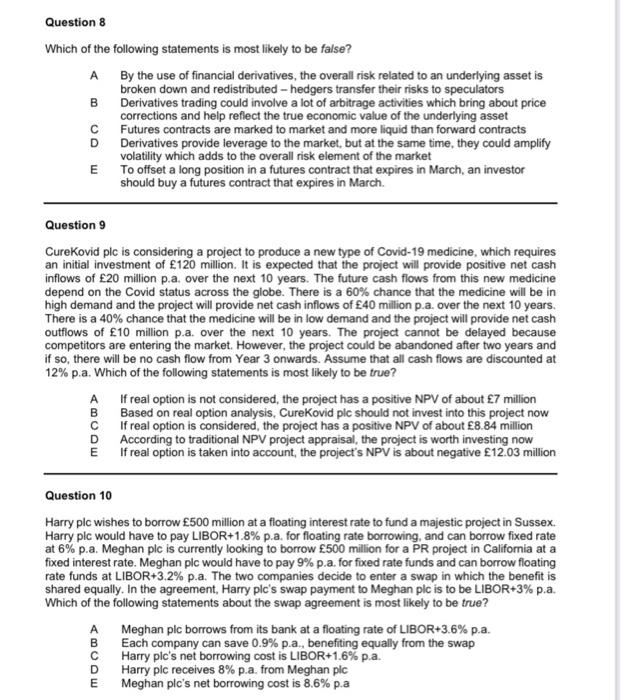

Question 8 Which of the following statements is most likely to be false? A By the use of financial derivatives, the overall risk related to an underlying asset is broken down and redistributed - hedgers transfer their risks to speculators B Derivatives trading could involve a lot of arbitrage activities which bring about price corrections and help reflect the true economic value of the underlying asset C Futures contracts are marked to market and more liquid than forward contracts D Derivatives provide leverage to the market, but at the same time, they could amplify volatility which adds to the overall risk element of the market E To offset a long position in a futures contract that expires in March, an investor should buy a futures contract that expires in March. Question 9 CureKovid plc is considering a project to produce a new type of Covid-19 medicine, which requires an initial investment of 120 million. It is expected that the project will provide positive net cash inflows of 20 million p.a. over the next 10 years. The future cash flows from this new medicine depend on the Covid status across the globe. There is a 60% chance that the medicine will be in high demand and the project will provide net cash inflows of 40 million p.a. over the next 10 years. There is a 40% chance that the medicine will be in low demand and the project will provide net cash outflows of 10 million p.a. over the next 10 years. The project cannot be delayed because competitors are entering the market. However, the project could be abandoned after two years and if so, there will be no cash flow from Year 3 onwards. Assume that all cash flows are discounted at 12% p.a. Which of the following statements is most likely to be true? A If real option is not considered, the project has a positive NPV of about 7 million B Based on real option analysis, CureKovid ple should not invest into this project now C If real option is considered, the project has a positive NPV of about 8.84 million D According to traditional NPV project appraisal, the project is worth investing now E If real option is taken into account, the project's NPV is about negative E12.03 million Question 10 Harry plc wishes to borrow 500 million at a floating interest rate to fund a majestic project in Sussex. Harry plc would have to pay LIBOR+1.8\% p.a. for floating rate borrowing, and can borrow fixed rate at 6% p.a. Meghan plc is currently looking to borrow 500 million for a PR project in California at a fixed interest rate. Meghan plc would have to pay 9% p.a. for fixed rate funds and can borrow floating rate funds at LIBOR+3.2\% p.a. The two companies decide to enter a swap in which the benefit is shared equally. In the agreement, Harry plc's swap payment to Meghan plc is to be LIBOR+3\% p.a. Which of the following statements about the swap agreement is most likely to be true? A Meghan plc borrows from its bank at a floating rate of LIBOR+3.6% p.a. B Each company can save 0.9% p.a., benefiting equally from the swap C Harry plc's net borrowing cost is LIBOR +1.6% p.a. D Harry plc receives 8% p.a. from Meghan plc E Meghan plc's net borrowing cost is 8.6% p.a