Answered step by step

Verified Expert Solution

Question

1 Approved Answer

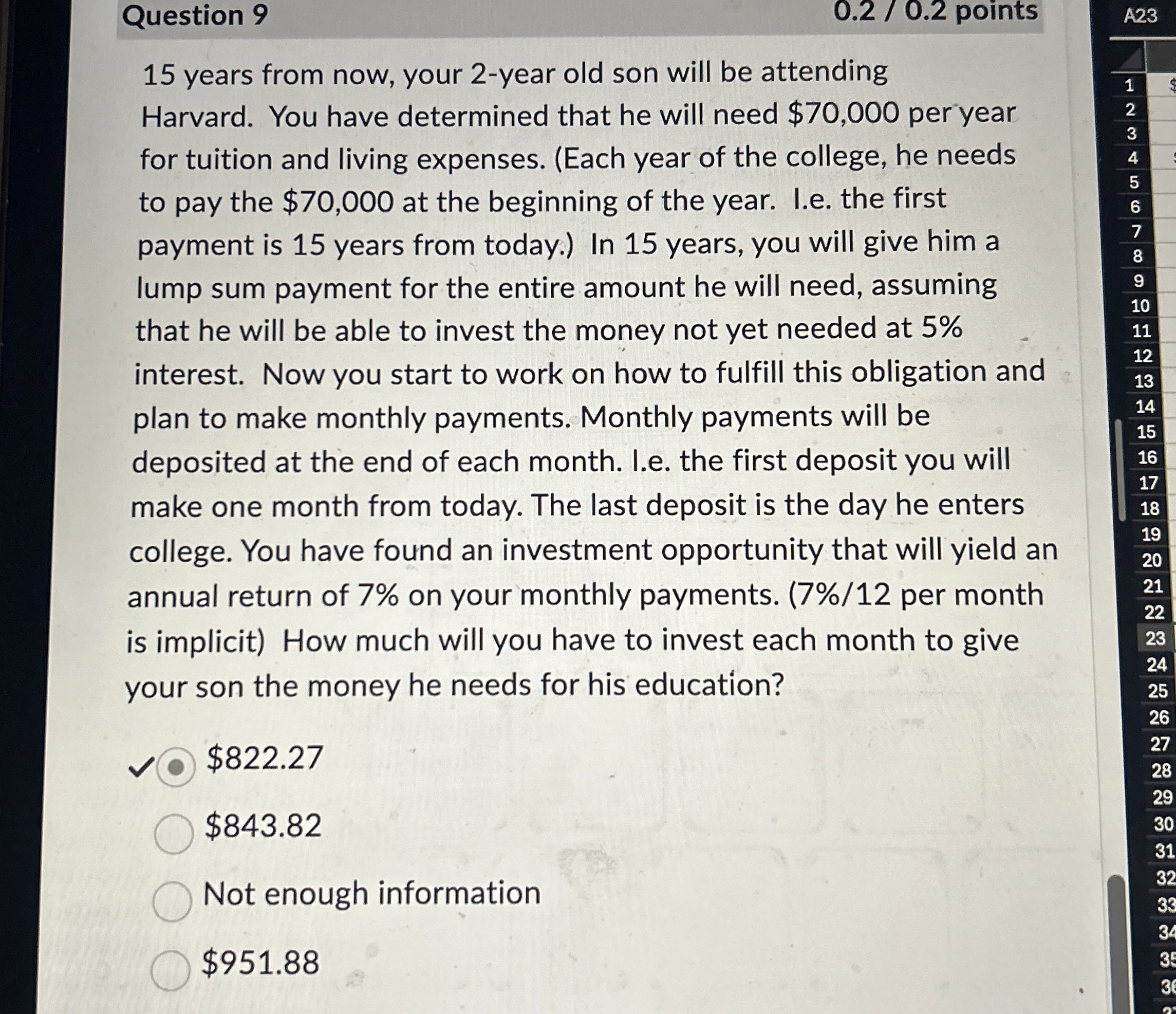

Question 9 0 . 2 0 . 2 points 1 5 years from now, your 2 - year old son will be attending Harvard. You

Question

points

years from now, your year old son will be attending

Harvard. You have determined that he will need $ per year

for tuition and living expenses. Each year of the college, he needs

to pay the $ at the beginning of the year. I.e the first

payment is years from today. In years, you will give him a

lump sum payment for the entire amount he will need, assuming

that he will be able to invest the money not yet needed at

interest. Now you start to work on how to fulfill this obligation and

plan to make monthly payments. Monthly payments will be

deposited at the end of each month. I.e the first deposit you will

make one month from today. The last deposit is the day he enters

college. You have found an investment opportunity that will yield an

annual return of on your monthly payments. per month

is implicit How much will you have to invest each month to give

your son the money he needs for his education?

$

$

Not enough information

$

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started