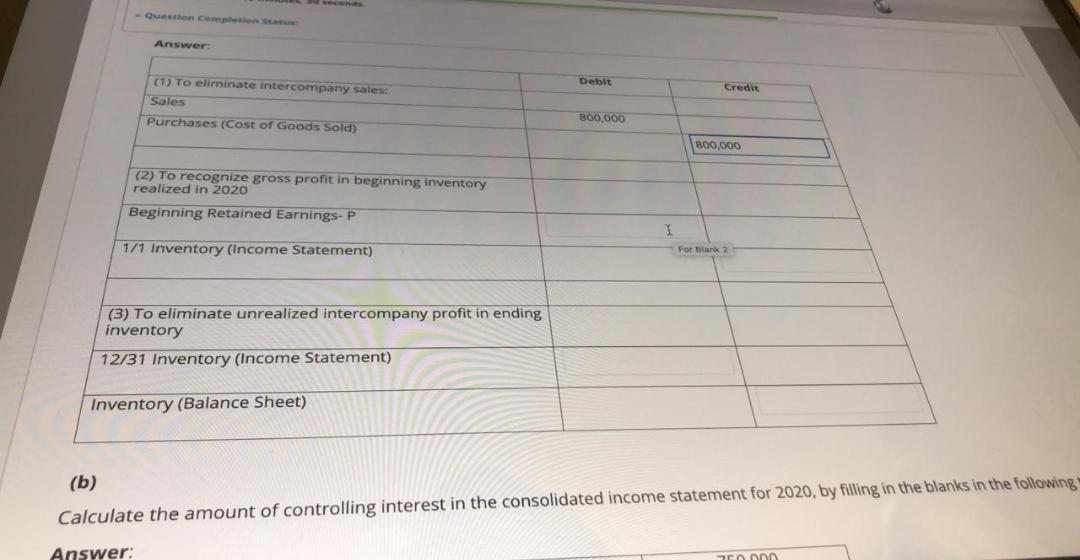

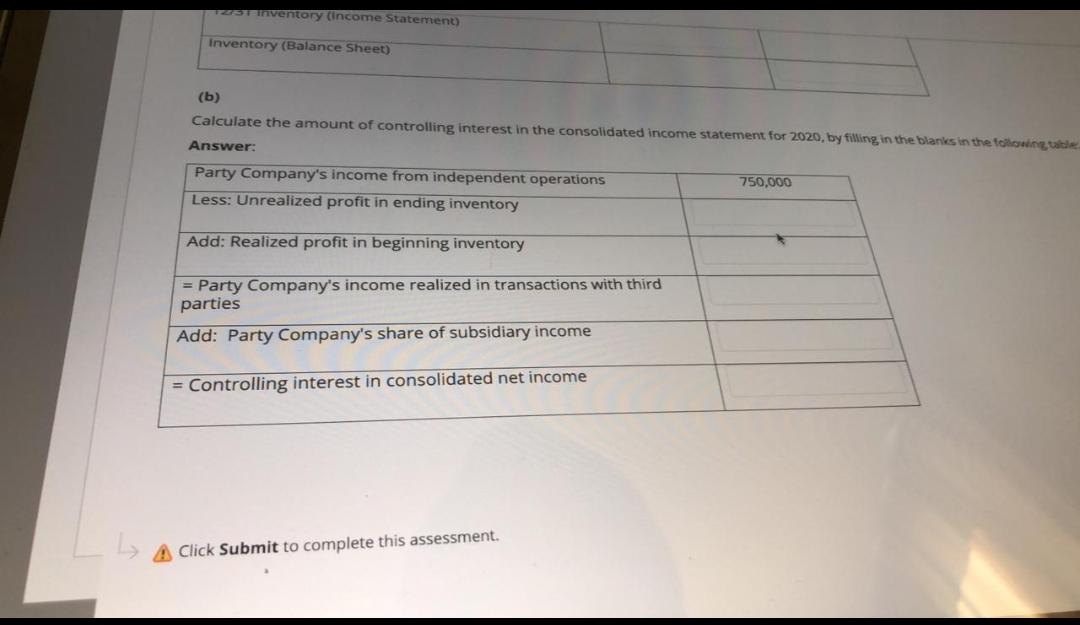

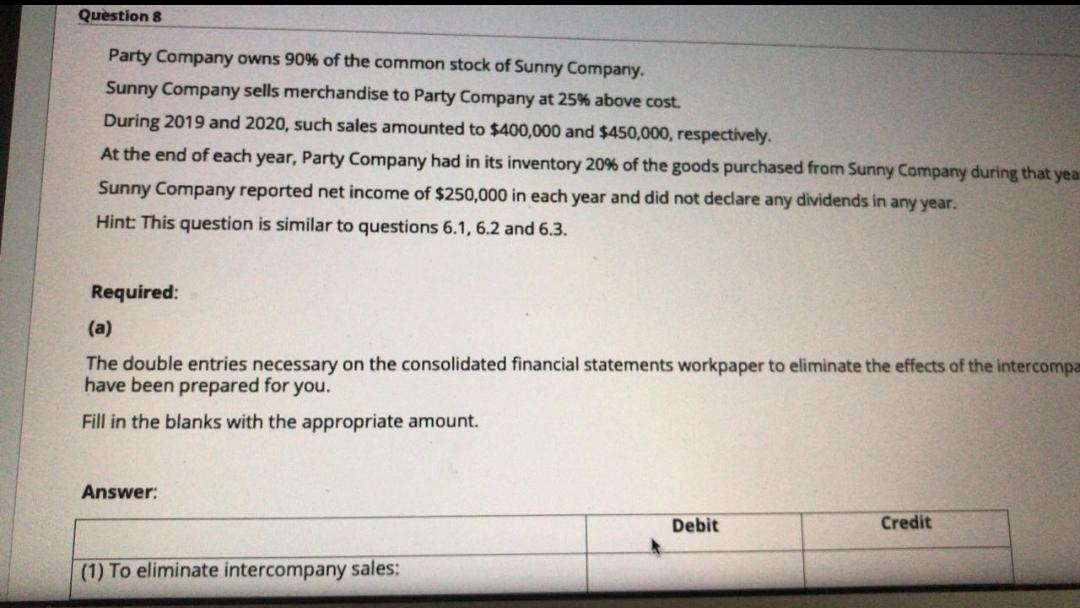

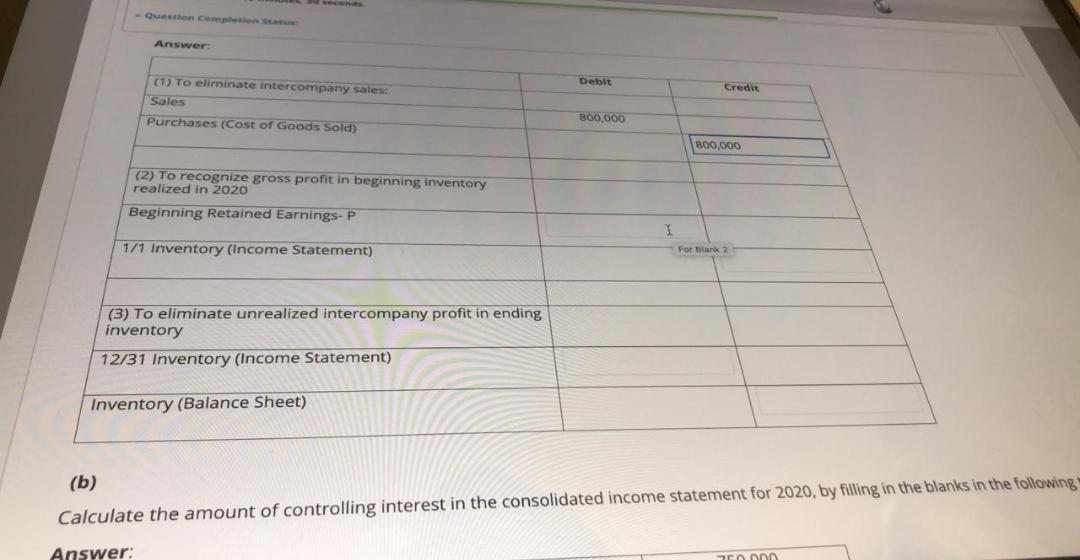

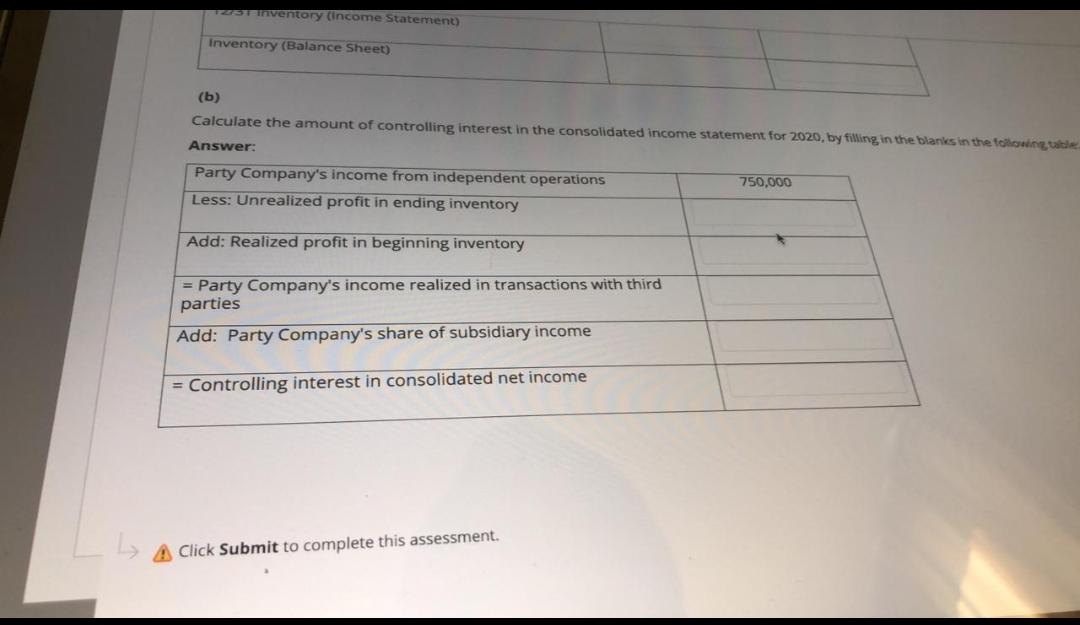

Question 8 Party Company owns 90% of the common stock of Sunny Company. Sunny Company sells merchandise to Party Company at 25% above cost. During 2019 and 2020, such sales amounted to $400,000 and $450,000, respectively. At the end of each year, Party Company had in its inventory 20% of the goods purchased from Sunny Company during that yea Sunny Company reported net income of $250,000 in each year and did not declare any dividends in any year. Hint: This question is similar to questions 6.1,6.2 and 6.3. Required: (a) The double entries necessary on the consolidated financial statements workpaper to eliminate the effects of the intercompa have been prepared for you. Fill in the blanks with the appropriate amount. Answer: Debit Credit (1) To eliminate intercompany sales: Question complete Answer Debit Credi (1) To eliminate intercompany sales: Sales Purchases (Cost of Goods Sold) B00.000 800,000 (2) To recognize gross profit in beginning inventory realized in 2020 Beginning Retained Earnings-P I 1/1 Inventory (Income Statement) For Blank 2 (3) To eliminate unrealized intercompany profit in ending inventory 12/31 Inventory (Income Statement) Inventory (Balance Sheet) (b) Calculate the amount of controlling interest in the consolidated income statement for 2020, by filling in the blanks in the following Answer: non inventory (Income Statement) Inventory (Balance Sheet) (b) Calculate the amount of controlling interest in the consolidated income statement for 2020, by filling in the blanks in the fologie Answer: Party Company's income from independent operations 750,000 Less: Unrealized profit in ending inventory Add: Realized profit in beginning inventory = Party Company's income realized in transactions with third parties Add: Party Company's share of subsidiary income = Controlling interest in consolidated net income A Click Submit to complete this assessment. Question 8 Party Company owns 90% of the common stock of Sunny Company. Sunny Company sells merchandise to Party Company at 25% above cost. During 2019 and 2020, such sales amounted to $400,000 and $450,000, respectively. At the end of each year, Party Company had in its inventory 20% of the goods purchased from Sunny Company during that yea Sunny Company reported net income of $250,000 in each year and did not declare any dividends in any year. Hint: This question is similar to questions 6.1,6.2 and 6.3. Required: (a) The double entries necessary on the consolidated financial statements workpaper to eliminate the effects of the intercompa have been prepared for you. Fill in the blanks with the appropriate amount. Answer: Debit Credit (1) To eliminate intercompany sales: Question complete Answer Debit Credi (1) To eliminate intercompany sales: Sales Purchases (Cost of Goods Sold) B00.000 800,000 (2) To recognize gross profit in beginning inventory realized in 2020 Beginning Retained Earnings-P I 1/1 Inventory (Income Statement) For Blank 2 (3) To eliminate unrealized intercompany profit in ending inventory 12/31 Inventory (Income Statement) Inventory (Balance Sheet) (b) Calculate the amount of controlling interest in the consolidated income statement for 2020, by filling in the blanks in the following Answer: non inventory (Income Statement) Inventory (Balance Sheet) (b) Calculate the amount of controlling interest in the consolidated income statement for 2020, by filling in the blanks in the fologie Answer: Party Company's income from independent operations 750,000 Less: Unrealized profit in ending inventory Add: Realized profit in beginning inventory = Party Company's income realized in transactions with third parties Add: Party Company's share of subsidiary income = Controlling interest in consolidated net income A Click Submit to complete this assessment