Question

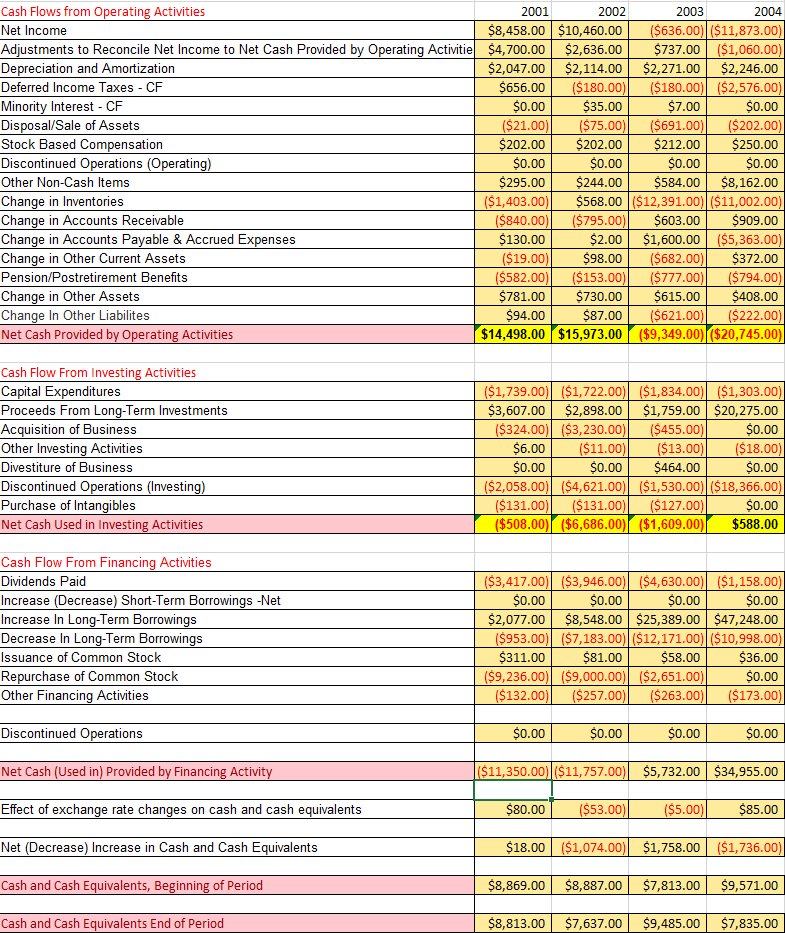

Question 8: Read the Cash Flow statement from SMKD Company and answer the following question. 1.Has there been an observable trend in the company's cash

Question 8:

Read the Cash Flow statement from SMKD Company and answer the following question.

1.Has there been an observable trend in the company's cash flow from operating activities, investing activities, and financing activities?

2.Specifically, how have cash items from operating activities changed? Do the changes raises any concerns?

3.How is the company's ability to generate positive future net cash flows?

4.How is the company's ability to meet its obligations?

5.Based on the current state of the cash flow statement, does the company has a need for external financing?

Cash Flows from Operating Activities 2001 2002 2003 2004 Net Income $8,458.00 $10,460.00 ($636.00) ($11,873.00) Adjustments to Reconcile Net Income to Net Cash Provided by Operating Activitie $4,700.00 $2,636.00 $737.00 ($1,060.00) Depreciation and Amortization $2,047.00 $2,114.00 $2,271.00 $2,246.00 Deferred Income Taxes - CF $656.00 ($180.00) ($180.00) ($2,576.00) Minority Interest - CF $0.00 $35.00 $7.00 $0.00 Disposal/Sale of Assets ($21.00) ($75.00) ($691.00) ($ 202.00) Stock Based Compensation $202.00 $202.00 $212.00 $250.00 Discontinued Operations (Operating) $0.00 $0.00 $0.00 $0.00 Other Non-Cash Items $295.00 $244.00 $584.00 $8,162.00 Change in Inventories ($1,403.00) $568.00 ($12,391.00) ($11,002.00) Change in Accounts Receivable ($840.00) ($795.00) $603.00 $909.00 Change in Accounts Payable & Accrued Expenses $130.00 $2.00 $1,600.00 $5,363.00) Change in Other Current Assets ($19.00) $98.00 ($682.00) $372.00 Pension/Postretirement Benefits ($582.00) ($153.00) ($777.00) ($794.00) Change in Other Assets $781.00 $730.00 $615.00 $408.00 Change In Other Liabilites $94.00 $87.00 ($621.00) ($222.00) Net Cash Provided by Operating Activities $14,498.00 $15,973.00 ($9,349.00) ($20,745.00) Cash Flow From Investing Activities Capital Expenditures Proceeds From Long-Term Investments Acquisition of Business Other Investing Activities Divestiture of Business Discontinued Operations (Investing) Purchase of Intangibles Net Cash Used in Investing Activities ($1,739.00) ($1,722.00) ($1,834.00) ($1,303.00) $3,607.00 $2,898.00 $1,759.00 $20,275.00 ($324.00) ($3,230.00) ($455.00) $0.00 $6.00 ($11.00) ($13.00) ($18.00) $0.00 $0.00 $464.00 $0.00 ($2,058.00) ($4,621.00) ($1,530.00) ($18,366.00) ($131.00) ($131.00) ($127.00) $0.00 ($508.00) ($6,686.00) ($1,609.00) $588.00 Cash Flow From Financing Activities Dividends Paid Increase (Decrease) Short-Term Borrowings -Net Increase in Long-Term Borrowings Decrease in Long-Term Borrowings Issuance of Common Stock Repurchase of Common Stock Other Financing Activities ($3,417.00) ($3,946.00) ($4,630.00) ($1,158.00) $0.00 $0.00 $0.00 $0.00 $2,077.00 $8,548.00 $25,389.00 $47,248.00 ($953.00) ($7,183.00) ($12,171.00) ($10,998.00) $311.00 $81.00 $58.00 $36.00 ($9,236.00) ($9,000.00) ($2,651.00) $0.00 ($132.00) ($257.00) ($263.00) ($173.00) Discontinued Operations $0.00 $0.00 $0.00 $0.00 Net Cash (Used in) Provided by Financing Activity ($11,350.00 ($11,757.00) $5,732.00 $34,955.00 Effect of exchange rate changes on cash and cash equivalents $80.00 ($53.00) ($5.00) $85.00 Net (Decrease) Increase in Cash and Cash Equivalents $18.00 ($1,074.00) $1,758.00 $1,736.00) Cash and Cash Equivalents, Beginning of Period $8,869.00 $8,887.00 $7,813.00 $9,571.00 Cash and Cash Equivalents End of Period $8,813.00 $7,637.00 $9,485.00 $7,835.00Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started